The Australian dollar rallied a bit during the trading session on Friday, getting about 40 pips. The market has recently broken out and therefore this is something that you should be paying attention to. Remember that the Australian dollar is highly sensitive to the Chinese economy, and therefore the US/China trade situation. Ultimately, this is a market that will probably continue to go higher due to the fact that we have seen so much in the way of a shot to the upside.

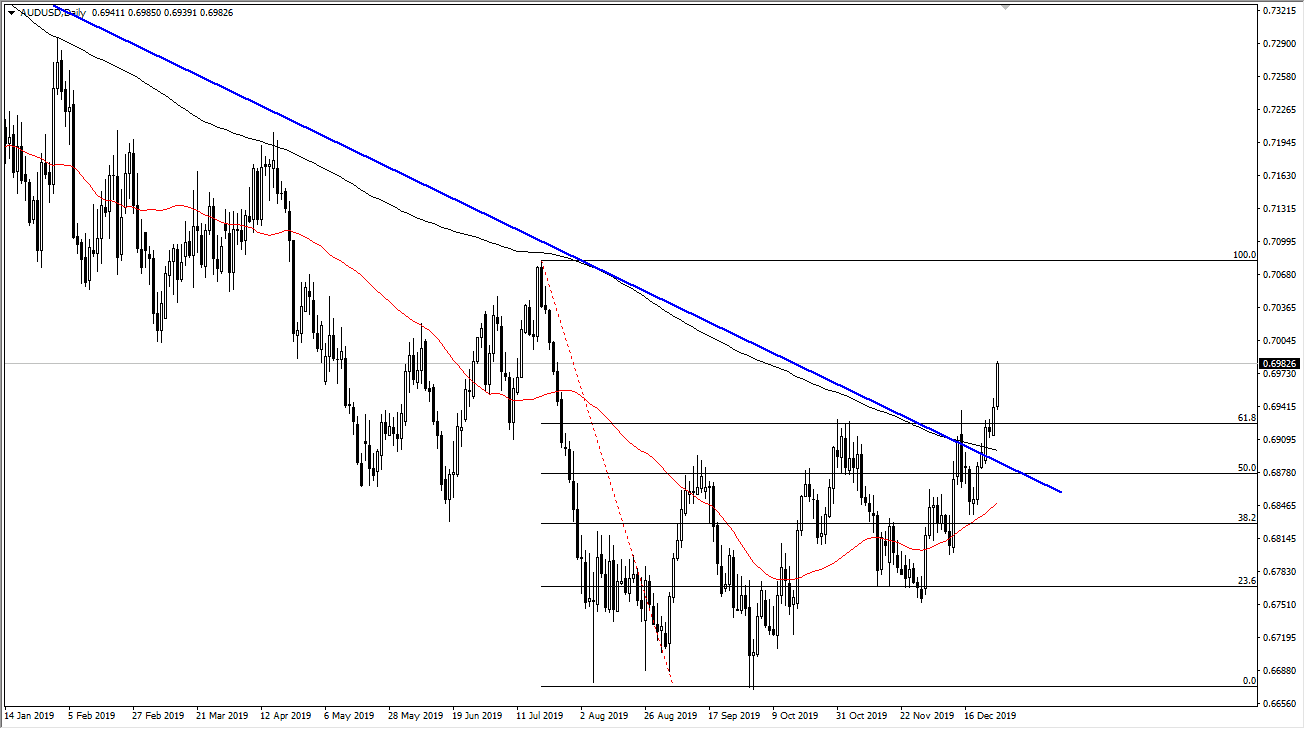

The downtrend line has been broken significantly, and so has the 200 day EMA. By being above the 200 day EMA, it’s likely that we will continue to go much higher from a longer-term standpoint. Beyond that, the 61.8% Fibonacci retracement level is also in the rearview mirror, so I do think that the buyers will continue to jump in and take advantage of this. Ultimately, we also have the 50 day EMA underneath looking to curl up and above the 200 day EMA to form the so-called “golden cross”, and therefore should send this market much higher.

Looking to the chart, you can see that the candlestick for the day is closing at the very highest, and that normally means that we get a bit of follow-through. That being said though, we get a short-term pullback and be more than willing to buy this market, as we have clearly changed the overall attitude. This market will continue to have a lot of headline risk, but I look at pullbacks as buying opportunities as the US/China trade situation gets better, and at the very least it seems like it is going to calm down a bit. That being said, the market has it move that much per day so there are still plenty of opportunities if you are patient enough. For myself, I would like to see something to the effect of a 50 PIP pullback that I can take advantage of. That would roughly send the market back down to the 61.8% Fibonacci retracement level to retest it for support. Longer-term I expect the market to go towards the 100% Fibonacci retracement level, and even further than that given enough time. We are in the midst of a trend change, and these things are almost always messy and difficult. I have no interest in shorting the Aussie dollar unless something significant happens between the Americans and the Chinese.