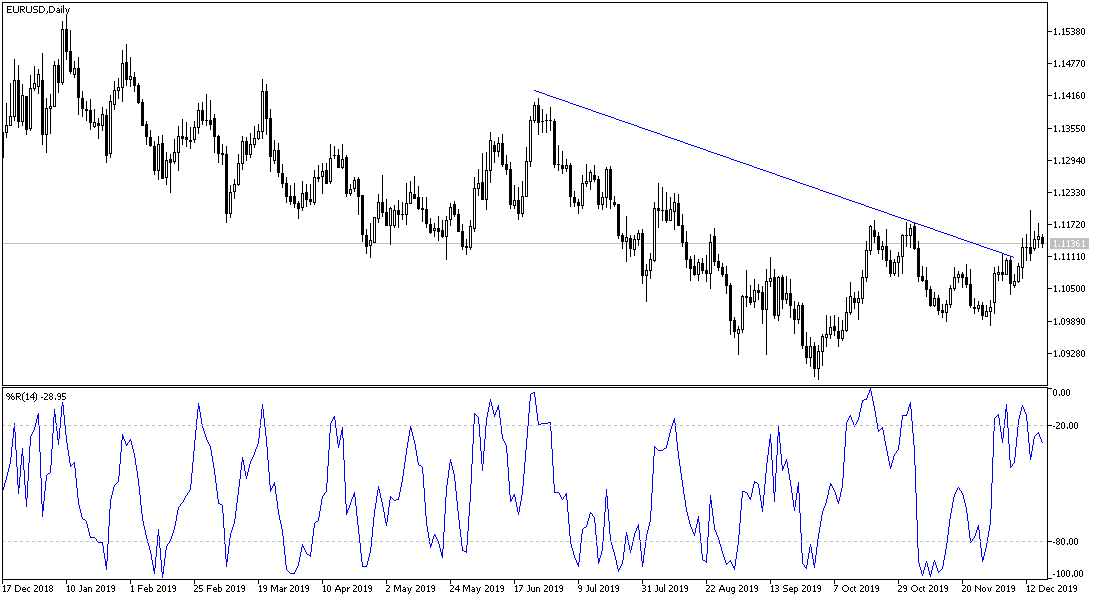

The EUR/USD price is still unable to return to test the important 1.1200 resistance, and for the first time in four months, the pair reached it during last Friday's trading session after the announcement of the Phase 1 trade agreement between the two largest economies in the world, and optimism from the big victory for the conservatives in the general elections, which facilitates the Boris Johnson government’s task of passing the Brexit deal to ensure Britain’s exit from the European Union by the deadline of January 31, 2020. The Euro resumed its decline to the 1.1130 support, as it did not have the necessary momentum to complete the bullish correction.

From the United States of America, the Democratic-controlled House of Representatives voted to pass a 1.4-trillion-dollar government-level spending package, giving President Donald Trump a victory for his plans to build a border fence between the United States and Mexico, while giving Democrats increased spending across a range of domestic programs. Expenditure legislation would prevent any government closures in the United States at the end of this week.

And before that, there was the announcement of an increase in US industrial production last month, recording the largest gains in more than two years, supported by the end of the strike at GM. The Federal Reserve announced that industrial production - which includes production in factories, mines and utilities - rose 1.1% in November, reversing a decline - 0.9% in October and recorded the biggest jump since October 2017.

Manufacturing production increased by 1.1%, rising by 12.4% in production of cars, trucks and auto parts. GM's strike ended in late October. Excluding the auto industry, industrial output rose 0.5% last month and manufacturing production rose 0.3%. All increases were more than economists had expected.

The American industry has suffered a severe setback due to President Donald Trump's trade wars, which have led to rising costs and creating uncertainty for many companies.

According to the technical analysis of the pair: There is no change in my technical view of the EUR/USD performance, as it still has the opportunity for a bullish correction as long as it is stable above the 1.1120 resistance, and in case that the highest resistance, at 1.1200, is breached, it will increase the strength of the bullish momentum. With it, the technical indicators will also touch overbought areas. On the downside, the closest support levels for the pair are currently 1.1120, 1.1080 and 10.990 respectively.

As for the economic calendar data: First there will be statements by the new European Central Bank Governor, Christine Lagarde, then the IFO index for the German business climate, ending with the announcement of the CPI numbers, which are the most prominent to measure inflation in the bloc. There are no significant US economic releases today.