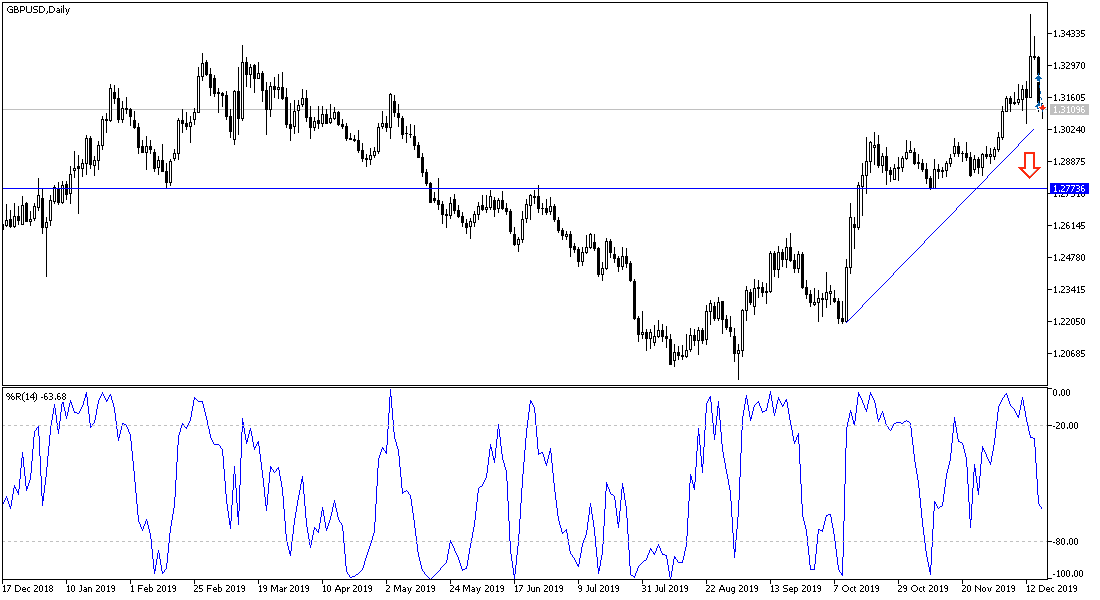

During yesterday's trading, the GBP/USD price collapsed to the 1.3100 support, with losses of more than 200 points in one session, which is the closest to the levels before the British election results, which supported the pair’s rapid rise to the 1.3514 resistance, its highest since May 2018. The pound's collapse against other major currencies came after British Prime Minister Boris Johnson strengthened his position on Britain's exit from the European Union, backed by a majority of neo-conservatives in Parliament, and ruled out any extension of the 2020 deadline to conclude a trade deal with the European Union.

While lawmakers met in the first session of parliament since Johnson won the election last week, Downing Street said the government would include a provision in the draft Brexit Agreement to rule out extending Britain's trade negotiations deadline with the bloc after next year. This could mean leaving Britain without a deal on commercial terms at the beginning of 2021, a prospect that worries many UK companies.

The Conservatives, led by Johnson, won a majority of 80 votes in Parliament in last week's general election - the most decisive victory for the Conservative Party since the 1980s - as voters gathered in areas that had previously supported the Labor Party, based on Johnson's promise to "end Brexit."

That majority gives Johnson the ability to overcome opposition to Brexit’s plans and implement his legislative agenda - unlike his conservative predecessor Theresa May, who led a minority administration and failed to win support from lawmakers on her Brexit scheme.

The inclusion of a legal clause that excludes a trade extension would confirm Johnson's commitment to leave the European Union entirely by the end of next year, although he will not prevent his government from changing its mind later. Meanwhile, opposition politicians said that the move would cause more uncertainty for companies, which are still not sure of Britain's trade relationship with the European Union, three and a half years after the UK voted to leave the bloc.

According to the technical analysis of the pair: The return of the uncertainty contributed to the collapse of the GBP/USD by 1.5% in one trading session, and the stability below the 1.3100 support will motivate the bulls to search for new buying levels, the closest at the present time are 1.3080 and 1.2990 respectively. The collapse below the last level is a strength of the downtrend again, and the collapse of the expectations of the rise that the pair enjoyed after the announcement of the results of the early elections in Britain amid a sweeping victory for the Conservatives, which was what the markets wished for. On the upside, the return of stability above 1.3300 resistance will support the move to breach the last resistance at 1.3500 again.

As for the economic calendar data today: inflation figures will be announced from Britain, with the Consumer Price Index and Producer Price Index announced. There is no significant US data today.