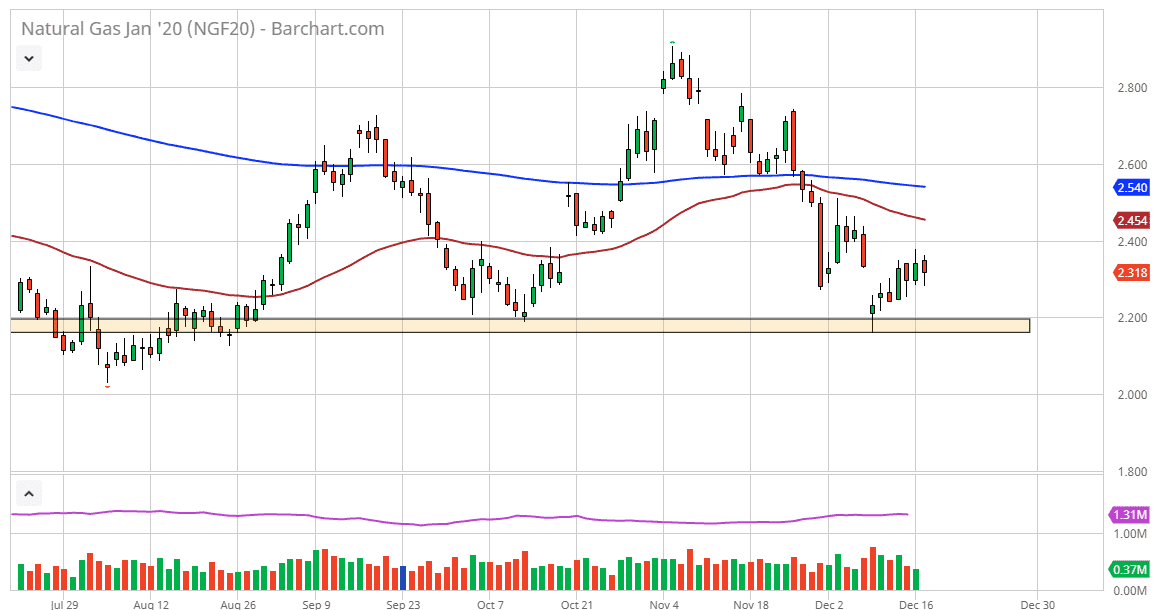

Natural gas markets initially fell during the trading session on Tuesday but turned around to show signs of strength again. We have filled the gap recently, and it now looks as if we are going to look above the $2.40 level as a signal to start buying. That being the case, if we can break above the $2.40 level then we will go looking towards the $2.50 level and then the $2.60 level. Natural gas markets do tend to move in $0.10 increments, and therefore it’s likely that we will continue to grind to the upside.

Looking at the longer-term chart, the $2.20 level should be massive support, and therefore it’s difficult to imagine breaking down through there, but if we were to reach towards that area, I would be all over the idea of buying a short-term bounce. If we can break above the $2.60 level, then we could be looking at a move back to the $3.00 level. The natural gas markets are very sensitive to the weather, and those reports do change quite often. That being said though, this is the time a year where we get more demand for natural gas of typically, I’m a buyer and not a seller. I recognize that the situation for suppliers in the United States has been horrible this year, mainly because the Americans had increased drilling by 17% in 2019. Having said that though, we have had a couple of winter storms and it looks like more cold weather could be coming. If that’s the case, we could be building up pressure for a move to the upside.

If we were to break down below the $2.20 level it probably opens up a move down to the $2.00 level in what would undoubtedly be horrific for suppliers and could put the whole idea of profitability out of reach for suppliers, this winter. Typically, we will see some type of massive spike this time of year, which then gets sold off somewhere in the middle to end of January. It is then that we start to look at the spring contracts, which of course would feature less demand as temperatures rallied again. Ultimately, this is a market that should spike and then sell off again. Ultimately, this is a market that should get a boost higher, before we start selling again.