Prior to the holidays, which weaken liquidity in the markets, and with investors risk avoidance until the markets return to normal conditions, the GBP/USD pair welcomes the new year under downward pressure supported by the movement around and below the 1.3000 psychological support. The beginning of 2020 would have been strongly positive for the pair, were it not for the renewed fears in the markets of the future of a no-deal Brexit, even after a landslide victory for the Conservatives in the general and early elections. Britain took a big step toward Brexit on Friday when it gave lawmakers initial approval for a divorce bill, which conservative Prime Minister Boris Johnson issued, in a decisive vote that broke years of political deadlock over Britain's exit from the European Union.

The House of Commons, which was taken over by the Conservatives after Johnson’s victory in the elections last week, voted 358 to 344 in favor of the draft Brexit Agreement, paving the way for the UK’s departure from the European Union next month. Friday's vote was a moment of victory for Johnson, who won a leading parliamentary majority in the last general election amid a promise to end more than three years of political deadlock and cheerful conservative lawmakers gathered around the prime minister in the House of Commons after the vote, and asked him to sign copies of the bill. At the same time, opposition members seemed desperate.

The bill will get more scrutiny and possible amendment next month when lawmakers return from a two-week vacation, and it must also be approved by the upper house senates, elected by the parliament; the House of Lords. But Johnson's parliamentary majority means it almost certain to become law in January, and Britain will leave the European Union on January 31.

Brexit developments and the political situation in Britain have remained a strong influence on the performance of the pound against the other major currencies for three years.

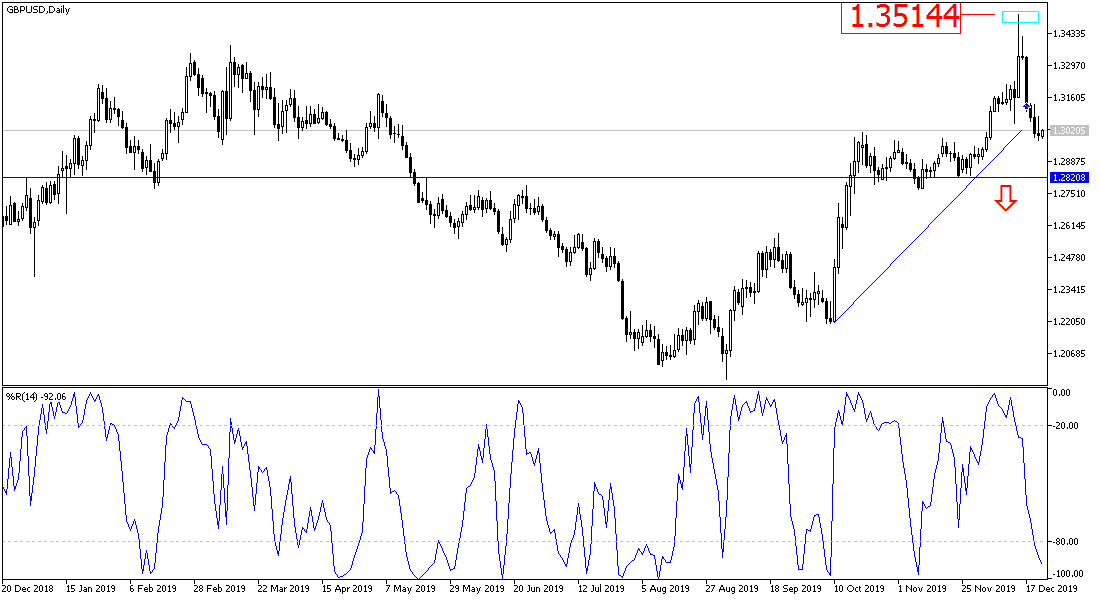

According to the technical analysis of the pair: Stability around and below the 1.3000 psychological support will confirm the strong GBP/USD downtrend and increase the momentum to move towards stronger support levels, with the closest ones are currently at 1.2965 and 1.2880, respectively. On the other hand, it is expected to return to the 1.3300 resistance to obtain a new opportunity for an upward correction. A limited and small-scale move is expected for the pair until after the Christmas and New Year holidays.

As for the economic calendar data today: All focus will be on the US session data with the announcement of US durable goods orders and new home sales.