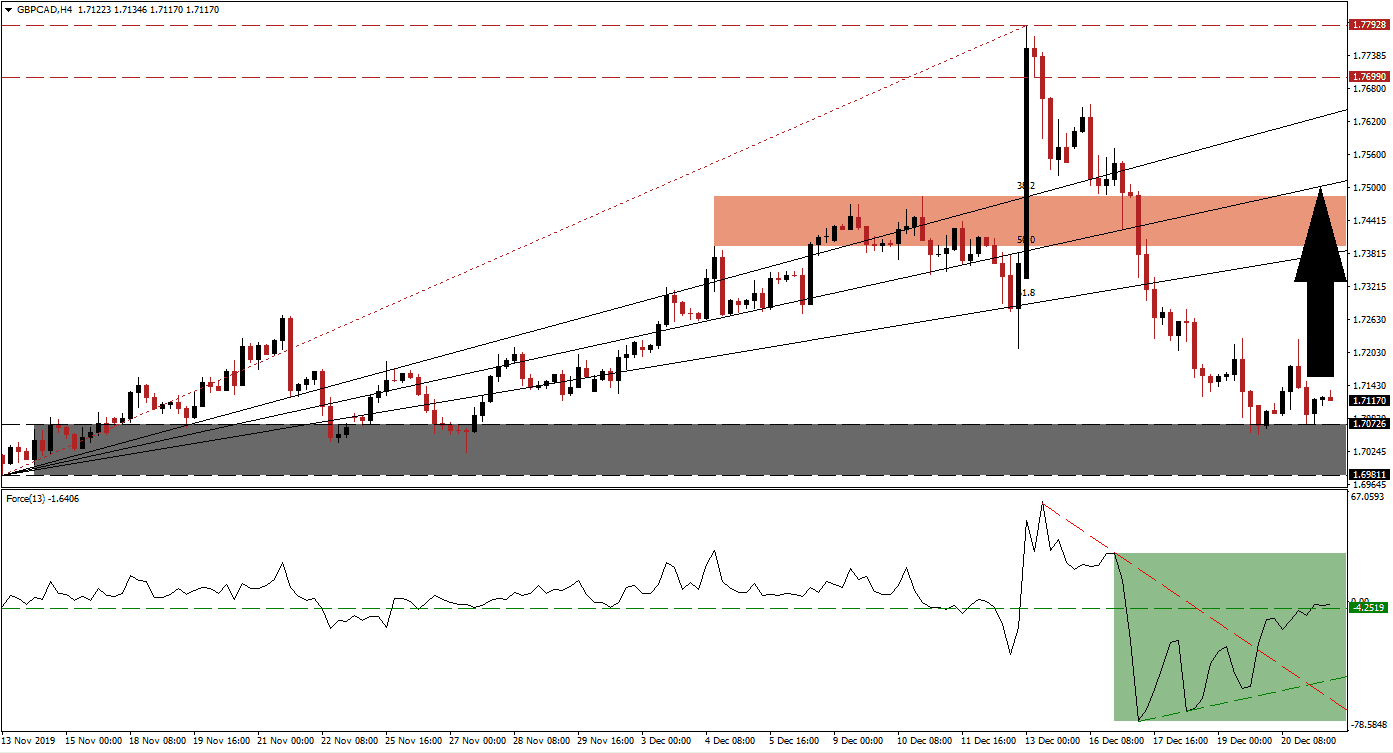

Following the sharp sell-off in the British Pound, after the announcement that an extension of the Brexit transition period past December 31st 2020 will be illegal, bullish momentum is recovering. Prime Minister Johnson secured an 80-seat majority in Parliament, and the UK is now expected to leave the EU on January 31st 2020. A no-deal Brexit remains a possibility, which sent the GBP/CAD lower, a normal development considering the significant rally before the collapse. A higher low was formed, and price action is anticipated to recover to the upside and close the gap to its ascending 61.8 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, recorded a fresh low as the GBP/CAD accelerated to the downside. The Force Index started to recover following the breakdown in price action below its 61.8 Fibonacci Retracement Fan Support Level, which converted it into resistance, and a positive divergence formed. This technical indicator pushed above its descending resistance level and turned its horizontal resistance level into support, as marked by the green rectangle. A push into positive territory is favored to follow and guide price action to the upside. You can learn more about the Force Index here.

One critical bullish development materialized as a result of the second higher low that formed during the sell-off. The GBP/CAD briefly dipped into its support zone located between 1.69811 and 1.70726, as marked by the grey rectangle, before recovering to the upside. A second dip lower was additionally reversed, and a short-covering rally us expected to follow. Forex traders are advised to monitor the intra-day high of 1.72261, the peak of the current recovery, from where new net long positions are anticipated after this currency pair eclipses this mark.

This currency pair will face its first meaningful resistance at its 61.8 Fibonacci Retracement Fan Resistance Level. It is approaching the bottom range of its short-term resistance zone located between 1.73941 and 1.74846, as marked by the red rectangle. Today’s Canadian GDP report may provide the next short-term catalyst, given the holiday-shortened trading environment. A breakout in the GBP/CAD above its short-term resistance zone is possible, and the next long-term resistance zone awaits this currency pair between 1.76990 and 1.77928.

GBP/CAD Technical Trading Set-Up - Price Action Recovery Scenario

Long Entry @ 1.71200

Take Profit @ 1.75000

Stop Loss @ 1.70000

Upside Potential: 380 pips

Downside Risk: 120 pips

Risk/Reward Ratio: 3.17

Should the Force Index accelerate to the downside and into its ascending support level, the GBP/CAD is expected to attempt a breakdown below its support zone. The long-term fundamental outlook remains bullish, and an extension of the sell-off should be considered an excellent buying opportunity. The next support zone following a breakdown is located between 1.67182 and 1.68175.

GBP/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.69500

Take Profit @ 1.67600

Stop Loss @ 1.70400

Downside Potential: 190 pips

Upside Risk: 90 pips

Risk/Reward Ratio: 2.11