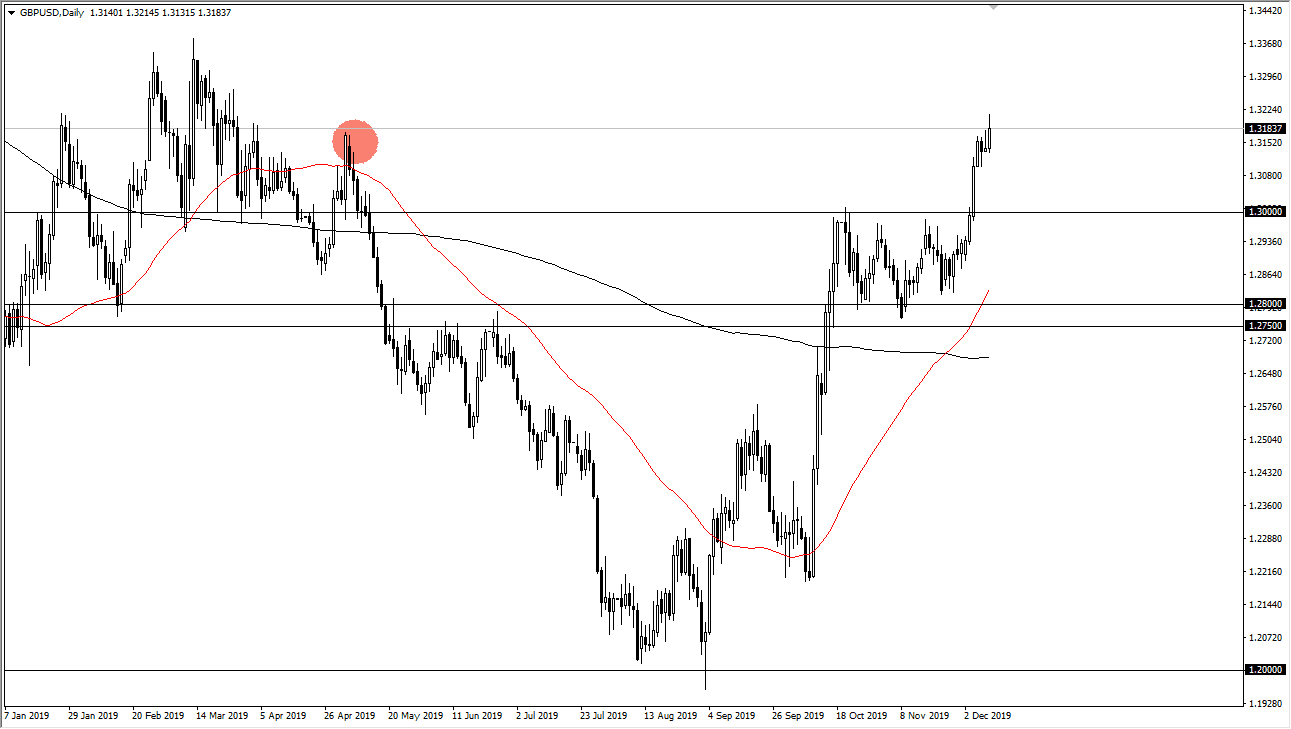

The British pound should continue to go higher given enough time, as we are broken above the top of the shooting star from the previous session on Tuesday. Ultimately, this is a market that is likely to continue to reach towards the 1.33 level above, which is significant resistance. At this point, short-term pullbacks continue to offer buying opportunities as we are in a very bullish market. The 1.3150 level is significant noisy supporting resistance, and at this point it’s likely that we will probably see a continuation of the bullish flag breakout that we recently had. I have no interest in shorting the British pound, unless of course the Labour Party ends up winning the election. In the meantime, the electoral polls suggest that the Conservative party should take control of Parliament, and therefore a Brexit may actually happen in our lifetime.

I believe that the 1.30 level is essentially the “floor” in the market and should continue to keep the market somewhat higher. At this point, if we were to break down below that level it would probably be some type of negative reaction to the election and all bets are off. Based upon the bullish flag that had formed on the market, it’s likely that we go to the 1.38 level given enough time. All things being equal this is a market that should continue to be bullish as the British pound is historically cheap, and therefore it makes quite a bit of sense that we continue to go higher if we can get the specter of Brexit out of the way. Granted, it just simply doing Brexit doesn’t solve all of the problems but it’s a step in the right direction.

If Labour was to win control of Parliament again, that could cause major issues and we could even see the 1.2750 level be broken to the downside. Ultimately, it’s very unlikely that happens, but it is also a major concern just in case the pollsters get the situation wrong. Ultimately, this is a market that they seem to be heading in one direction to look at pullbacks as potential value. The market may selloff just ahead of the Thursday election though, in order to collect profits. That being said, market participants look at this as a value proposition from what I see, and that should continue to be the case going forward.