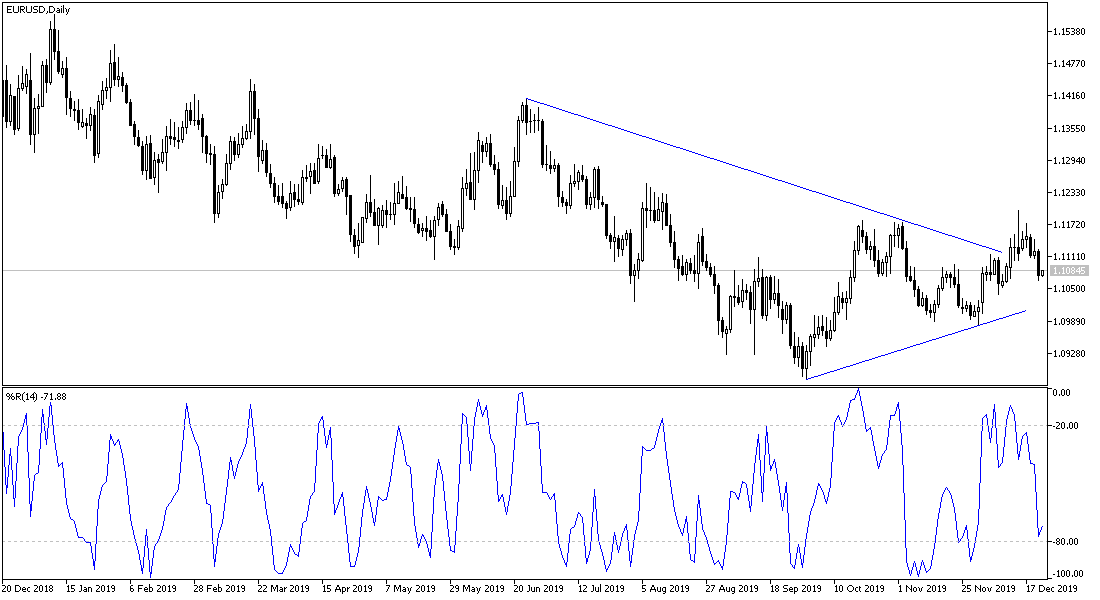

On the daily chart, it appears clear that the EUR/USD has broken form the bullish channel by moving towards the 1.1066 support, and the trend may be completely transformed by moving below the 1.1000 support. The European single currency did not get any support through which it could continue the upward correction, which pushed it towards the 1.1200 resistance, as investors want a continuation of the positive results of the economic data in the Eurozone, especially from Germany. Financial markets will become increasingly calm this week during the Christmas holidays. Global stock markets are ending a strong year. The highest levels were recorded in the S&P500 and the Dow Jones Stoxx 600. The MSCI Emerging Markets Index is at its best level since August 2018. The performance of risk assets is good, while interest rates are maintained until further notice. The commodity CRB index is around year highs.

The US dollar got support at the end of last week's trading, as the data showed that the US economy saw growth as expected in the third quarter. The Commerce Department said that gross domestic product jumped 2.1 percent in the third quarter, unchanging from the estimate released last month and in line with economists' expectations. The unedited GDP growth in the third quarter reflects a modest acceleration from the 2.0% increase in the second quarter.

A separate report showed that consumer spending grew 0.4% in November, the strongest rise since July, and income bounced back after a weak reading in October. In general, the rapid pace of spending in November is a reassuring sign that consumers, who account for about 70% of economic activity, are helping the economy to offset the obstacles represented by President Donald Trump's trade wars to the global economic recession. Many economists expect the US economy to grow at an annual rate of 2% in the last quarter of the year.

In contrast, European Central Bank data showed that the current account surplus in the Eurozone rose in October, driven by trade surplus and initial income. The current account surplus increased to 32 billion Euros from 28 billion Euros in the previous month.

According to the technical analysis of the pair: If the price of the EUR/USD pair returns to the 1.1000 support, and gets established below it, then that will strengthen the downtrend of the pair again. On the other hand, it is awaiting a return to breach the 1.1200 resistance to confirm the strength of the upward correction. In general, the single European currency still lacks incentives for an upward correction, with the continued weak economic performance in the Eurozone led by Germany. It is expected to have quiet moves in a limited range in light of the Christmas holidays this week, with investors not interested in adventure until the markets returned to work normally.

As for the economic calendar data: All focus will be on the US session data, as durable goods orders and new home sales will be announced.