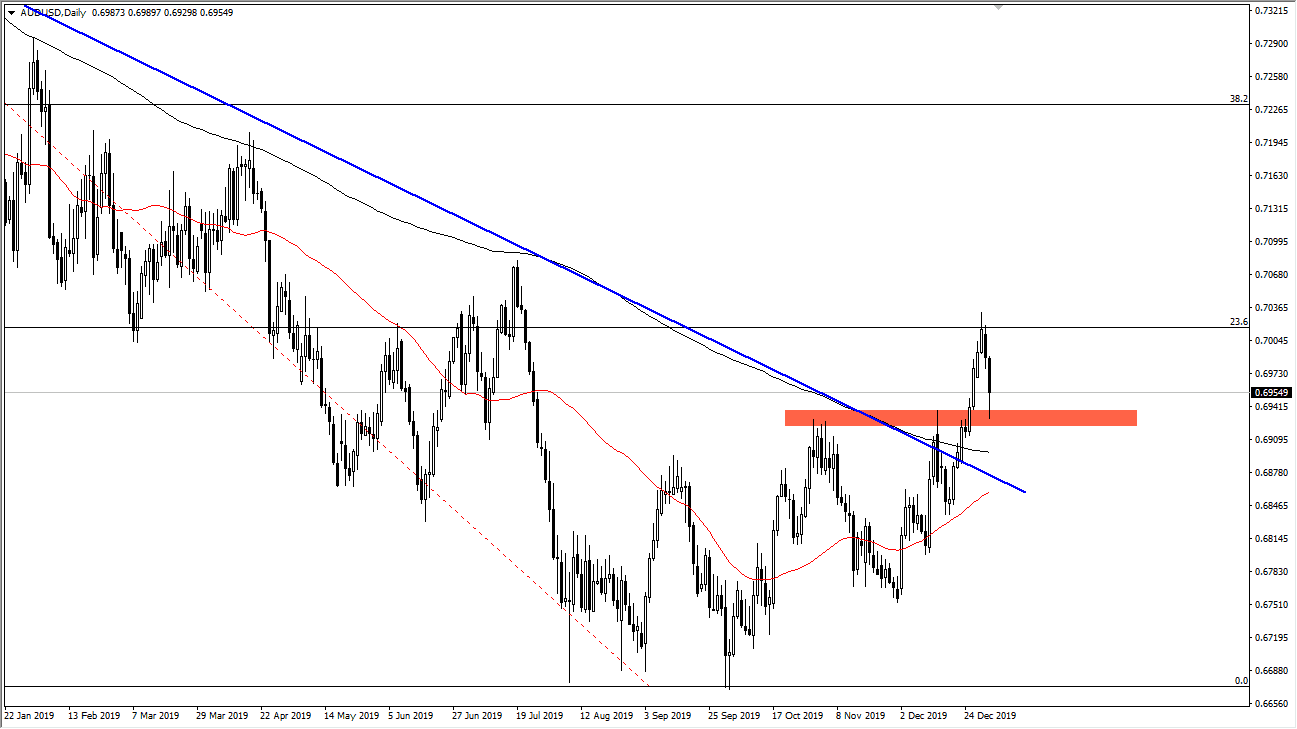

The Australian dollar got hit rather hard during the Friday session as word got out that the Americans had killed an Iranian general. This was a major “risk off” move, found all across the markets, including not only the Australian dollar, but several other instruments. You can see that the Aussie did in fact tag the 0.6950 area, an area that I had looked for as a potential buying opportunity. With that in mind I like the idea of buying the Aussie in this general vicinity, understanding the fact that the market has been very noisy and will probably continue to be so. That being said, the Australian dollar is highly sensitive to the US/China trade situation as well, but that does seem to be getting better.

Looking at the technical analysis, the 200 day EMA has been broken to the upside just as a major downtrend line has been sliced through as well. At this point, it’s very likely that we will see traders take advantage of “cheap Australian dollars”, building up a larger position for the longer-term move. I do not have any interest in trying to short this pair because I believe that it is more than likely going to be a scenario where the trend is trying to change. As soon as we get a signature on that “Phase 1 deal”, I believe that it’s only a matter of time before people start to look to the next phase. If it looks as if the market is going to continue to get good news out of the US/China trade situation, it will more than likely push the Australian dollar higher as it is so sensitive to China itself.

I believe that we are seeing the beginning of a major trend change, at least in the intermediate timeframe. Whether or not it last through the entirety of 2020 might be a different question but right now the Australian dollar has been broken through a couple of different major resistance levels, and quite frankly is at such extraordinarily cheap levels that it makes sense that we would continue to see a bit of a push to the upside. Having said all of that, it’s not going to be easy so please keep that in mind in position size accordingly. It’s not until we break down below the 0.6850 level that I would be considering shorting this market.