For the third consecutive day, the EUR/USD pair continues to benefit from the weakening of the dollar and moves through the 1.1200 psychological resistance, with gains touching the 1.1220 resistance, the highest for the pair in more than four months, and settles around 1.1205 at the time of writing, and before the announcement of the American consumer confidence data. The pair stabilized around its gains despite the faltered risk appetite, and the European single currency rose against all other major currencies, aside from the New Zealand dollar and the British pound, with no clear catalyst for this step after sales in emerging currency markets. In the last hours of 2019, Major US stocks indicators are still at record levels and have risen by 23-36% this year. Treasury yields continued to decline slightly.

Current currency performance, as markets digest reports of a US missile attack on an Iranian-backed armed group in Iraq and Syria. Secretary of State Mike Pompeo told reporters that such strikes may be justified, so it is possible that the movement of risk prices in the currency and general markets may be driven by the possibility of new tensions between the United States and Iran in the Gulf.

For world trade. US President Donald Trump said last week that he and his Chinese counterpart would sign their Phase 1 agreement "when they meet." The agreement has already avoided a new round of tariffs this month, but so far no formal signature has occurred, and they may meet in the coming weeks, and markets may be concerned if what happened is just ink on paper.

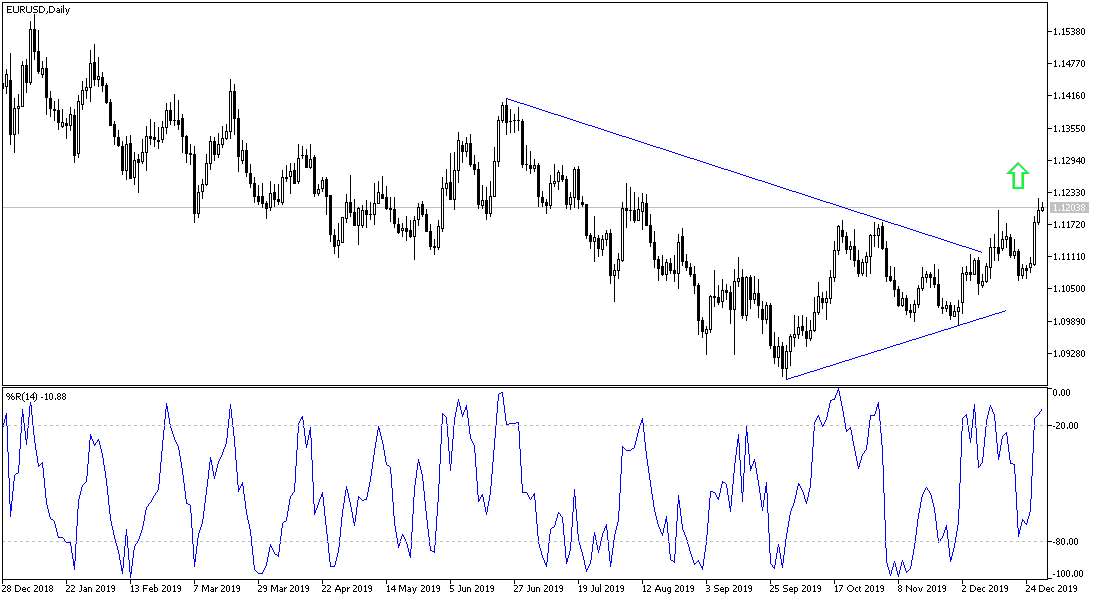

According to the technical analysis: The stability of the EUR/USD pair above the psychological 1.1200 resistance supports the strength of the bullish correction, and the pair may remain around that region for the next week, which is awaiting the announcement of a package of important US economic data that shows the performance of the economy by the end of 2019. Showing strength will end on the pair gains quickly. At the present time, the closest resistance levels for the pair are 1.1245, 1.1330 and 1.1400 respectively, and I still prefer to sell the pair from each upside level. On the downside, the closest support levels for the pair are now at 1.1165, 1.1090 and 1.1000, and the last level is an end to the upward correction, and returning to its downward channel, which is still standing on the long run.

As for the economic calendar data today: There are no significant releases from the Eurozone today, and only from the United States of America, with the release of Consumer Confidence data.