The strength of the US dollar this time did not prevent gold prices from holding onto its gains around the $1482 resistance at the time of writing. It may end the transactions of 2019 at the highest level it in six years. In this week, liquidity will decrease, and investor interest in financial markets in general will weaken, due to Christmas and New Year holidays. The stability of the US economic growth for the third quarter of 2019, as expected, did not pressure the dollar, and thus did not give gold the opportunity to achieve stronger gains.

The US economy may get some help from a recently announced initial trade deal that would at least allay tensions between the United States and China. This announcement, along with better recent economic data, helped push US equity markets to new highs.

Three interest rate cuts by the US Federal Reserve this year, which partly reflected four interest rate increases last year, helped support the economic recovery. The budget agreement approved this week is expected to increase billions of dollars in increased spending on military and domestic programs next year, helping to support growth. However, even with these gains, analysts expect growth to slow further in 2020, influenced by continued global economic weakness.

Another headwind might be the 2020 presidential election. It is expected to raise business concern over government policies, given the sharp differences between Trump and his Democratic rivals.

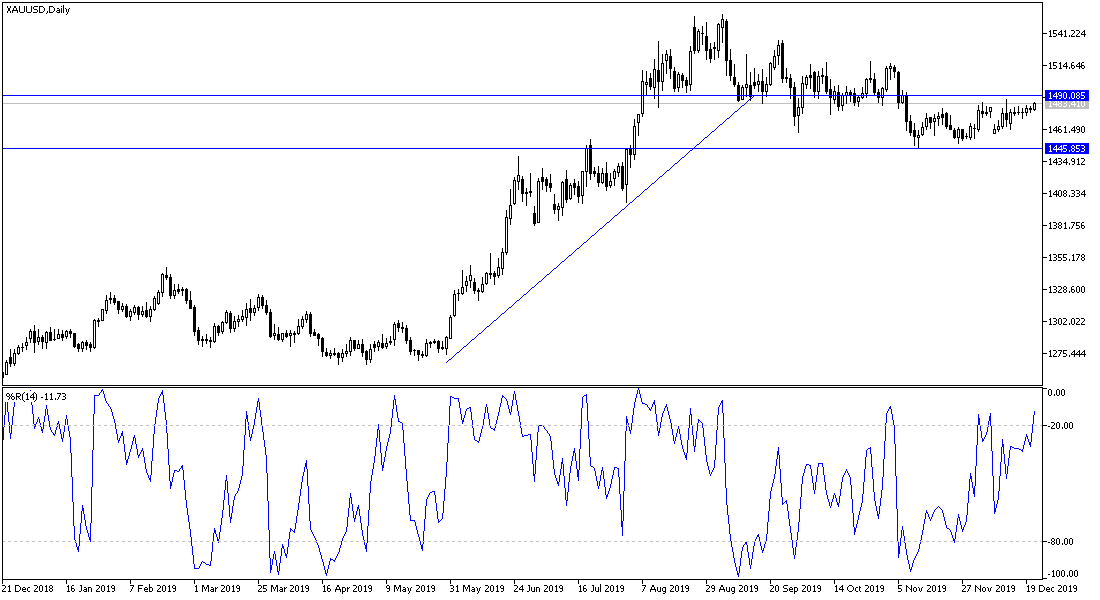

According to the technical analysis of gold: there is no change in my technical view of gold prices, as the performance is stable for several sessions, and foreshadowing for a longer period a forthcoming price explosion in either direction. Exceeding the $1485 resistance barrier may push the price of gold to the $1500 psychological resistance, and thus strengthen the current bullish trend for gold. On the other hand, the return of gold to the $1458 and $1455 support levels will support the downtrend. I still prefer to buy gold from every bearish level.

As for the economic calendar data today: The price of gold will interact with the announcement of the US economic data; durable goods orders and new home sales. In addition to the extent of investor risk appetite.