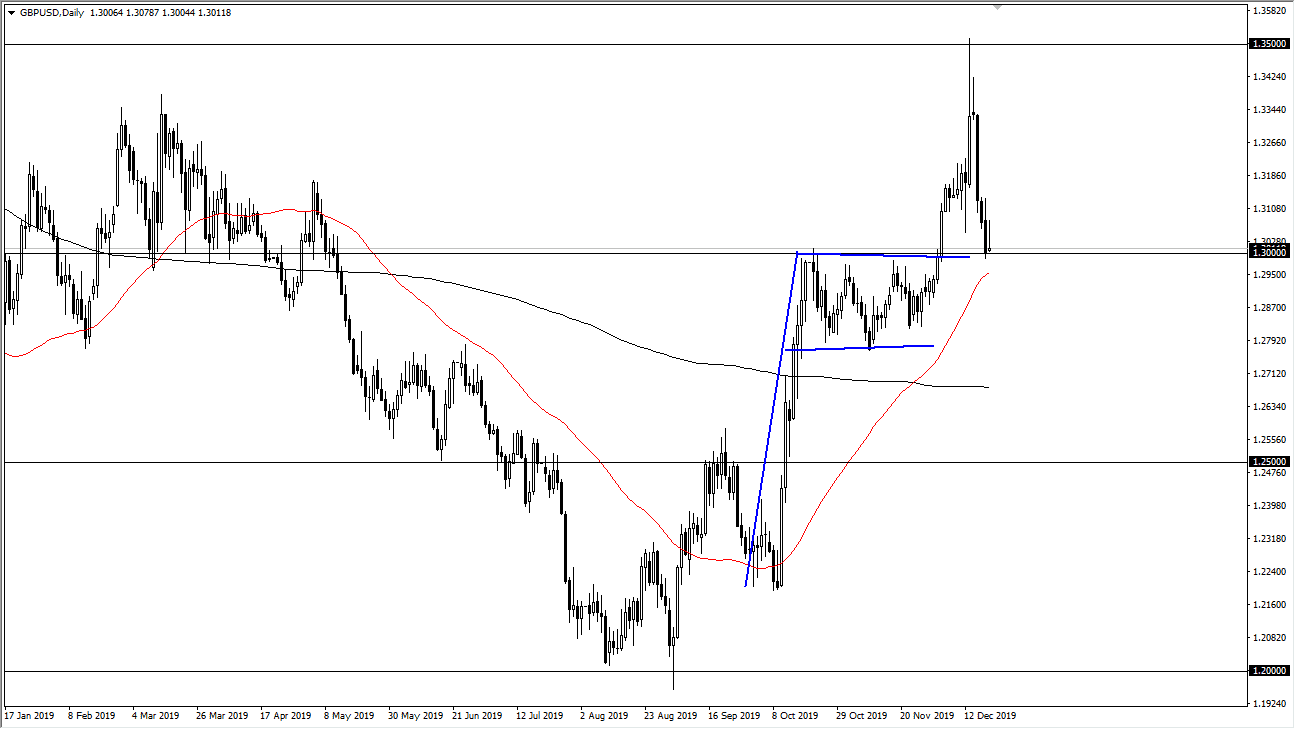

The British pound rallied significantly during the trading session only to give back the gains and form what could be an inverted hammer. At this point it will be interesting to see where we go next, but this is more or less a “binary trade” waiting to happen. The market breaking above the top of the candlestick for the trading session would be an explosive move and an inverted hammer which of course is a bullish sign. At that point I would anticipate that the market could go to the 1.35 handle, but there are so many people out there worried about Brexit right now that it’s difficult to imagine that scenario.

If we break down below the 1.30 level, there should be a lot of support extending all the way down to the 1.2880. That is the flag and if that was to get broken down below it’s likely that we would see a complete collapse. It’s hard to tell what happens next, because the British are going to leave the European Union and they are not going to ask for an extension. So now it comes down to the latest headline coming from either Europe or London. Does any of this sound familiar? In other words, this is the same thing and type of market that we are looking at ahead in 2020 that we have seen through most of the last three years.

All things being equal I like the idea of buying a break above the top of the candlestick if we get it, but if we break down below here and not interested in selling until we get below the 1.28 level because I see such amount of noise in order flow underneath that could become an issue. Keep in mind that were heading into the Christmas week, and therefore it’s likely that the market is going to be extraordinarily thin and struggle to move. Having said that though, if we get a headline that moves the British pound involving Brexit, it will probably be exaggerated in either direction as volume will be thin. With that being the case, it’s going to be difficult to trade and you should keep a small position going if anything. Waiting until January 6 when traders come back from the holiday season isn’t necessarily the worst idea either. With that, we are still in an uptrend but this candlestick for Friday is an ominous sign.