Renewed anxiety in the markets and investors ’escape from risk in the final hours of 2019 trading, were the catalysts for gold prices to achieve more gains, which hit the $1524 level of an ounce and the highest gold prices for more than three months. The decline in the US dollar was an additional catalyst for prices achieving its recent gains, as the relationship between gold and the US dollar is reversed. The US dollar was the worst of the G10 currencies last night, as it fell below the 96.750 level, its lowest level in 6 months.

The dollar's losses did not stop after the announcement of the trade balance data that showed that the deficit of goods and services in the United States fell to its lowest level since 2017 in November, as the discrepancy between imports and exports decreased from $66.8 billion to $63.2 billion, and markets were looking for an increase to - 69.2 Billion dollar. Reduced deficits indicate increased demand for currency and often lead to increased economic growth.

The Chicago PMI, which measures activity in the third largest US city, exceeded expectations for December on Monday, but that was not enough to disrupt the declining trend of the dollar. The Chicago PMI increased from 46.3 to 48.9 this month and markets were expecting a rise to 48.2. The ISM Manufacturing PMI scheduled for release at 15:00 on Friday is more important to the markets, although it is also expected to see a rally.

Renewed tension in the Middle East region after the American strikes in both Iraq and Syria, and renewed skirmishes with North Korea after its threat to test new missiles, and the long wait for the formal signing of the first phase trade agreement between the United States of America and China, were all catalysts for the yellow metal to gain more, as it is one of the most important Safe Havens for investors in times of uncertainty.

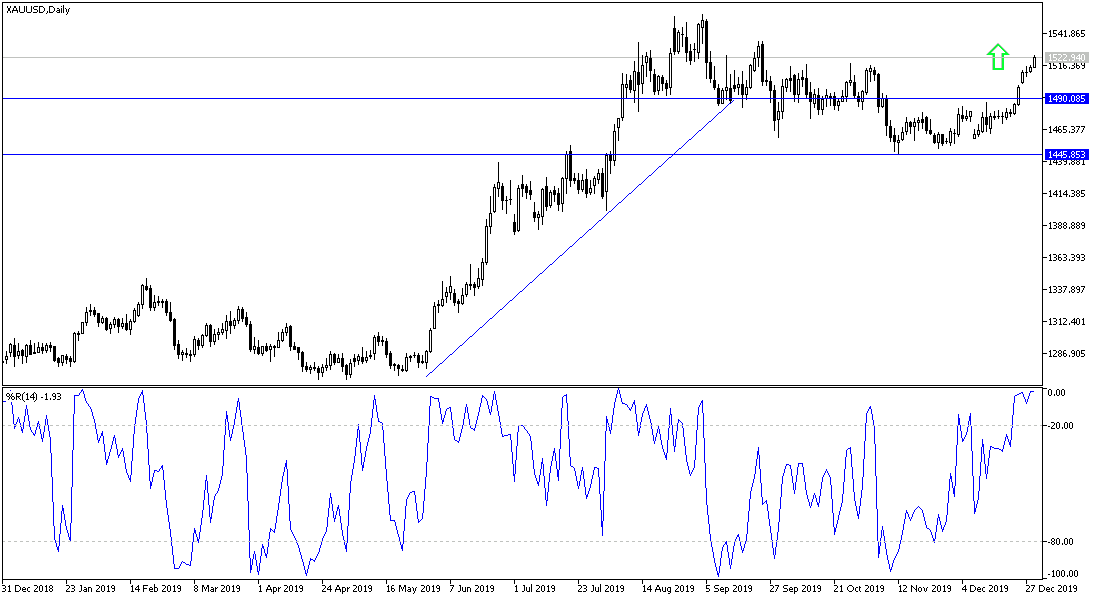

According to the technical analysis of gold: price stability above the $1500 psychological resistance is a catalyst for the gold’s upward trend, and prices has reached all the levels of resistance that we expected in the recent technical analyzes of gold, in the event of stability above that important resistance. At the present time, the technical indicators have reached strong buying saturation areas and a downward correction is awaited at any time for profit taking operations. It may be sold for this purpose from the current level at 1524 and also in the event of moving towards higher levels, the closest ones are 1532 and 1544 respectively. On the downside, the closest support levels for gold are currently at 1505, 1494 and 1485 respectively.

After announcing Chinese data in the morning, gold will react to the announcement of American consumer confidence and investors continued run from the risk.