The British pound has rallied significantly during the trading session on Friday, to break back above the crucial 1.30 level. Now that we have recaptured that, it’s very likely that the market will continue to go higher but it’s not as if we are going to shoot straight up in the air. The elections are out of the way, and that of course has helped, but now people have to wonder whether or not the United Kingdom will leave the European Union in a “hard Brexit”, or if they are going to strike some type of deal.

At this point though, the market need certainly more than anything else and now we have a unified United Kingdom government that we can look to, and it looks likely that Brexit will happen sooner rather than later. What’s the end result? Nobody really cares as far as currency traders are concerned, we just need something to trade off up. The European Union continues to struggle, so there is the possibility that the United Kingdom will outperform, despite a lot of the panic and fear driven headlines.

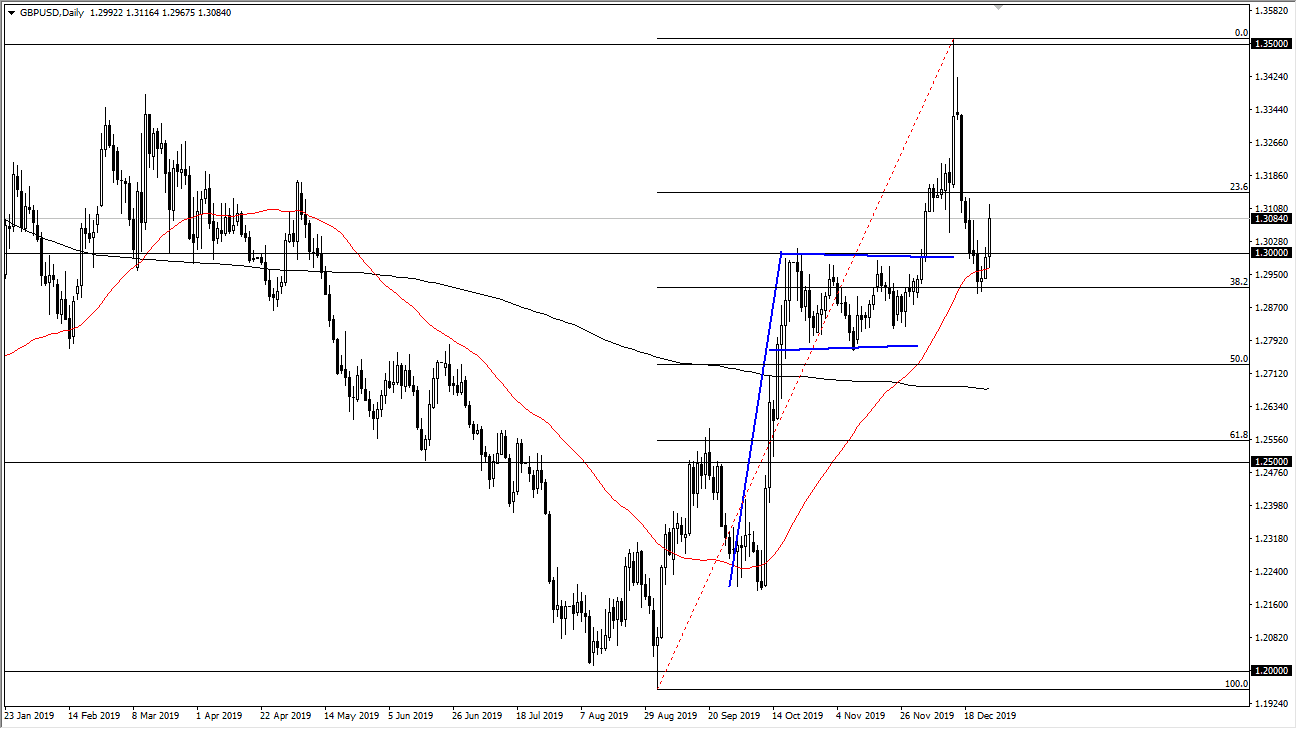

Looking at the chart, we have reached towards the bullish flag that sent the market higher to begin with, so therefore it’s likely that we will see quite a bit of buying pressure in this area, just as Friday suggested. I think short-term pullbacks at this point will likely to offer value, and I will play it as such. The 50 day EMA is likely to continue to offer quite a bit of support from both a psychological standpoint, and of course the technical standpoint. If we can break above the highs of the trading session on Friday, that is also a buy signal, as I don’t really have a sell signal at this point in mind. I suppose if we break down below the bullish flag, then you could have the argument that it’s time to start selling, but quite frankly I don’t see that happening unless we get some type of shock announcement. All things being equal, I anticipate that over the next several weeks we will reach back towards the 1.35 handle yet again. I think that based upon the bullish flag, the target is actually going to be closer to the 1.38 handle, as the measured move from the bullish flagpole suggests. If we were to break down below the 1.28 handle, then we could be looking at the 1.25 level.