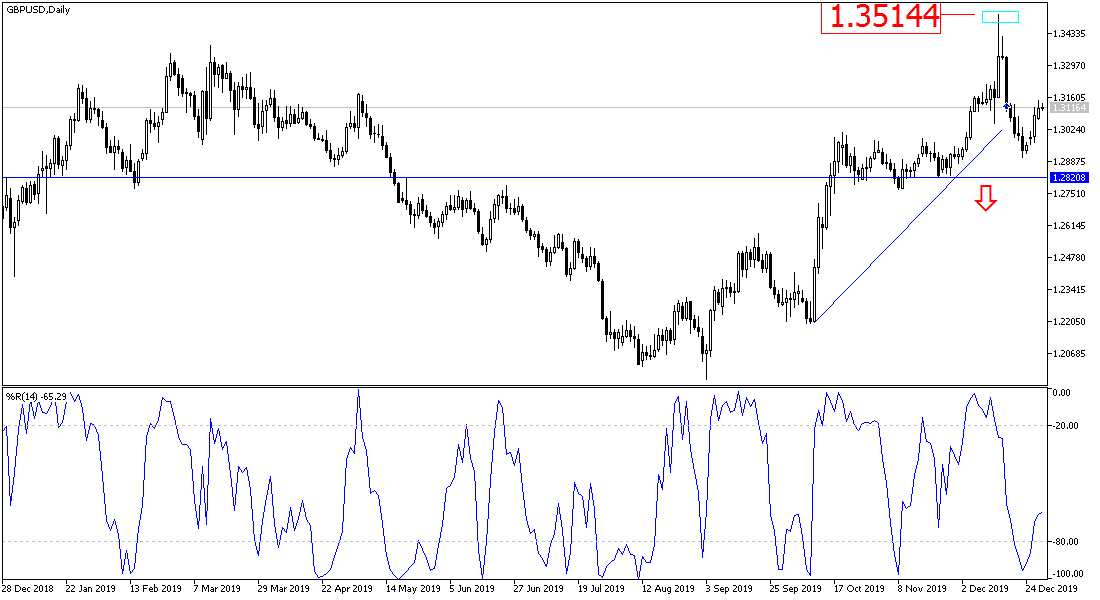

The overwhelming conservative victory in the early general elections in Britain made them more powerful and fierce in dealing internally and externally. Markets welcomed their victory and pushed the price of the GBP/USD pair to the 1.3515 resistance, the highest since May 2018, and the Boris Johnson government easily passed the Brexit Agreement through the House of Commons, and therefore Britain will exit the bloc on the scheduled date of January 31, 2020. But Boris Johnson has returned with the threat that there may not be an extension of the transition period beyond 2020. Which contributed to the pair falling to the 1.2905 support. With the decline of the US dollar, the opportunity for the pair to correct bullishly was good, and gains reached the 1.3150 level before settling around 1.3115 at the time of writing. Despite the rebound, the markets are still pessimistic about the future of Brexit, and that it may eventually happen without a deal.

The pound has stabilized after European Commission President Ursula von der Leyen told the French and German press that an extension of the transition period for Brexit is likely to be necessary, and an agreement will be required in the middle of the year. And if that is part of the European Union’s maneuver in negotiations about the future relationship between the two sides, the markets may soon be concerned about the prospect of a renewed “no deal” Brexit at the end of 2020. This would be negative for sterling and end the confidence of the global financial markets.

In general, Britain has not left the European Union yet. During the transition period, the United Kingdom and the European Union have to negotiate a new trade agreement. Uncertainty about Brexit will continue to curb GDP growth. However, it is likely that the British economy will continue to improve in 2020 due to the effects of fiscal stimulus. But this will not likely be enough to ensure a rise in interest rates in 2020 or a rise in the British pound beyond 1.3500.

According to the technical analysis: GBP/USD is trying to avoid a return to the bears ability to perform by moving around and below the 1.3000 psychological, and at the same time, the return of the bullish momentum strength in the pair is in need to breach the 1.3300 resistance, which may push the pair back to the next psychological resistance at 1.3500 (The top of Conservative victory in the elections) which supports the strength of the upward correction. The British pound has risen 10.7% against the dollar since early October, when Johnson announced for the first time that he had agreed to the UK exit terms with the European Union.

The pair is not looking for any important economic data from Britain, and the focus will only be on the announcement of the US Consumer Confidence Index data.