The Australian dollar has gone back and forth during the trading session on Wednesday, as we have no real directionality for the markets now that the US/China trade deal situation has faded away. At this point, it looks very likely that we will continue to see a lot of chop, but it does look like we are trying to rally longer term. With that being the case, it’s very likely that we will continue to see buyers on dips, and you should also take a look at the longer-term chart to read more into what’s going on here.

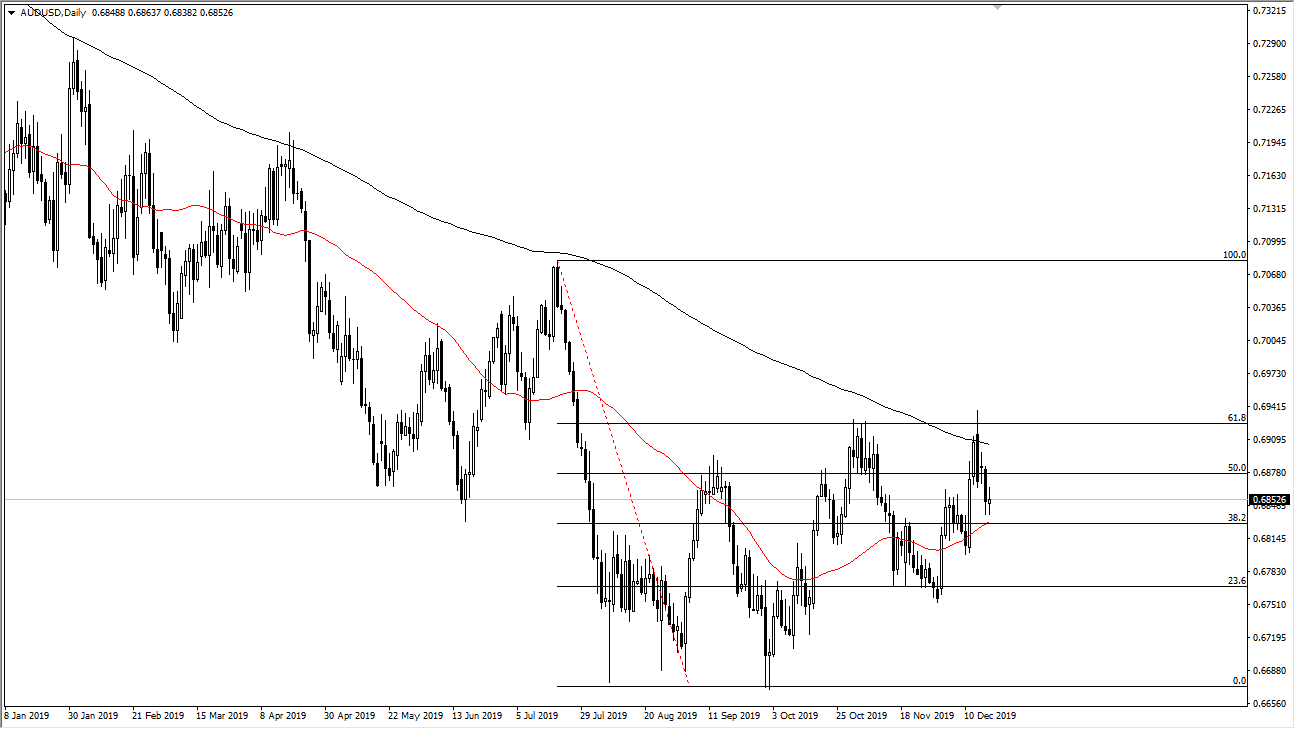

Ultimately, this is a market that I think will continue to go higher and will more than likely continue to move back and forth with the overall risk appetite based upon the US/China trade deal. Right now, it looks like we are going to continue to see movement forward, and that should continue to cause the Australian dollar to look more attractive as it is highly sensitive to the Chinese economy. That being said, it’s the wrong time of year to expect explosive moves, so I think we will continue to grind higher more than anything else. For what it’s worth it should be noted that the 50 day EMA underneath is offering support, but the 200 day EMA above is offering resistance. I think that the market will eventually break above that 61.8% Fibonacci retracement level if we get some good news coming out of that whole scenario.

The Chinese numbers have been a bit of a mixed bag as of late, but they have started to show signs of life. There is the argument to be made for a series of “higher lows”, and for that matter even a series of slightly “higher highs.” At this point, the market looks very likely to be very difficult to navigate, but I do believe that it’s likely we have seen the bottom, at least for the short term. If we do break down below the 0.6750 level, then the whole thing falls apart and we go looking towards the 0.6680 handle. This is a market that will continue to move upon the latest Twitter headlines coming out of Donald Trump and news announcements coming out of Beijing. In other words, this will be more of the same next year once we get through the holidays as this is a market that is trying to change the overall trend.