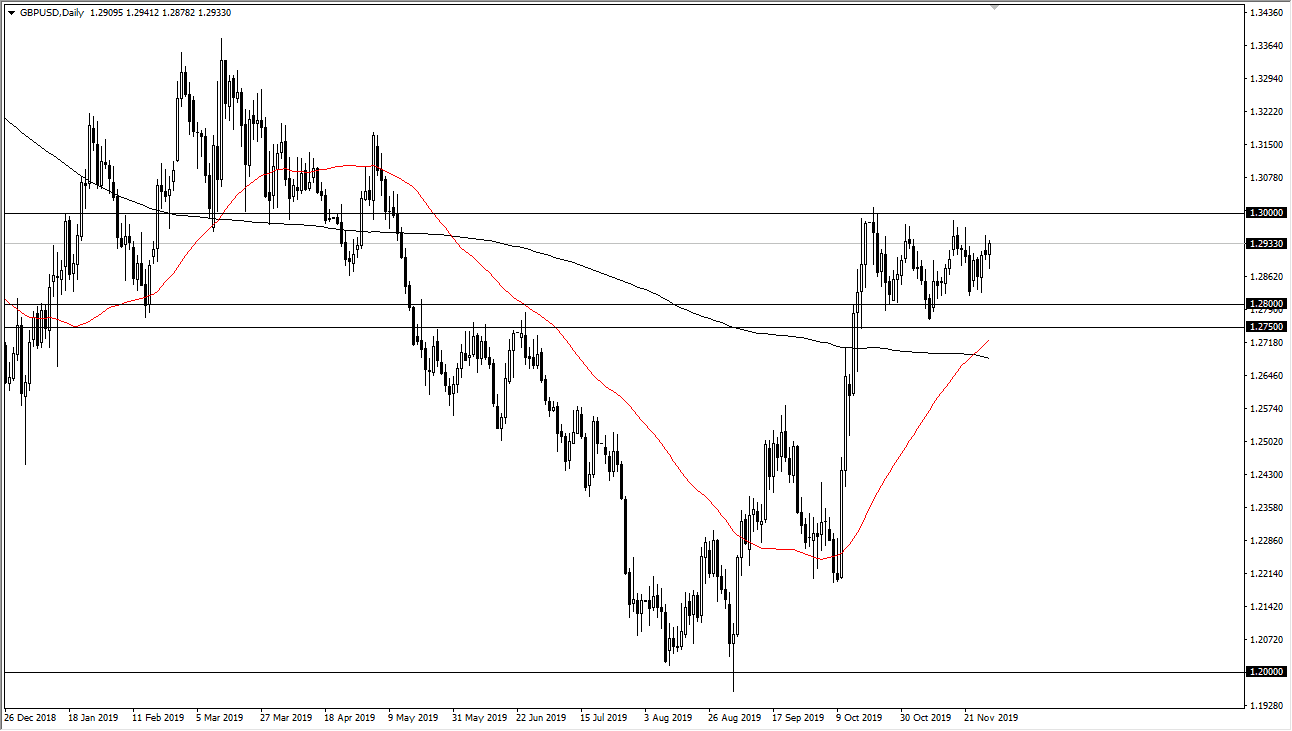

British pound traders initially sold to kick off the trading session on Friday, but then turned around to show signs of life again. Ultimately, the British pound looks as if it is trying to build up enough momentum to finally break out to the upside, with the 1.30 level offer in a major resistance barrier. When you look at the chart it doesn’t take a whole lot of imagination to see a bullish flag, so at this point I think it’s only a matter of time before we break out to the upside.

Pullbacks continue to offer buying opportunities all the way down to at least the 1.2750 level, and quite frankly when you look at the most recent lows we do continue to grind to the upside. There have been election polls that suggests the Tories are going to take a majority control of the UK Parliament, and that of course gives the opportunity for Boris Johnson to finally get through the Brexit situation. After all, sometimes the market participants think more along the lines of looking for certainty then whether or not Brexit into being a good thing. In the meantime, we need to look at the British pound as being historically cheap, so buying it makes quite a bit of sense, beyond that, the bullish flag that has formed suggests that we could go as high as 1.38 over the longer term. Don’t be wrong, I don’t think it happens overnight, but once we do break the 1.30 level it could be a matter of chasing the trade, sending a flood of money into this market.

To the downside, the 1.2750 level should be massive support. However, if we do break down below there, I think there’s even more support at the 1.25 handle as it is a large, round, psychologically significant figure. Furthermore, we have the so-called “golden cross” that has just happened, something that longer-term traders like. This is a bullish sign, and I do think that longer-term money is starting to build up British pound positions, as it is at such a low level, and quite frankly unless the United Kingdom falls apart, this currency should rally given enough time. Low leverage makes sense, but at this point we could see this market be very choppy, but it’s only can it take a headline or two of the right type to send this market through the roof.