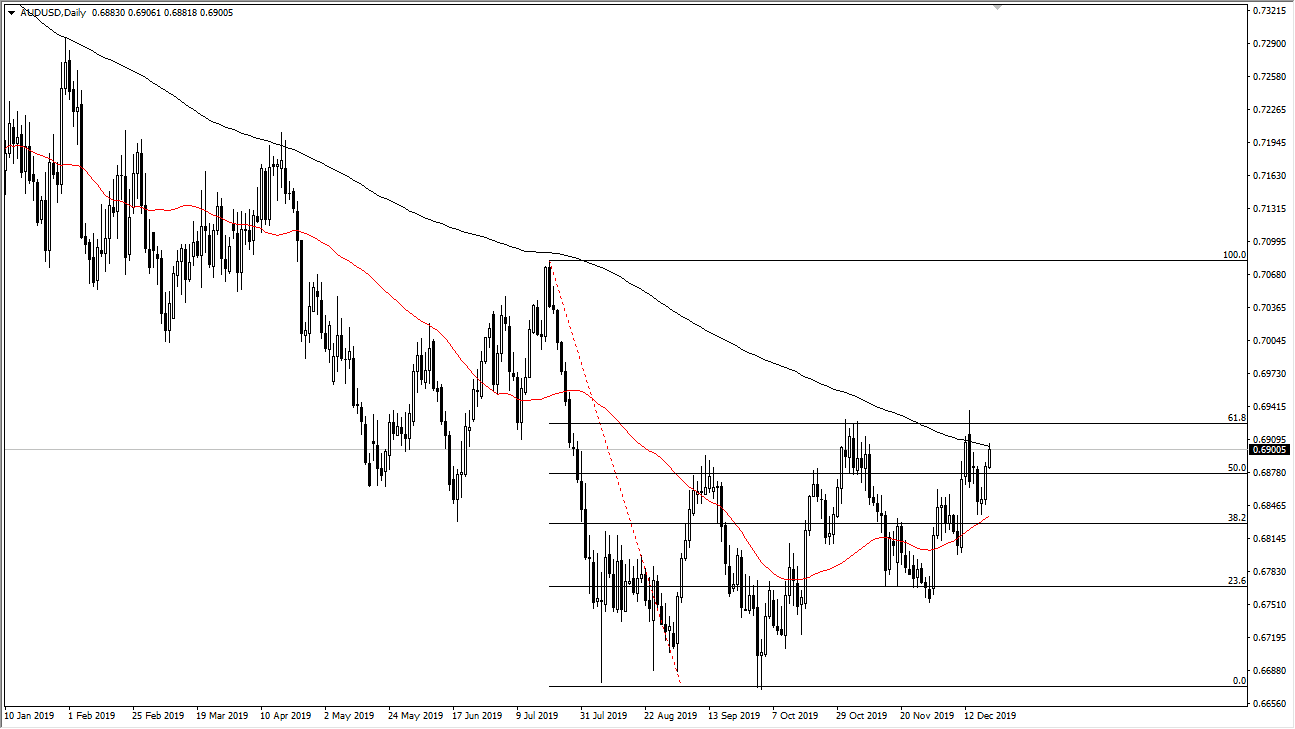

The Australian dollar has rallied a bit during the trading session on Friday, reaching towards the 200 day EMA. The 200 day EMA is of course a major indicator of trend, and it should be noted that we have tested it several times. I think that it’s only a matter of time before the Australian dollar breaks above the most recent high and continues to go to the upside. Looking at this chart I believe that if we can break above the highs from earlier in the week this market will have changed the trend, and therefore we could go much higher. Overall, this is a market that I think will continue to be worth paying attention to as the Australian dollar is so sensitive to the US/China trade situation.

Looking at the chart, we have made a series a “higher lows”, which of course is a very bullish sign. Ultimately, I think that the market will then go looking towards the 0.70 level as it is a large, round, psychologically significant figure. Beyond that, the market is likely to see a move towards the 0.71 handle as it is the 100% Fibonacci retracement level. All things being equal it’s likely that the Australian dollar will move right along with the latest headlines of the American/Chinese trade war, and if things do calm down a bit it’s likely that the Australian dollar will continue to climb.

That being said, if we get some type of negative headline coming out of that situation it will send the Australian dollar tumbling quite drastically. Recently we have seen the Australian economy put up excellent employment figures, and that of course will come into play as well. This is a market that will continue to be and focus due to the trade war, and as we head into the Christmas week it’s very difficult to imagine that we are going to make major moves, at least not positive major moves. That being said, if Trump or Xi say something very negative about the trade deal, that could send the Aussie much lower and rapidly. All things being equal I think we continue the slow upward grind in general, and therefore I like the idea of buying the Aussie on dips as it offers significant value going forward. Selling is not a thought at this point, but I would reevaluate things if we get sub 0.68 anytime soon.