The Australian dollar has gone back and forth during the trading session on Tuesday as we continue to see a serious lack of clarity when it comes to the trade situation and of course we are facing the extension of trade tariffs on the Chinese starting this Sunday. If December 15 comes and goes without some type of delay of the tariffs, it’s likely that it will be thought of as very negative for global trade, and it should work against the value of the Australian dollar. After all, the Aussie is very sensitive to Chinese growth as Australia is a major supplier of hard commodities.

This market has move right along with headlines, and we will almost certainly get some type of headline over the next couple of days. This shows why the market has gone back and forth during the day and hasn’t really gotten anywhere, which mirrors the US stock indices. In a sense, this week is all about the December 15 deadline, and I suspect that we could get a little bit of a pullback if we don’t have some type of an agreement by the close of business on Friday. That being said, there is also the possibility that something is announced over the weekend, sending the market much higher. We could see a massive gap on higher on Monday, or perhaps even a gap lower. Quite frankly, at this point it’s going to be very noisy.

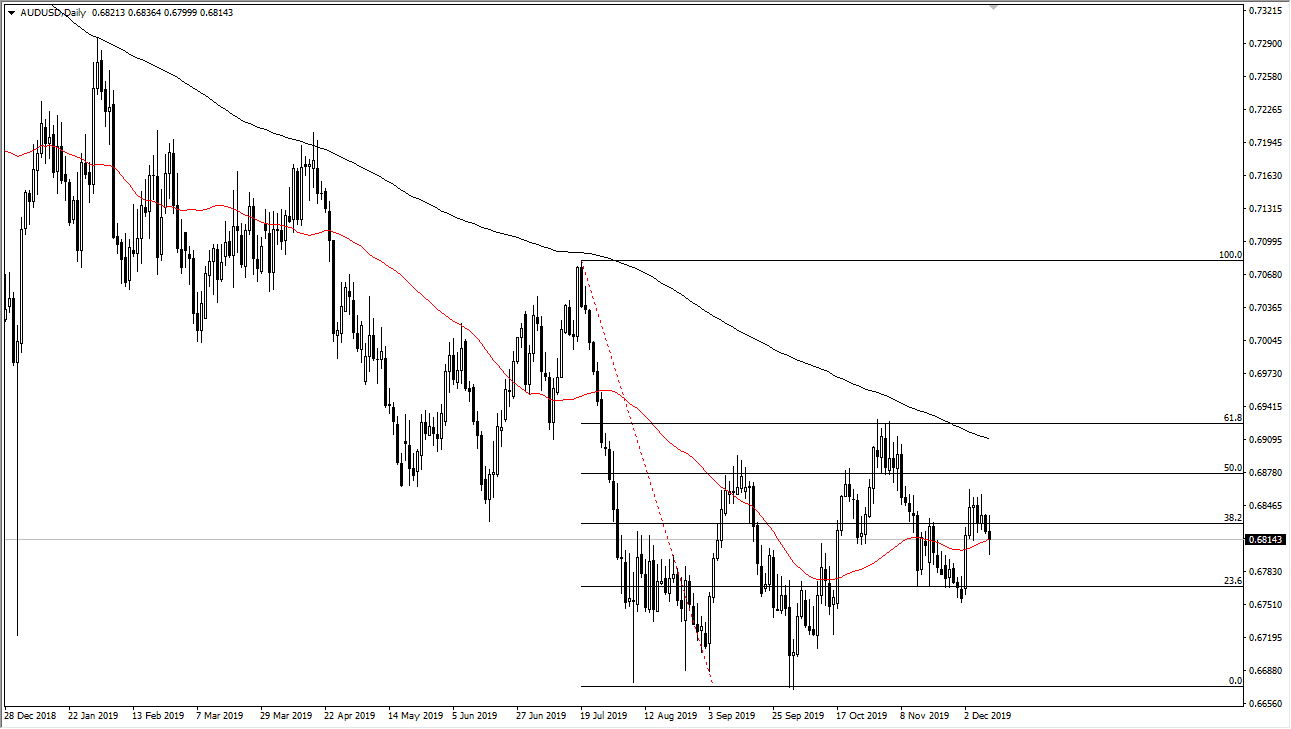

In the meantime, I suspect that this is probably a market that is it worth trading, but I would also point out that the market has made a “higher low” as of late, after forming a double bottom. That being said if we can turn around and continue to go higher, I suspect that the trend will have changed, and we probably go looking for a major breakout above the 200 day EMA. Once we clear that level a lot of longer-term traders will start to “buy-and-hold”, as the Australian dollar is historically cheap. That being said, this market is been held hostage by the trade war, and probably will continue to do so going forward. If we were to turn around a break down below the most recent low at the 0.6750 level, then we will test that double bottom yet again. I expect the next couple of days to be almost pointless though, at least until we get some type of an announcement.