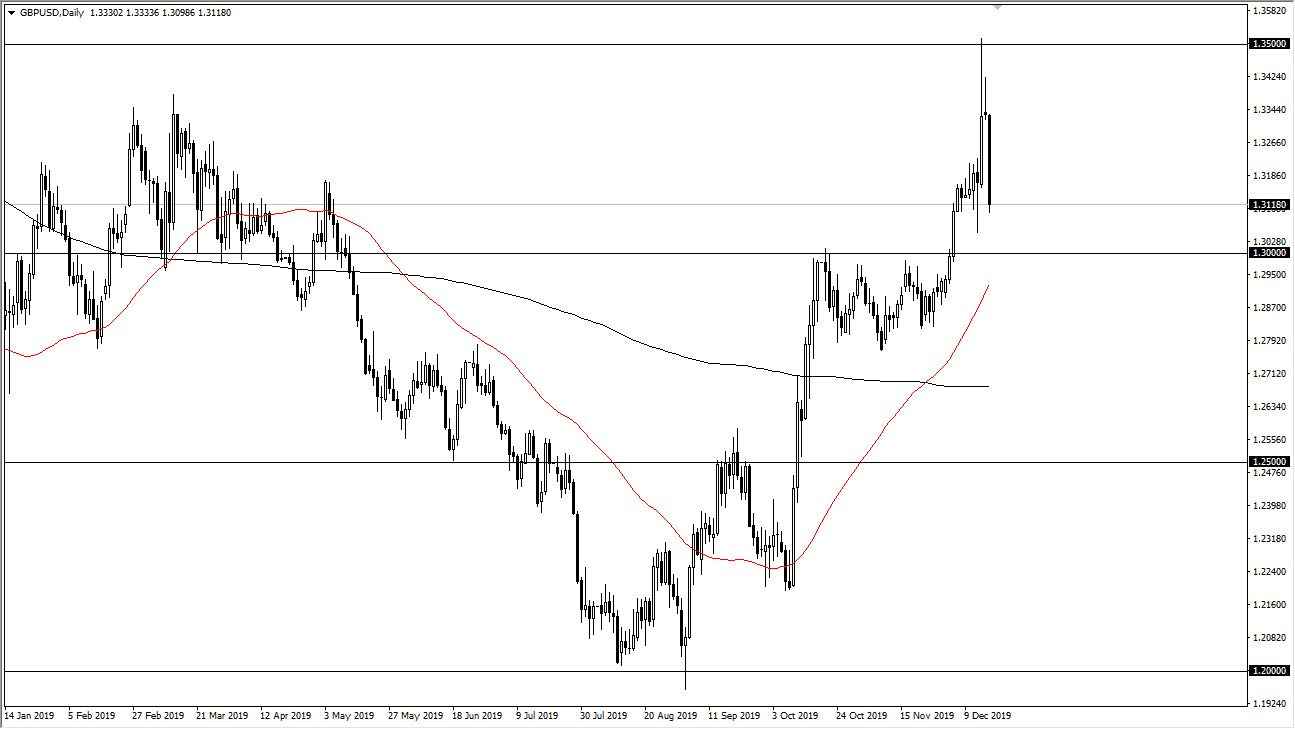

The British pound broke down significantly during the trading session on Tuesday, reaching down towards the 1.31 handle. At this point, the market is looking at significant support underneath extending all the way down to the 1.30 level. At this point, the 1.31 level is the beginning of a huge area, and I think at this point the market is going to continue to see a lot of interest as we have sold off so drastically as of late. The recent comments by Boris Johnson suggesting that he was going to prevent any type of delay of Brexit by the British government have spooked the market but quite frankly I think it was looking for reason to sell off as evident by giving back half of the postelection gain, and then of course the shooting star from the next session. In other words, the 1.35 level was going to be “a bridge too far.”

The market has been extraordinarily bullish as of late, and now it’s likely that people will start looking towards the market for value, on these pullbacks. I think that it’s only a matter of time before we see some type of bounce in the general vicinity that we are approaching, but you may need to wait for a daily candlestick in order to make that move. To the upside, the 1.35 level of course will continue to be a massive barrier, but if we can get above the 1.35 handle, it’s likely that we will continue a much larger run. There are a lot of concerns when it comes to Great Britain in rightfully so but at this point in time it’s very likely that the market still looks at the British pound as being undervalued.

We have recently seen the “golden cross”, and of course the bullish flag, both of those tell me that there is a lot of interest in buying the British pound. The 1.38 level was the measured move from the bullish flag, and quite frankly I think we go higher than that given enough time. There are a lot of short covering moves out there just waiting to be had, and I do think that the British pound is the longer-term cyclical uptrend now, but there will of course be the occasional headline that causes major issues for those trading the Pound. I remain bullish but I also recognize that looking for value will probably be the best play.