Gold markets initially tried to rally during the trading session on Thursday, but as you can see have gotten slapped right back down. There has been a lot of noise involved in this market during the trading session, as people continue to worry about the trade war and the coming tariffs on Sunday.

Initially, the market was rallying in gold, reaching towards the crucial $1500 level. As a result, we have seen a lot of volatility simply because the tweet of Donald Trump suggesting that a “very big trade deal with China is near” has had traders thinking that perhaps we would not get those tariffs on Sunday. At this point though, the market then sold off rather drastically as it was more of a “risk on” type of move. The problem with that of course is the fact that Donald Trump has tweeted that more than once, and then we ended up seeing some type of disappointment as he went ahead and slapped tariffs on despite everything was going great. Ultimately, the gold market is sitting just above a crucial support level, and just below a crucial resistance level. With that being the case, it makes quite a bit of sense that we have trouble building up any serious traction.

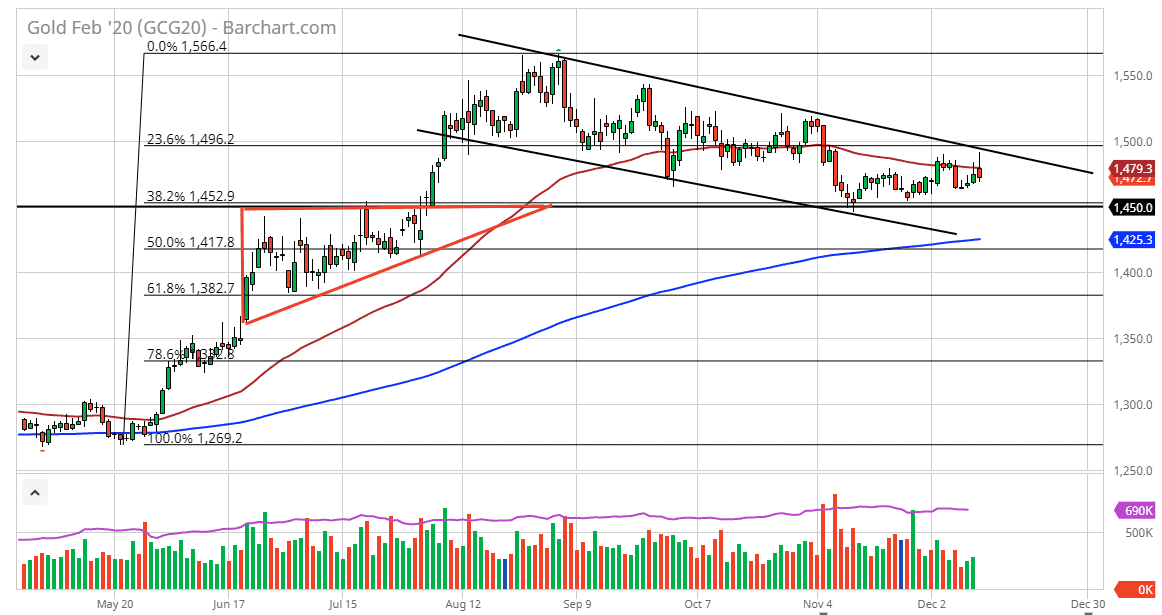

The shape of the candlestick is rather ominous, but the massive support at the $1450 level should be paid attention to. Not only that, if we were to break down below there it’s likely that the 200 day EMA which is painted in blue should come in and offer support next. A break at that level opens up the door to extreme selling as the uptrend would then be over. In the short term, it’s very likely we simply go back and forth in this general vicinity as there is no real impetus for the market to move in one direction or the other until we get an idea as to what the tariffs situation will be. Unfortunately, we won’t know that more than likely until Sunday itself, and Monday could open up with a massive gap in one direction or the other. With that being the case, it makes quite a bit of sense to simply sit on the sidelines and wait for the market to tell you which direction it wants to go. With that being the case, I am very neutral for the Friday session, but I believe that we will get a clear sign on Monday.