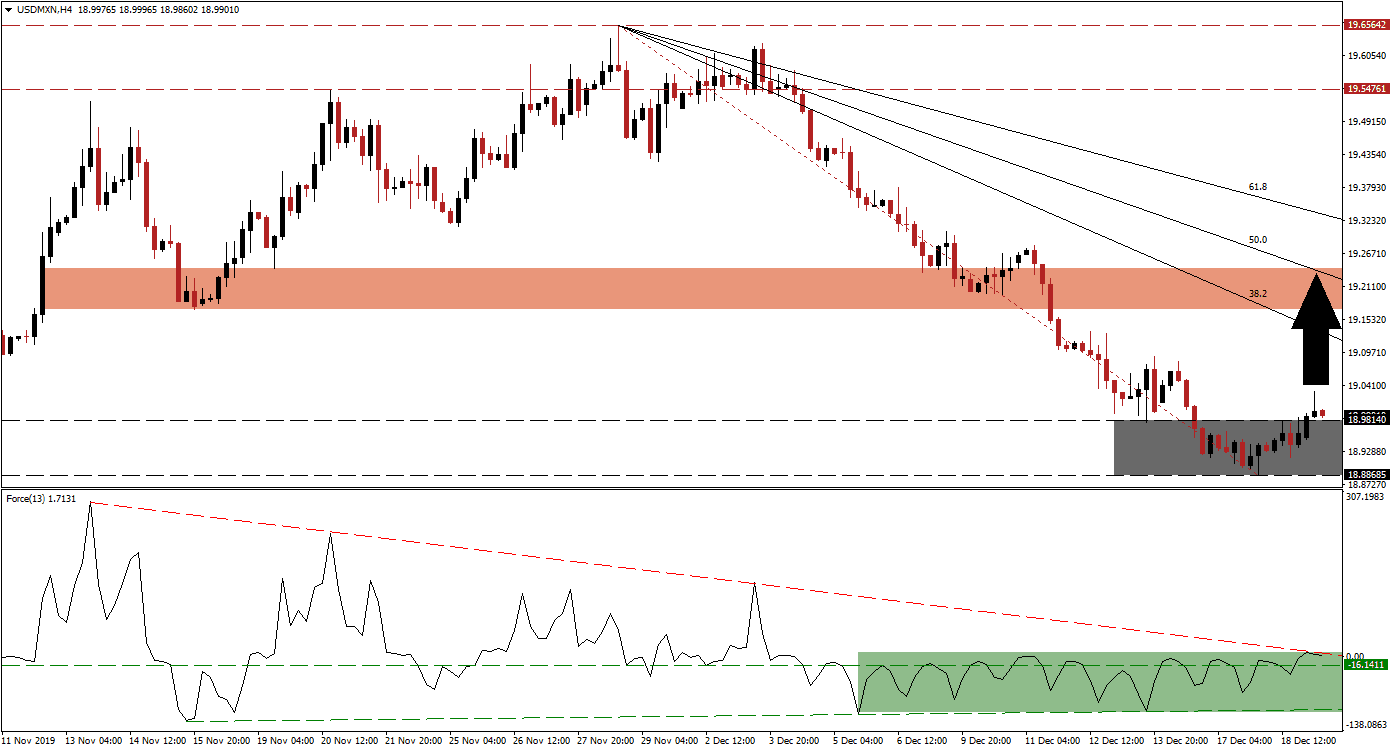

A growing number of analysts and economists view the announced phase-one trade deal between the US and China as insignificant. Lack of clarity from both sides remains a major concern for financial markets, and this armistice between both parties does nothing to support the ailing global economy. The USD/MXN remains in an extremely long-term bearish chart formation, but a short-term advance is expected to emerge following the breakout above its support zone.

The Force Index, a next-generation technical indicator, points towards the lack of momentum to either direction, as marked by the green rectangle. A minor positive divergence preceded the breakout in this currency pair and the Force Index move above its horizontal resistance level, converting it into support. This technical indicator moved into positive territory, suggesting bulls have taken control of the USD/MXN. A breakout above its descending resistance level is likely to follow, leading to more short-term upside potential. You can learn more about the Force Index here.

After price action pushed above its support zone located between 18.88685 and 18.98140, a marked by the grey rectangle, a short-covering rally is favored to unfold. This should close the gap between the USD/MXN and its descending 38.2 Fibonacci Retracement Fan Resistance Level. Another bullish development emerged after this currency pair moved above its Fibonacci Retracement Fan trendline. Minor economic data out of the US came in slightly better than economists expected, setting the stage for a counter-trend advance.

This currency pair may advance into its short-term resistance zone located between 19.17184 and 19.24057, as marked by the red rectangle. The 50.0 Fibonacci Retracement Fan Resistance Level is passing through this zone, anticipated to end the short-covering rally. An advance into the short-term resistance zone will keep the long-term downtrend intact, and ensure its longevity. The fundamental outlook for the USD/MXN remains bearish. You can learn more about a resistance zone here.

USD/MXN Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 18.99000

Take Profit @ 19.19950

Stop Loss @ 18.92500

Upside Potential: 2,095 pips

Downside Risk: 650 pips

Risk/Reward Ratio: 3.22

Should the Force Index fail to push through its descending resistance level, a reversal is favored to take it into its shallow ascending support level. The USD/MXN is then anticipated to extend its long-term downtrend, with a breakdown below its support zone. With a resurgence in bearish momentum, this currency pair may descend into its next support zone zone located between 18.65860 and 18.74506. More downside is possible but requires a fresh fundamental catalyst.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 18.8500

Take Profit @ 18.6600

Stop Loss @ 18.91500

Downside Potential: 1,900 pips

Upside Risk: 650 pips

Risk/Reward Ratio: 2.92