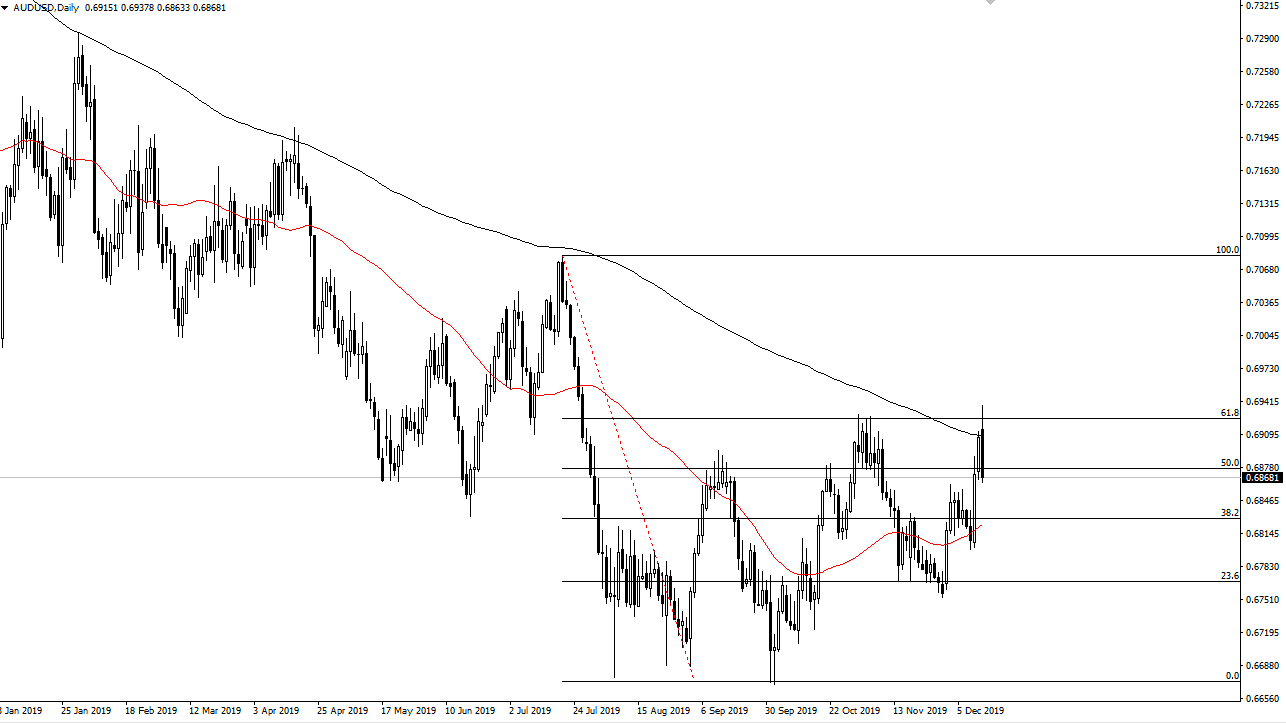

The Australian dollar has initially tried to rally during the trading session on Friday but found enough resistance above the 200 day EMA to turn things right back around and wipe out the candlestick from the Thursday session. By doing so, it looks as if we will probably go looking towards the 50 day EMA which is starting to curl higher at the 0.6825 handle. At this point the market will need to make a “higher low” to continue the pattern that we have seen for some time. The market should then turn things right back around and go looking towards the 0.6950 level, which I think is the gateway to higher pricing.

On the other hand, if the market does break down below the 0.68 level, then it’s likely that the market goes down to the 0.67 handle underneath where we have seen a bit of a “double bottom.” Ultimately, if that was to give way it would be a catastrophic turn of events for the market, and probably show a major “risk off” type of move.

Keep in mind that the Australian dollar is highly levered to the Chinese economy so it’s a bit perplexing that the Australian dollar didn’t get much of a lift during the trading session. In fact, the candlestick is rather negative, and at this point, the market is likely to continue to drift a bit lower. However, if the market is going to continue to react to the trade headlines, this reaction gives me the impression that we have not seen the end of the volatility. Quite frankly, I do think that the Australian dollar is trying to form a bit of a bottom, but if we break down below the candlestick from Wednesday, that will wipe out that ambition for the short term. Alternately, if we do break above that 0.6950 level, the market is likely to go looking towards the 100% Fibonacci retracement level which is closer to the 0.71 handle. This would also be right along with some type of “risk on” type of trade such as being related to the US/China situation. While we made some strides on Friday, quite frankly this reaction and the lack of clarity continues to cause major issues. That being said, the market will have a lot to think about over the weekend, so pay attention to the Monday candlestick. Pay attention to the levels mentioned previously as well.