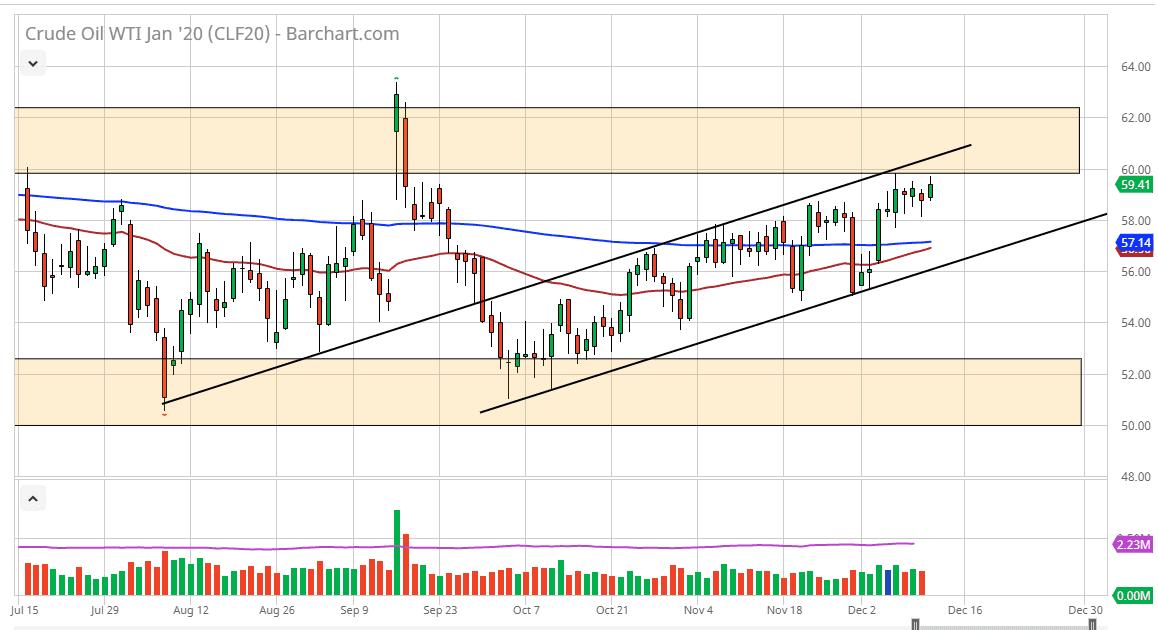

The West Texas Intermediate Crude Oil market will more than likely continue to test the $60 level, as we have seen the market do over the last several days. The Thursday session came within a few pennies of touching that level, but then pulled back a bit. At this juncture, you can see that the hammer that formed from both Monday and Wednesday suggests that there is a lot of support underneath, especially near the $58 level.

If we were to break down below the $58 level, it’s likely that the market could go down to the moving averages that I have on the chart. The 50 day EMA which is colored in red is getting ready to try to break above the 200 day EMA, of course painted in blue. If we were to turn around a breakthrough there, the market is likely to continue to find buyers from a longer-term standpoint. That being said, I believe that it’s only a matter of time before pullbacks get but based upon value. The $60 level above will continue to be very difficult to overcome, because quite frankly I think it’s only a matter of time before we would find more sellers. The $62.50 level is the top of a range of noise, and that noise should continue to be sold into.

The uptrend and channel that I have marked on the chart also is something that you should be aware of. In other words, it looks like we are trying to go higher, but it is probably going to take a lot of work. To the downside, if we were to break below the uptrend line that makes of the bottom of the channel, that would be very negative, and it could send this market down to the $52.50 level, possibly even as low as the $50 level as it is the bottom of that support range underneath. In general though, I do believe that crude oil is trying to make a move to the upside but there is so much in the way of supply when it comes to the future contract up there that we simply are going to bounce around in this area for the next couple of days, and I think short-term trading will probably continue to be the best way to go, simply going back and forth with the advent flow of the market.