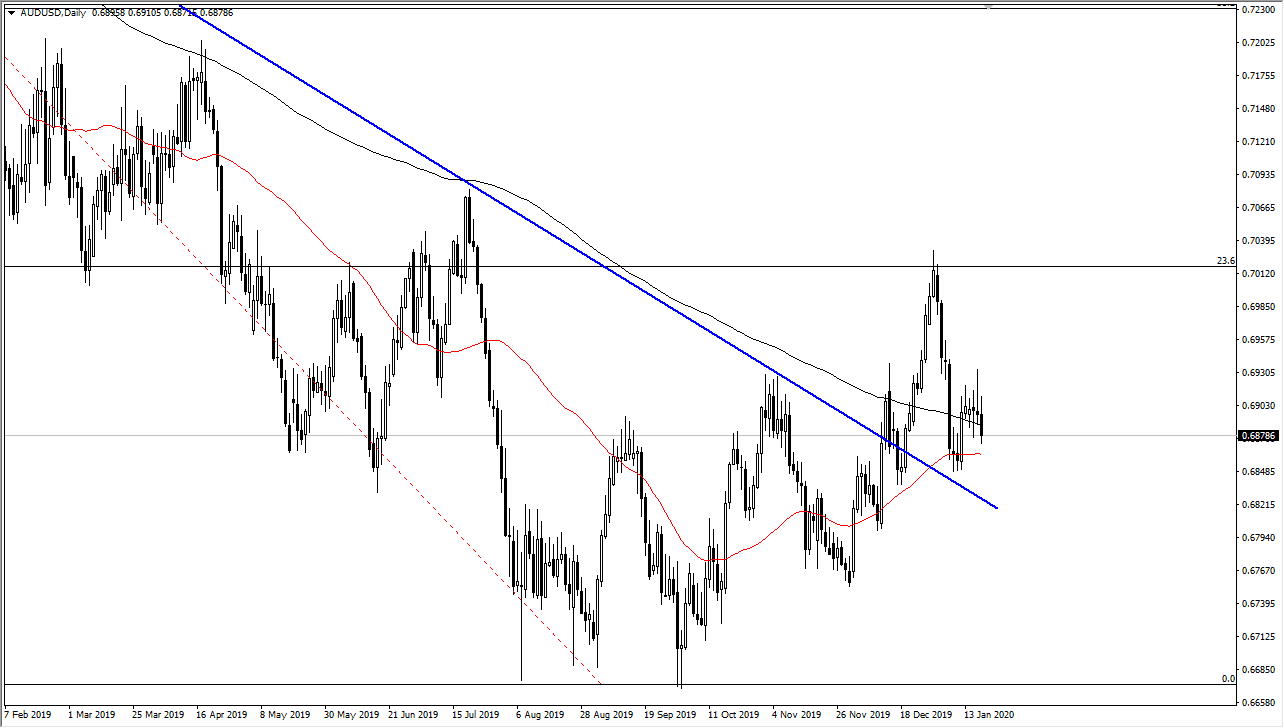

The Australian dollar has gone back and forth during the trading session on Friday but ended up forming a negative candlestick as we continue to dance around the 200 day EMA which of course is a large technical indicator. Furthermore, the 50 day EMA is coming in just below to turn things around, and it’s likely that we will see a lot of questions when it comes to the US/China trade relations. Granted, in the short term it looks like we are calming down and therefore it should by extension be good for the Australian currency.

For what it’s worth, we did get some very strong numbers coming out of China overnight, so it does suggest that perhaps we are going to continue to see the Australian dollar tried to pick up and change the overall trend, but at this point we are quite ready to do so. We have been going sideways for the entirety of the week, so with that in the back of our minds, we have to keep the idea of this potential trend change in effect, but also recognize that when you get trend changes it tends to be a very noisy affair.

We had broken above a major downtrend line, and now we continue to make “higher lows” at this point. If we can break above the shooting star from the Thursday session, it’s likely that the Aussie will continue to go higher, perhaps reaching towards the 0.70 level. I have no interest in trying to short this pair, even though it could very well pull back. If it does, it’s likely that the 0.68 level is the absolute “floor” in the market, so if we were to break down below there it’s likely that we will go much lower.

It looks as if the 50 day EMA is trying to reach towards the 200 day EMA, perhaps crossing above it and forming a bit of a “golden cross.” If it does happen, then it becomes a bullish signal for longer-term traders. I think that eventually we will see this market take off to the upside, but we need some stability first, and we need to continue to see buyers come in and pick it up. At this point, I think it’s only a matter of time before we do go higher. Having said that, I am bullish but I also recognize that a lot of work is yet to be done.