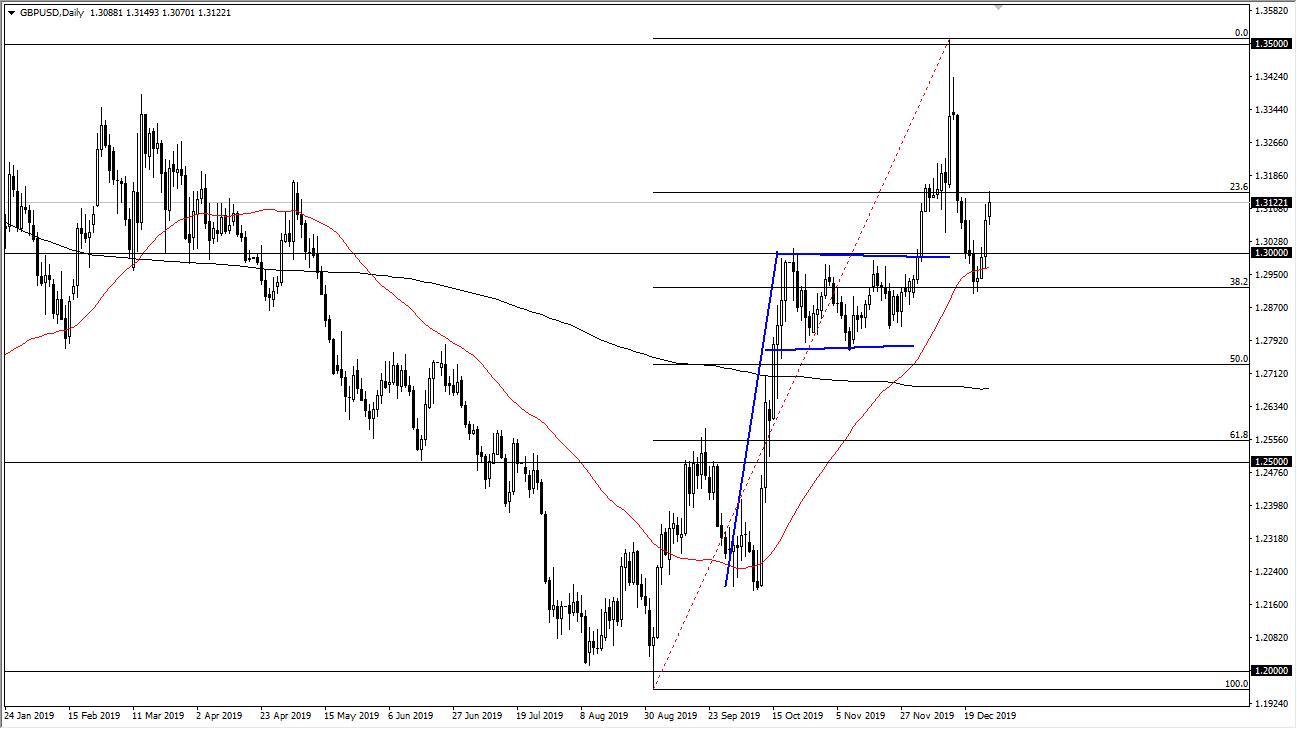

The British pound rallied a bit during the trading session on Monday after the traders came back from the weekend, but ultimately this looks like a scenario where we are going to try to continue to break to the upside. The market has recently tested a major bullish flag for support and found it exactly where you would anticipate. By bouncing in the way, we have, it suggests that we are going to go much higher, reaching towards the 1.35 level above which was the recent high. That doesn’t mean that we get there right away, and as a result I think that we will get the occasional pullback in order to take advantage of value.

The 1.30 level should also offer support, just as the 50 day EMA well. Remember, the British pound has been rocked back and forth due to the occasional Brexit headline, and of course the election results. Now that we have gotten a lot of that noise all the way it would make sense to see this market continue the longer-term uptrend. Remember, the liquidity will be a bit then at this point, but ultimately this is a market that had been in a nice uptrend before pulling back in a “sell the news” event after the election results. Now that we have gotten a lot of the soft traders out of the way, it looks like we are ready to go back towards the highs and fulfill the longer-term move.

The bullish flag measures for a move to the 1.38 handle, and obviously we haven’t gotten there yet. Because of this I think that the longer-term traders will continue to hang on to this pair until we get there, probably going right along with buying on the dips going forward. If we were to break down below the most recent low, then the market could go looking towards the 1.28 handle, and then possibly the 1.25 level. Nonetheless though, this is a market that should continue the overall attitude that we have seen for some time and it’s likely that the market should follow through the soon as we get liquidity back in the market after the holidays. Ultimately, this is a market that I like buying on dips. It will be very choppy to say the least, but I still favor the upside as the British pound is historically cheap.