The British pound has spent the last couple of weeks rallying as we start to head into the holidays. At this point in time, the British pound has already seen the election come and go, and now that Boris Johnson is going to be PM for five years and there is a Tory Parliament, it’s obvious that the UK will finally leave the European Union. This is great, because the one thing that we have desperately needed in this pair has been clarity. We do have a bit of clarity now at least in the sense that the Brexit is happening in our lifetime.

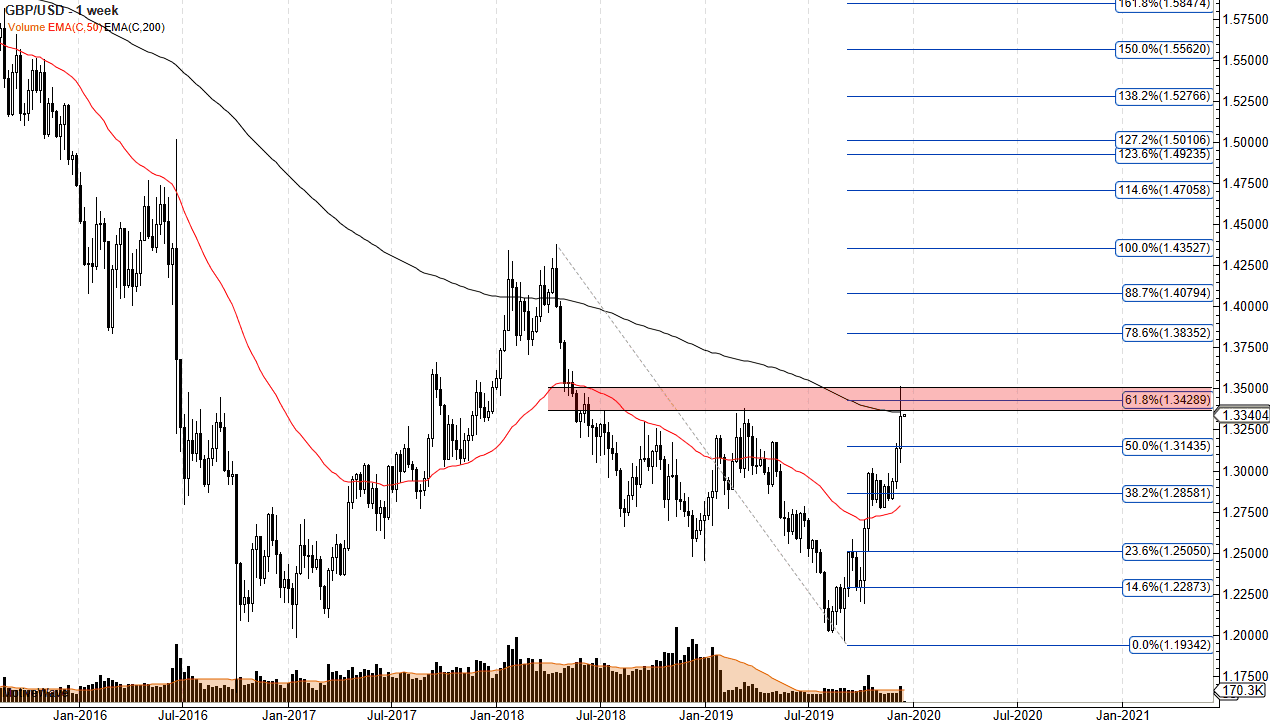

Now comes the hard part. Believe it or not, the entire situation has just flipped over. Now that the British government will be somewhat united, the conversation between the UK and the EU suddenly becomes a little easier to get done. That being said, the British pound has fulfilled some of its target, and the 200 week EMA has been pierced it. In fact, after the election the British pound jumped as high as 1.35, and that is going to be the point on the chart that needs to be paid attention to the most.

Calling a direct target during Q1 of 2020 is going to be almost impossible, because the negotiations for a new trade agreement between the United Kingdom and the European Union will go back and forth. Because of this, I am looking at this market as one that has a couple of major levels to pay attention to, and then trades can be placed. The 1.35 level is the most obvious place on the chart to pay attention to, and if we were to break above the 1.35 handle, it then opens up the door to the 1.38 level. What’s interesting is that the bullish flag that has broken to the upside still measures for a move to the 1.38 level and ultimately that is likely to be fulfilled. Whether or not it can be done in Q1 is another question. After all, there will be a lot of volatility when it comes to this pair.

To the downside, if we were to break down below the 1.32 level, then it opens up a move down to the 1.30 level underneath which should be massive support. It would be a bit surprising to see the market break down below there. That being said, the 61.8% Fibonacci retracement level should offer a bit of resistance as well so I anticipate the initial move might be a slight pullback, but that should be good for building a longer-term move.