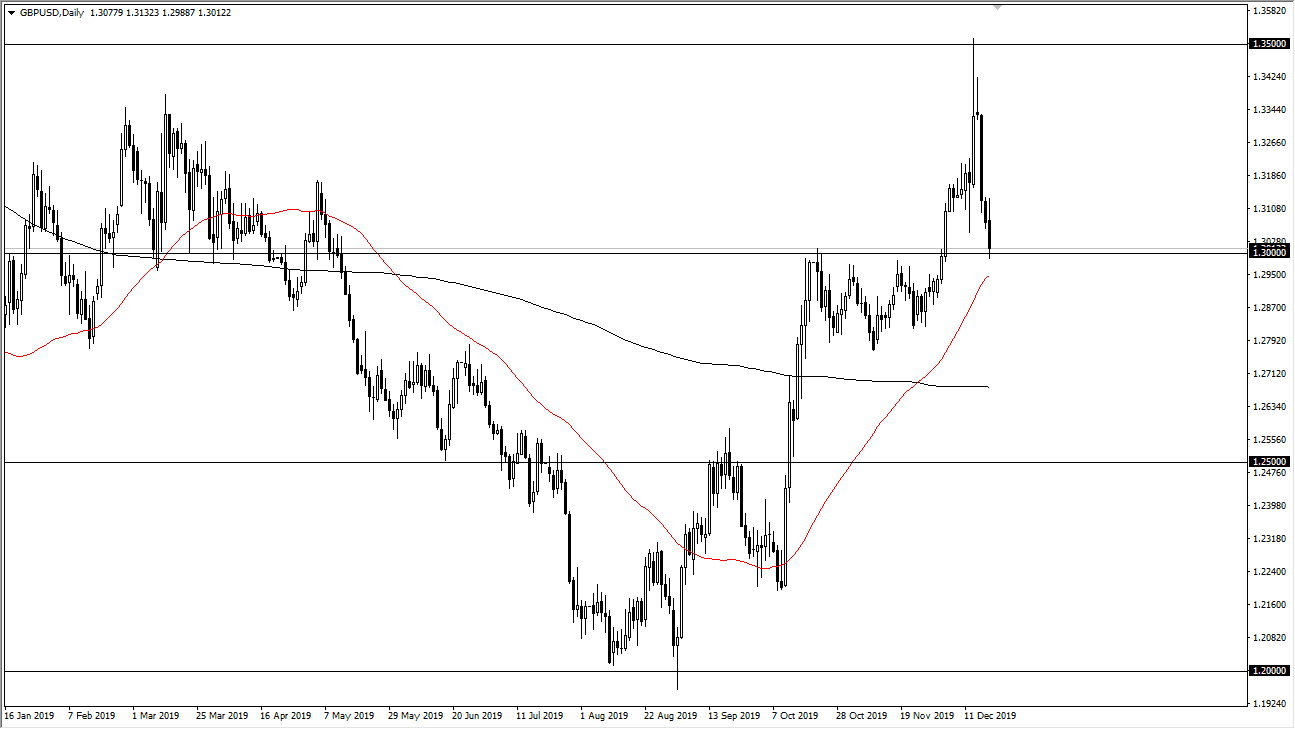

The British pound has initially tried to rally during the trading session on Thursday, but then broke down significantly to reach towards the psychologically important 1.30 level. That’s an area that is important because it is a large, round, psychologically significant figure, and it is also the top of a major bullish flag that should come into play for the longer-term. If we break down through the 1.30 level in continue to drive towards the 1.28 handle, this would be a very negative sign. Ultimately, this is all about the Boris Johnson comments about pushing Brexit through with or without any type of deal, or more specifically that he was not willing to ask for some type of extension. Because of this, the British pound has fallen off of a cliff since then.

The 50 day EMA is underneath, reaching towards the 1.30 level, and it should cause some type of support. Ultimately, if we see a bounce from there it could be a really good sign and could send this market back towards the 1.35 handle. All things being equal, it’s a matter of waiting to see what happens next and quite frankly it’s probably in the hands of Boris Johnson at this point.

The flag measures for a move to the 1.38 handle, and while I do believe we can get there eventually, it’s going to take some time. Break above the 1.35 level will be difficult, but eventually it’s likely to happen. We need some stability in the Brexit situation and right now it doesn’t seem to be very likely. I do think that eventually as we start to get more information, it will probably favor the British pound overall, but clearly the way that the market has reacted to Boris Johnson’s comments shows you just how skittish things are going to be.

If we do break down below the 1.28 handle, this thing could break down to the 1.25 handle next. Quite frankly, most British pound traders are getting fed up with the behavior of the market, and more importantly the politicians. I suspect that volume is lighter than usual due to not only the time a year but all of the danger that has been a mainstay of trading Sterling over the last couple of years. Between now and New Year’s Day I would not expect too much, barring some type of comment coming out of London which of course is always possible.