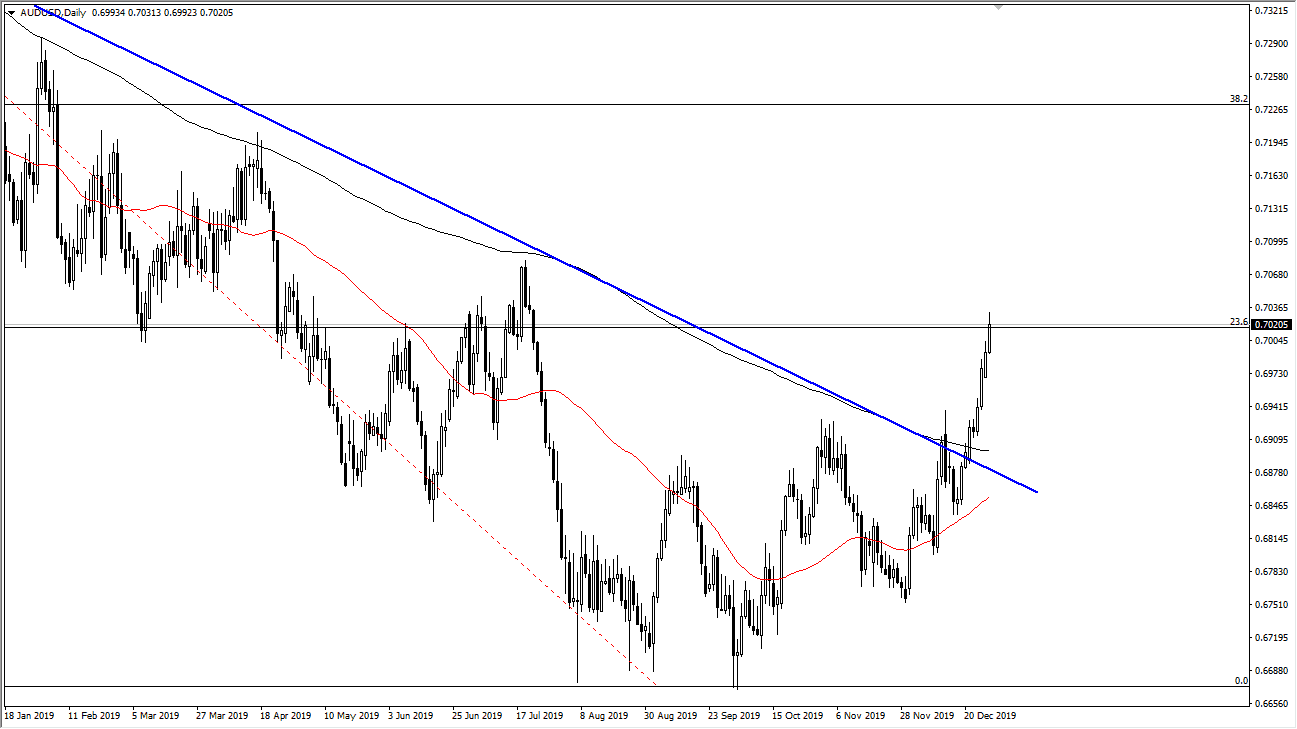

The Australian dollar has rallied a bit during the trading session on New Year’s Eve, but this is a market that is starting to get a little bit overextended. At this point, I think that the pullback that’s coming should be thought of as a potential buying opportunity. Markets cannot go straight up in the air so you would not anticipate that we go much higher in the short term. Ultimately though, we are starting to see the 50 day EMA reach towards the 200 day EMA and it also looks like we could cross some time relatively soon.

I think we will find plenty of buyers wanting to get into the market as they will have missed move. At this point, the market is likely to find plenty of people that are looking to get involved, especially considering that the United States and China look likely to sign the “phase 1 deal” on January 15. All things being equal I like the idea of buying dips, and therefore I will be very interested in the Australian dollar at the 0.6950 level. At this point, the market has clearly broken above the 200 day EMA and of course the downtrend line that I have marked on the chart. With all that being the case, it’s very likely that we will continue to see plenty of people starting to short cover, and of course try to get involved with that “fear of missing out” syndrome that all traders tend to suffer from.

The 0.70 level being popped above there is a good sign, but I think that it will be only a matter of time before we will probably have a certain amount of profit-taking and of course at this point there is probably a bit of exhaustion coming into play. I do like the idea of looking for value going forward and I believe that the Australian dollar will probably end up being one of the best-performing currencies in 2020 from what I can see. If the United States and China continue to show signs of getting along, that will continue to push this pair much higher as Australia’s such a major contributor of raw materials to the Chinese and of course will move up and down with the overall health of the Chinese economy and export economy.