The British pound has broken down rather significantly during the trading session on Tuesday, which is probably overdue after the knee-jerk reaction of the election. Keep in mind that most of the exit polls in the United Kingdom came out during the swap that happens every day at 5 PM in New York City, as the banks rollover. This keeps the market somewhat thin, so the knee-jerk reaction to those numbers being released might a bit overdone. Having said that though the ¥148 level has offered a bit too much in the way of resistance that the market has turned around to form a rather ugly candlestick after that.

The shooting star during the trading session on Monday was a bit telling, as it showed just how the market has been overextended, and therefore it’s likely that the market would continue to see a bit of selling pressure come in as people would have found themselves a couple of handles up and would be quick to take advantage of those profits. Because of this, we then fell rather hard to reach towards the bottom of the gap that had already been formed. The ¥143.50 level is going to offer a bit of support, just as the ¥142.50 level will also offer support. There is a little zone of support in that area that should eventually attract value hunters.

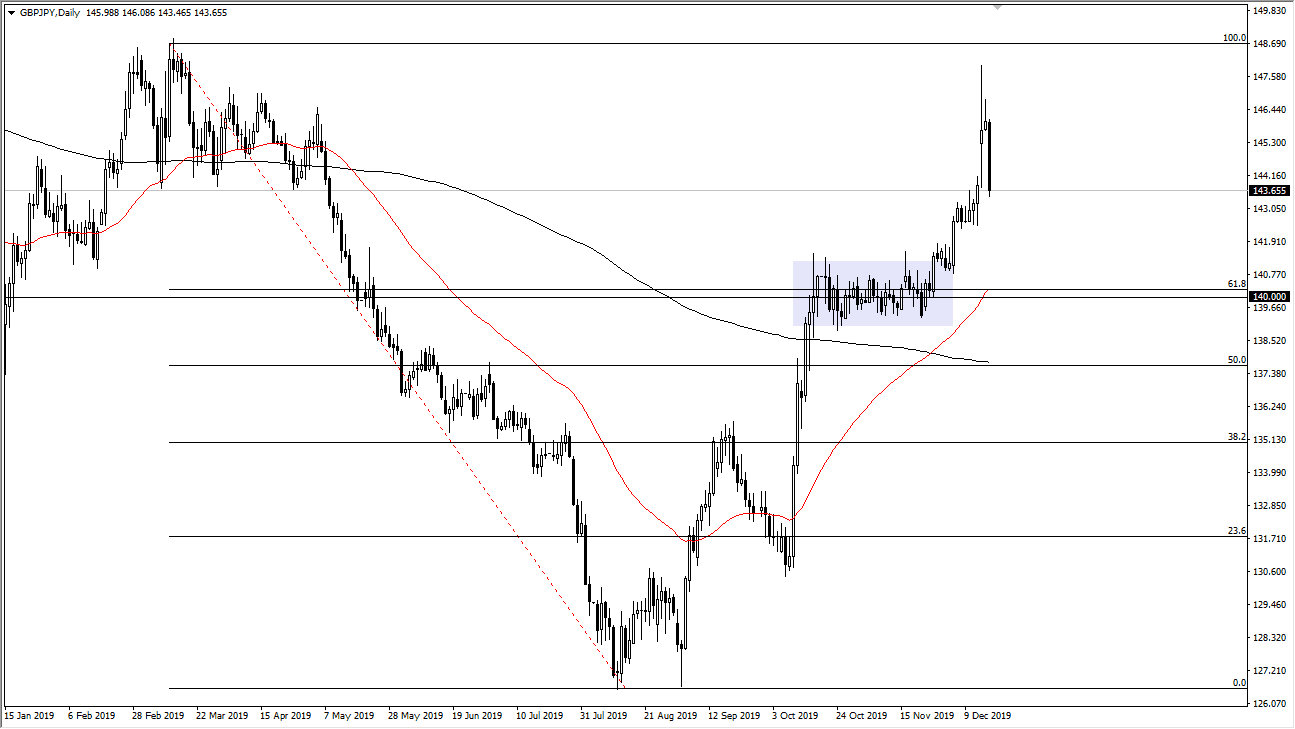

The market beyond that has a massive amount of support at the 140 and level, as we had broken out of a bullish flag from that area. At this point, you should also take a look at the fact that the 61.8% Fibonacci retracement level has been blown through, and that almost always means that the market is going to go looking towards the 100% Fibonacci retracement level. All things being equal, once we blow through their it’s very likely that the British pound should then go towards the 150 and level. The 50 day EMA crossing above the 200 day EMA is the so-called “golden cross”, which of course attracts a lot of longer-term traders as well. Having said all that, keep in mind that the GBP/JPY pair is highly sensitive to risk appetite overall, so pay attention to the stock markets around the world. If they do rally significantly from there, then it’s likely that this pair will then go higher. That being said, it also works in the other direction. I do think that the next couple of days should see buyers show up sooner rather than later.