Since the beginning of this week’s trading, and the failure of establishing above $1480 resistance, makes the narrow trading in a limited range, the best description of gold price performance, which motivates investors of the yellow metal to push prices towards $1500 psychological resistance. The markets seem to be awaiting the announcement of the Phase 1 Agreement details, which aims at resolving the trade dispute between the United States and China, and if it came in better than what the markets expect, investors will increase their risk appetite, which will be negative for gold, especially if it also shows a timetable with clearer details to end that trade war, which hampers the global economy as a whole.

The agreement, which was announced by US and Chinese officials last Friday, includes the suspension of tariffs on Chinese goods, as well as the reduction of existing tariffs in exchange for Chinese structural reforms and purchases of American goods. The trade deal removes a lot of uncertainty, although traders are still somewhat cautious as they await more details about the agreement.

In addition, the agreement does not end the trade war between the United States and China entirely, as some tariffs will remain in effect as negotiators begin the second phase of the talks.

It should be borne in mind that the general trend of gold, silver, copper and the US dollar index at Christmas and New Year’s Day "must be taken seriously", as the low volumes or thinking of markets with less liquidity than usual can cause losses for open trades. Besides waiting for the details of the commercial deal between the two largest economies in the world, US President Trump's judicial accountability developments are being watched. The yellow metal gains were also stalled with the record highs for major US stock indices.

The weakening of the US dollar is positive for commodities denominated by the currency, such as gold, has increased the US dollar index, DXY, which measures the performance of the dollar against a basket of six competing currencies to 97.20. For other metals, palladium fell 2.3% to $1918.60 an ounce, while platinum fell to $929.80 an ounce.

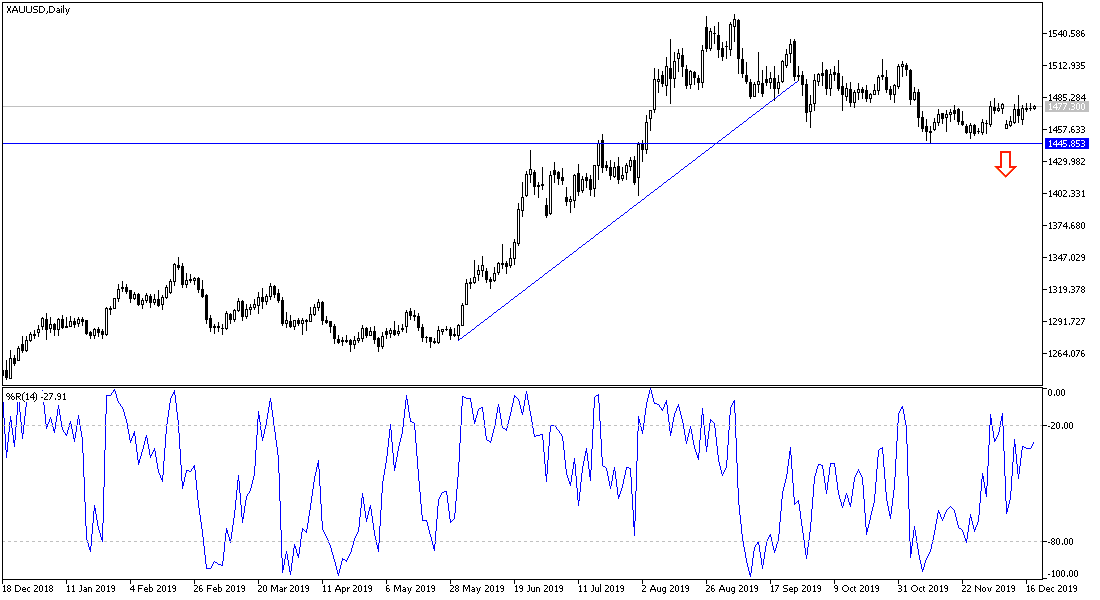

According to the technical analysis of gold: If gold prices stabilizes around the $1485 resistance, the bulls will be motivated to push the prices to the $1,500 psychological resistance in a short time. The current bullish outlook will be affected by the decline in gold to support levels at 1468, 1455 and 1440 dollars, respectively.

Gold will react today to the announcement of inflation figures from the UK and the Eurozone, and there are no significant US data releases today.