On the daily and four hours charts of the USD/JPY pair, it is clear that a bullish flag is forming and there is stability of the performance for several sessions, which foreshadows a strong movement coming in either direction. During trading last week, it remained stable between the 109.18 support and the 109.68 resistance and settled around the 109.40 level in the beginning of trading this week, which contains the Christmas holidays, and thus a limited performance of Forex markets. The US dollar received support at the end of trading last week after the US Department of Commerce announced that gross domestic product - the gross economic product for goods and services - increased at a moderate annual rate of 2.1% in the July-September quarter. A separate report showed that consumer spending - which accounts for 70% of US economic activity - grew 0.4% in November, the strongest rise since July, and income increased after a weak reading in October.

More than a month ago, some polls have sounded the alarm that US economic growth may slow sharply in the fourth quarter to an annual pace of 0.5% or less. On this basis, Trump has backed away from imposing a new round of tariffs on billions of dollars in consumer goods such as mobile phones made in China. Several sectors of the economy showed signs of flexibility. The housing market has recovered, with the help of three interest rate cuts this year by the Federal Reserve. More importantly, the job market is doing well. In November, employment jumped to its highest level since January, with US employers adding 266,000 new jobs.

For 2019, GDP growth is expected to come in at 2.3%, down from the 2.9% gains in 2018, which were the best since 2015. For the next year, analysts generally believe that growth will slow to 1.8% as expected . Where the interest began to fade from the $1.5 trillion tax cut that was passed in 2017.

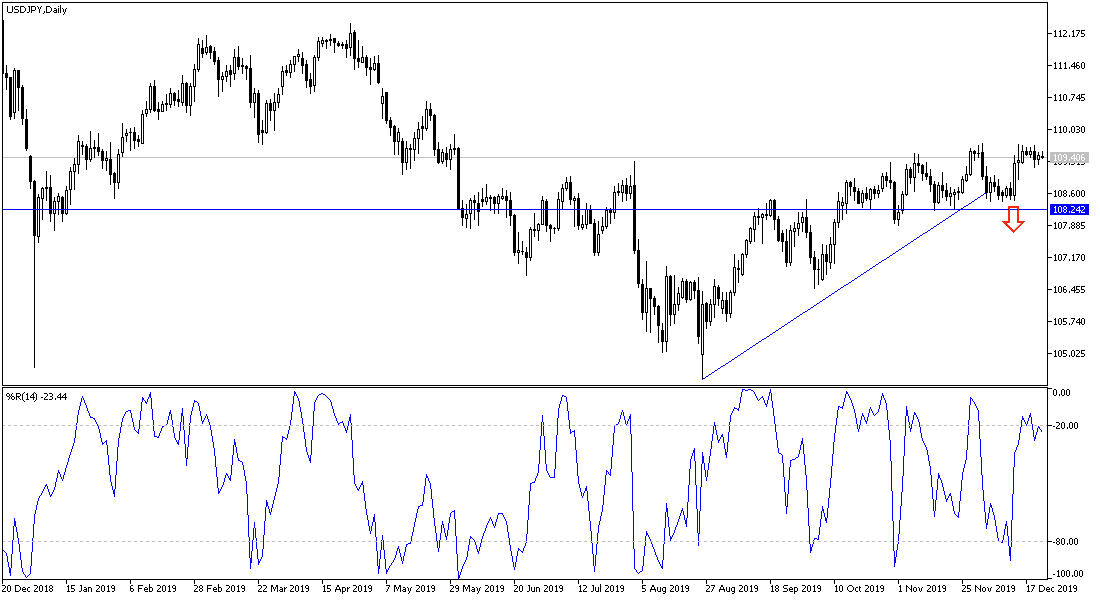

According to the technical analysis of the pair: The general trend of the USD/JPY pair is still bullish and is awaiting a return to the 110.00 psychological resistance area to confirm the strength of the trend. On the other hand, any movement of the pair towards the support levels 109.00, 108.45 and 108.00 is a threat to the continuation of the current trend and begins the trend reversal downside. A limited move is expected for the pair as the Christmas holidays are near and investors are reluctant to take new positions.

As for the economic calendar data: All focus will be on the US session data, as durable goods orders and new home sales will be announced.