The British pound has been at the epicenter of the three year debate on how to exit the European Union. That being said, it’s obvious that at this point we are getting closer to the end of the drama. With the UK elections happening in the month of December, the British pound is certainly going to be at the forefront of most people’s minds. As I write this, we have recently received election poll results that suggests the Tories will have a majority in Parliament. If that does in fact become reality, Brexit should happen relatively soon.

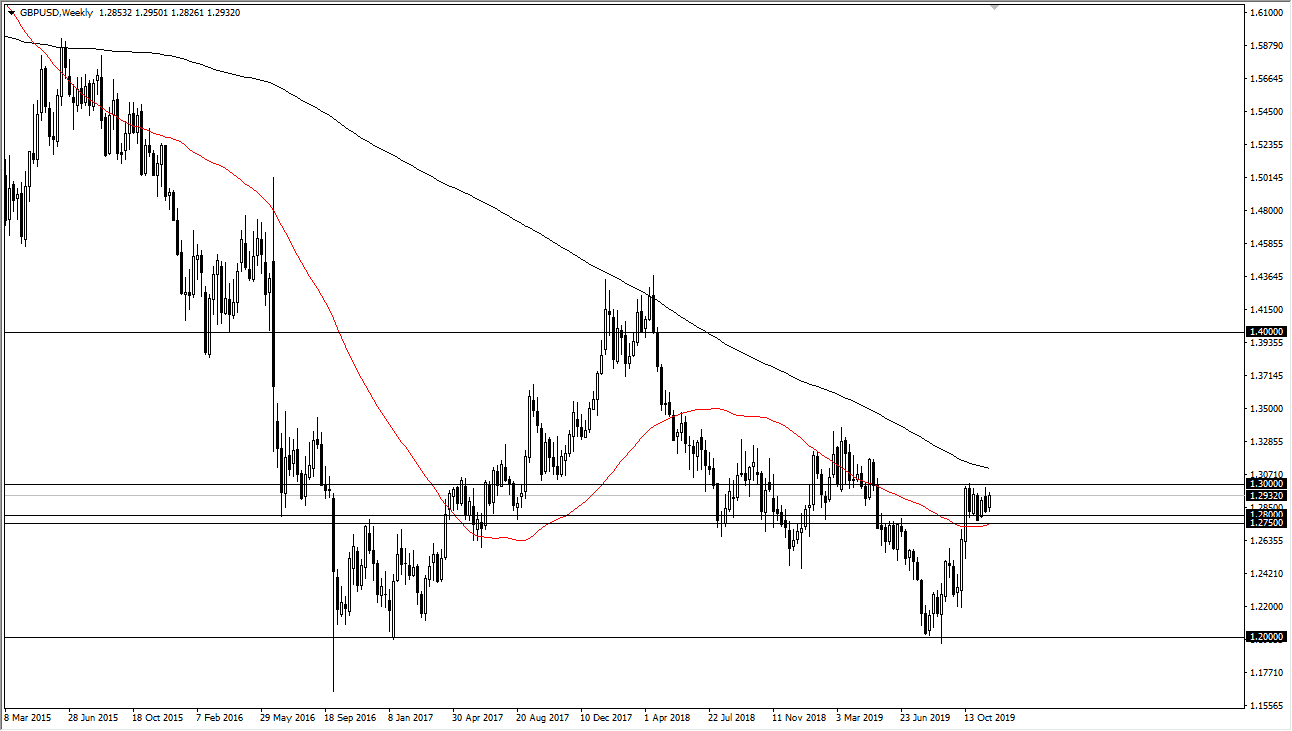

With that in mind, I suspect that a little bit of certainty in the future of Great Britain will do a lot for the British pound. We are currently testing an area near the 1.30 level, and if we can break out above there, it’s likely that the market will continue to go to the 1.33 handle. This will be more likely to happen as we get closer to the election in the middle of the month. Once that happens, then technical traders will try to finish the bullish flag, meaning reaching for the measurement. The measured move based upon the pole of the flag is for 1.38 to be hit. I think that is not only possible but a somewhat conservative target over the longer term.

Quite frankly, the British pound is historically cheap and if you have the wherewithal to hang on through all of the volatility and perhaps the ability to build up a core position, I firmly believe that in two years’ time we will be at least 20 handles above where we are now. However, for the month of December we will probably see a bit of back-and-forth trading but most certainly with a proclivity to buy the dip than anything else. With that in mind I like the idea of buying these dips for little bits of value, and once we break above the 1.30 level, I plan on hanging on for at least three handles. As far as selling is concerned, I have no interest in pursuing that, because there is so much obvious pent-up demand for British pounds, as the value hunters are starting to take over. All we need now is a little bit of good news and GBP/USD is going to start shooting straight up in the air again. That being said, be patient because you are probably going to need it this month.