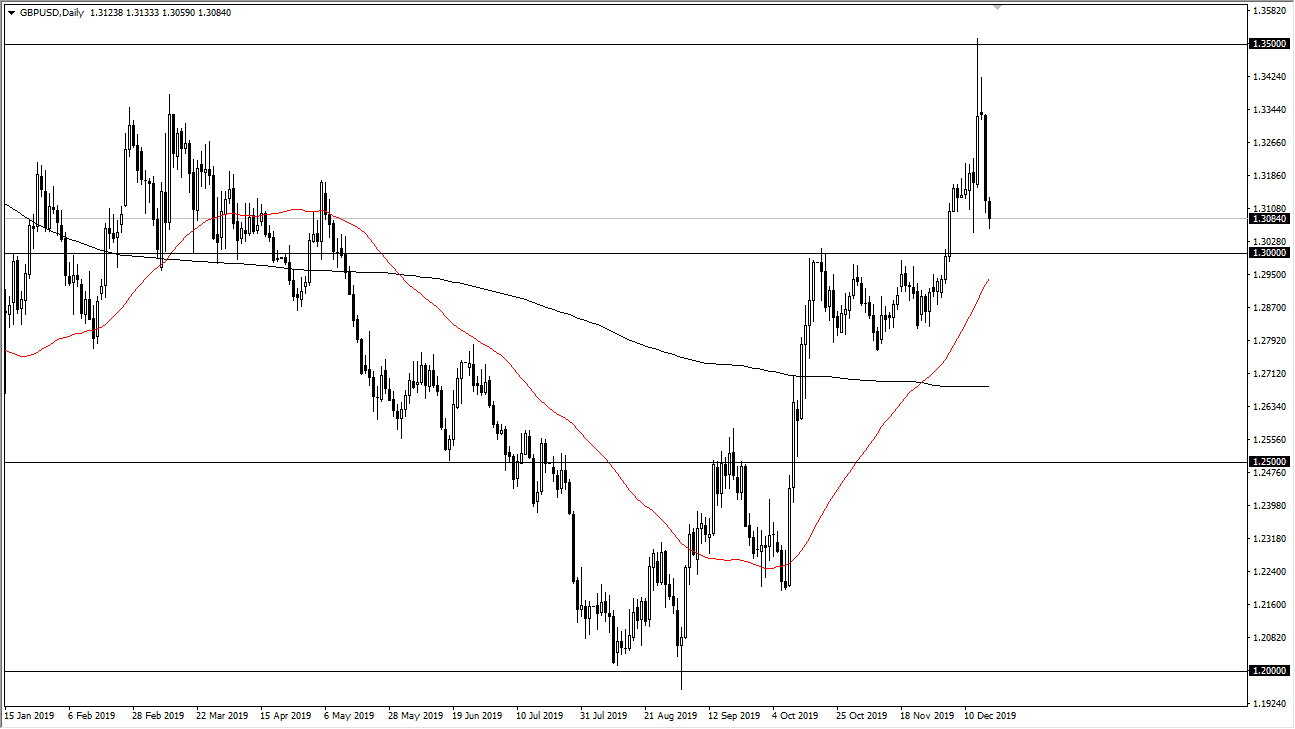

The British pound has fallen a bit during the trading session on Wednesday, reaching down below the 1.31 level. Ultimately, this is a market that looks as if it is going to go looking towards the 1.30 level underneath, which was the previous top of the bullish flag. The bullish flag of course is a very strong sign and it suggests that the market is going to go to the 1.38 handle given enough time. Ultimately, that is a longer-term call and I think we will eventually get there once we get a little bit more certainty in a little less noise when it comes to the post election situation.

Boris Johnson has suggested that he was willing to speed up the exit out of the European Union, and this has a lot of traders spooked when it comes to the British pound. Ultimately, the comments might simply be a negotiating tactic with the European Union, but nonetheless it has people freaked out. I do believe that the 1.30 level will be massive support and will bring in a lot of traders who have missed out on the major move to the upside. Beyond that, if we can break above the 1.35 handle, that opens up the door to the 1.38 handle. Keep in mind that the 1.35 level was slammed into after the exit polls came out from the election, and therefore it has a very “hot money” feel to it. Those typically get pulled back and that’s exactly what we have seen after Boris Johnson’s comments.

That being said, I am bullish and I’m simply waiting for some type of supportive candlestick on a daily chart to start buying. I think that at this point we will continue to see traders push to the upside in trying to buy the British pound which of course is historically cheap. If we were to break through the flag underneath, that would be a catastrophic move for the British pound and could unwind the entire push higher. I highly doubt that’s going to happen and believe that the British pound will probably be one of the better currencies to own next year, and we are starting to see a little bit of a pullback in order to attract more buyers, which is quite typically the case. With this, I am a buyer, but I need to see some type of daily candlestick that tells me it’s time to get involved again.