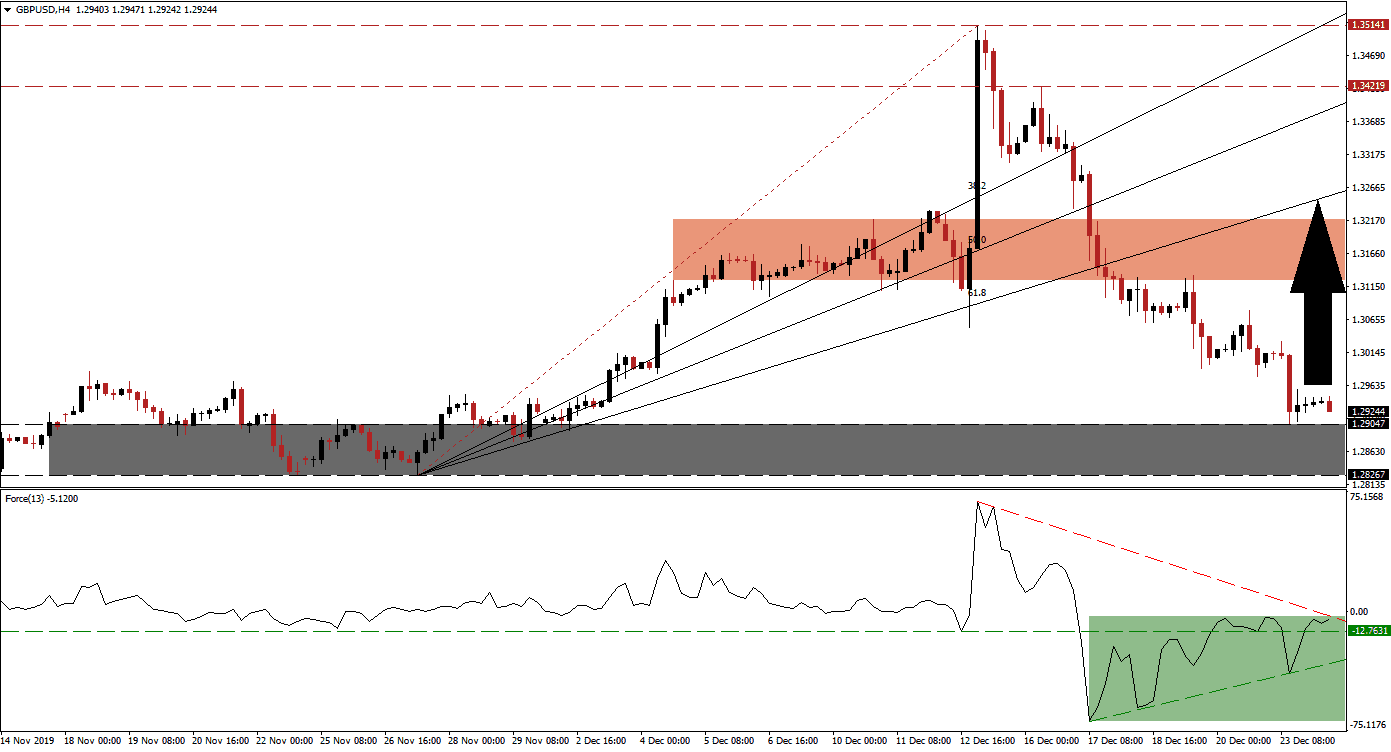

2020 is shaping up to be the year Brexit will be delivered. Prime Minister Johnson’s landslide electoral victory, the biggest in UK politics since 1987, secured an 80-seat majority in Parliament for his Tories. The country is now on track to leave the EU on January 31st 2020, but it will remain under its rules and regulations until the end of the transition period ending December 31st 2020. An announcement by the Prime Minister, declaring a bill-in-progress to make an extension of the transition period illegal, resulted in a sharp corrective phase. The GBP/USD erased the post-election rally, but bullish momentum is recovering as price action approached its support zone.

The Force Index, a next-generation technical indicator, contracted together with price action. After this currency pair completed a breakdown below its short-term support zone, converting it into resistance, the Force Index reversed and a positive divergence materialized. A breakout above its horizontal resistance level followed, converting it back to support. This technical indicator is now challenging its descending resistance level, as marked by the green rectangle. A push higher is favored to lead the Force Index into positive territory, allowing bulls to take control of the GBP/USD.

This currency pair graced the top range of its support zone located between 1.28267 and 1.29047, as marked by the grey rectangle. A higher low emerged, and this bullish development further assisted the momentum recovery. The GBP/USD is now favored to accelerate to the upside, partially fueled by a short-covering rally. Forex traders are advised to monitor the Force Index for a breakout above its descending resistance level, together with the intra-day high of 1.29505, the peak of a previous breakout, which led to a strong advance in this currency pair. A push above this level is likely to result in the addition of new net long positions.

Price action is anticipated to recover into its next short-term resistance zone located between 1.31248 and 1.3218, as marked by the red rectangle. More upside is favored as the Fibonacci Retracement Fan sequence already moved above this zone. With the long-term fundamental outlook for the GBP/USD bullish, this currency pair may extend its recovery with a breakout. The next long-term resistance zone awaits price action between 1.34219 and 1.35141. You can learn more about a breakout here.

GBP/USD Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 1.29250

Take Profit @ 1.32650

Stop Loss @ 1.28150

Upside Potential: 340 pips

Downside Risk: 110 pips

Risk/Reward Ratio: 3.09

In the event of a breakdown in the Force Index below its ascending support level, the GBP/USD could attempt a breakdown of its own. The US economy continues to show signs of growing weakness, yesterday’s durable goods orders provided the latest evidence. Any breakdown attempt in this currency pair should be considered an outstanding long-term buying opportunity. The next support zone is located between 1.26010 and 1.26771.

GBP/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.27900

Take Profit @ 1.26350

Stop Loss @ 1.28600

Downside Potential: 155 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 2.21