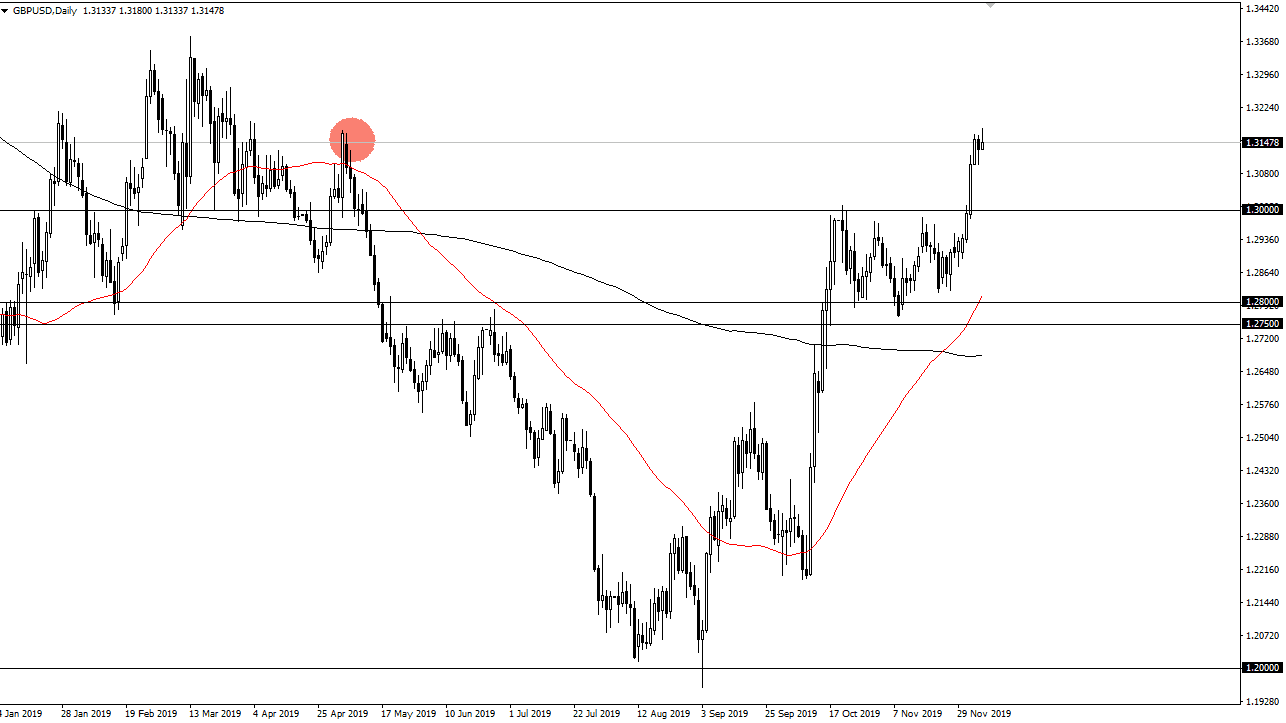

The British pound has rallied a bit during the trading session on Monday, only to give back about half the gains. By doing so, the market is likely to see a lot of noise, and a lot of volatility. Looking at the chart, it’s obvious that we are a little bit extended, but it should be noted that the previous candlestick for Friday was a bit of a hammer. I think that means we are simply going to bounce around this region, the 1.3150 level, ahead of the elections. Obviously, we have been in an uptrend for some time, it makes sense that we now have to await the results on Thursday of the parliamentary elections in England.

Looking at this chart, the 1.30 level underneath should be massive support, as it was previous resistance from the bullish flag. That area has been very resistive and the fact that we broke above it is a very strong sign. In fact, it’s not until we break significantly below the 1.30 level that I would be concerned about the uptrend and I think that unless there is some type of nasty surprise with the election, it’s very likely that we will continue to go higher, with the 1.33 level being the initial target. If we were to break above the 1.33 handle, then the next target will be the 1.35 level based upon the large, round, psychologically significant figure.

Based upon the bullish flag, it is likely that we continue to go to the 1.38 level based upon the measurement, and therefore it’s likely that we could go looking towards that level. Ultimately, this is a market that has been very strong and therefore one would have to think that sooner or later the buyers return. If we get some type of majority Parliament situation where the Tories run the show, then it’s likely that we finally get Brexit done with, which is at the very least going to be some type of certainty. The British pound has had almost no certainty over the last couple of years so that of course in and of itself would be bullish. I do believe that there is a lot of volatility just waiting to happen, but most certainly it appears without some type of shock election result, buying is the only thing you can do. Look at pullbacks as potential value.