The Australian dollar has broken higher again during the trading session on Monday, as traders continue to flock towards the Aussie dollar. Part of this will be short covering from a very negative year, but another thing that could be driving this is the fact that the United States and China are starting to play nicer together when it comes to the trade war, and that of course will greatly help the Australians as they are a major contributor to the Chinese economic engine as far as raw materials are concerned. With that in mind, it makes sense that the Aussie dollar would continue to strengthen, showing signs of relief if nothing else.

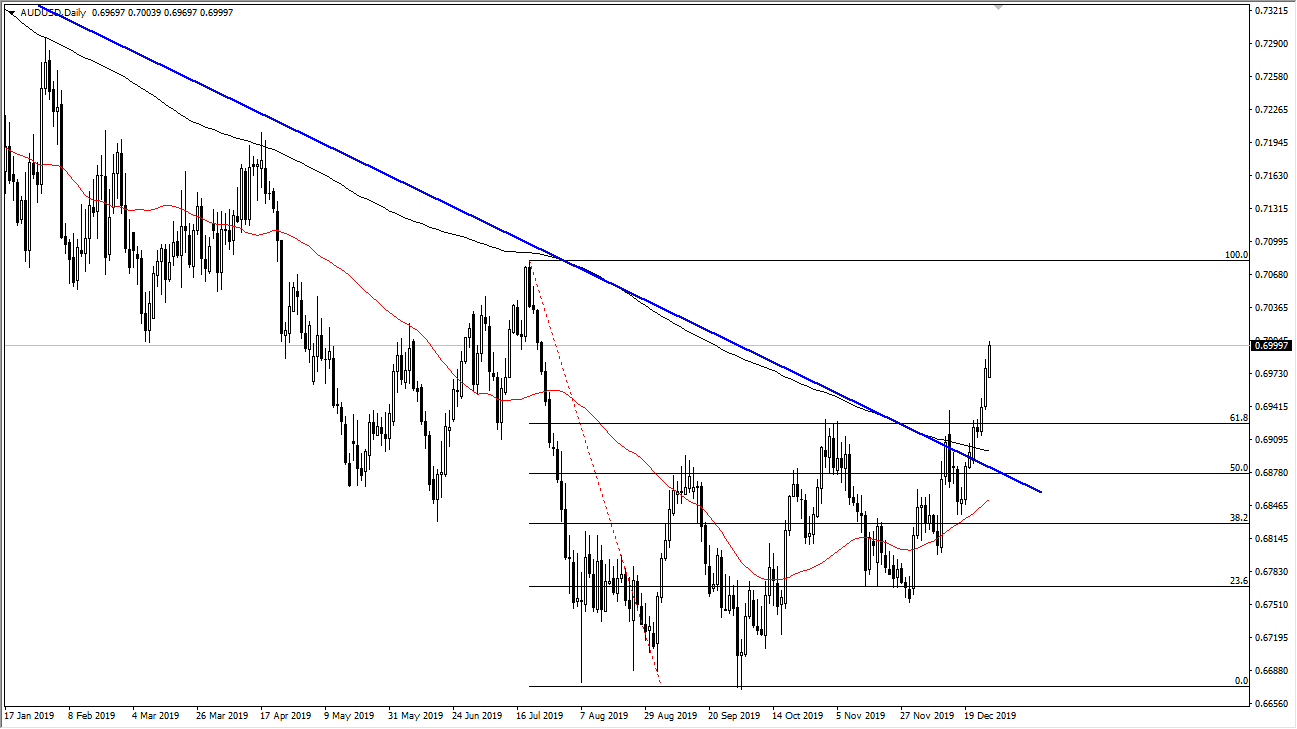

We have recently broken above the 200 day EMA, which of course is a sign that a lot of longer-term traders will use to determine the trend. We have the 50 day EMA starting to curl higher as well and it is probably only a matter of time before we get the so-called “golden cross”, something that a lot of people will pay attention to. The trend line being broken to the upside is a good sign, but regardless I think that another thing that is crucial is the fact that the market has broken above the 61.8% Fibonacci retracement level, which of course is a very major trend change sign as well. Quite often, we see the market move above to the 100% Fibonacci retracement level, which at this point is that target of 0.71 or so.

If we were to turn around a break down below the previous uptrend line then we could send this market down towards the 0.6750 level but I think at this point it’s obvious that as we head into an election year that the Americans will probably cooperate a bit more, and it certainly has been a different tune from the Chinese as well, as they are starting to see economic effects in the negative sense when it comes to what the trade war has done to their economy. Because of this, I look at dips as value and recognize that as we are at the very end of the year it makes sense that waiting for value to come back into play is probably the way going forward for most traders. I look at this as a value play and a major trend change it should extend through most of 2020.