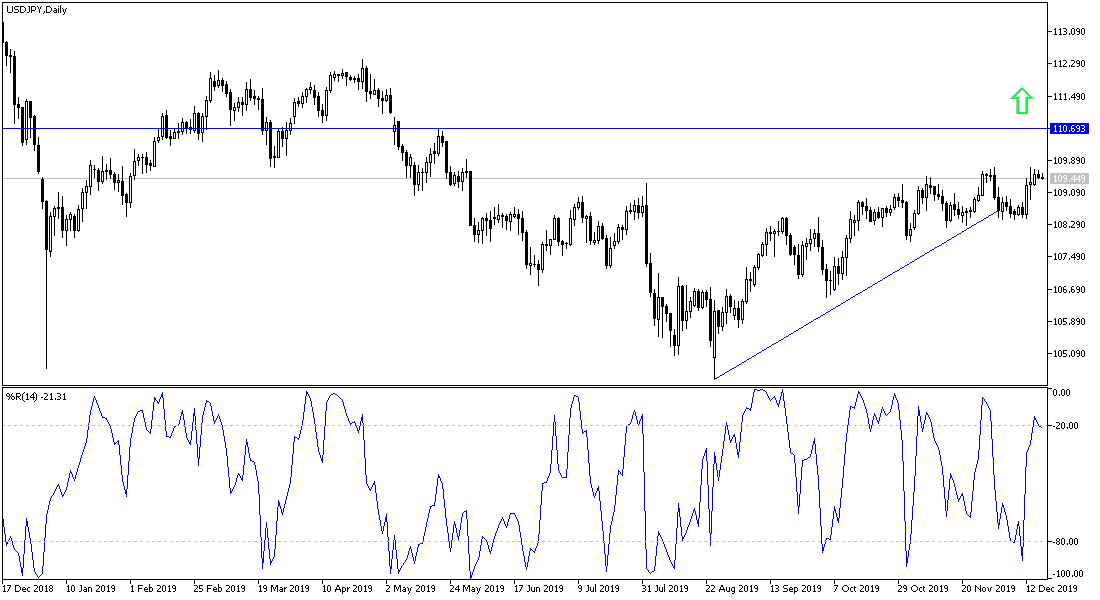

According to the performance on the daily chart, the USD/JPY is still in an upward correction phase, and at the same time, lacks the momentum to complete it. Since the beginning of this week's trading, the pair has not exceeded the 109.65 resistance gains, and it did not benefit much from the announcement of positive results for industrial production in the United States, which came in stronger than expected, with gains that are the highest in two years ago.

Industrial production - which includes production in factories, mines, and utilities - rose 1.1% in November, reversing a decline - 0.9% in October, and the biggest jump since October 2017. The U.S. manufacturing sector was affected by the length of the global trade dispute with China. Manufacturing production in the United States increased by 1.1%, rising 12.4% in production of cars, trucks, and auto parts. GM's strike ended in late October. Excluding the auto industry, industrial output rose 0.5% last month.

For American employment. The number of jobs available jumped in October after reaching its lowest level in 18 months in the previous month, indicating that the US labor market is still strong. The Ministry of Labor announced that the number of available jobs increased by 3.3% to nearly 7.3 million. It is an indication that companies remain confident enough in the economic outlook to create more jobs.

The figures provide the latest evidence that employers have largely ignored the uncertainties surrounding the trade war between the United States and China and the slowdown in global economic growth. While the number of jobs decreased from a record 7.6 million a year ago, it remains at a historic height. For about a year and a half, there were more jobs than unemployed people. The numbers follow the new jobs report earlier this month, with surprisingly strong gains of 266,000 jobs, and a drop in the unemployment rate to a 50-year low at 3.5%.

According to the technical analysis of the pair: There is no change in my technical view of the USD/JPY pair, so the upward correction will be strengthened if the pair succeeds in moving above the 110.00 psychological resistance, and any attempt by the pair to retreat below the 109.00 support will negatively affect the current bulls' trends. Overall, the technical indicators did not enter overbought areas.

Today's economic calendar has no important data, whether from Japan or the United States of America.