The West Texas Intermediate Crude market was all over the place during the trading session on Wednesday, in what would have been very thin trading as far as volume is concerned. With Thanksgiving being Thursday, but markets will close at 12 PM Central Standard Time, for several hours. Because of this, it’s very likely that markets won’t be able to be trusted during the trading session. At this point, I think that the market will at the best reach towards the $60 level above before we start seeing selling again. After all, this is a market that has been range bound for some time, so I don’t see it changing anytime soon.

All things being equal, I believe that the market will continue to be back and forth and choppy, and that makes quite a bit of sense because not only do we have concerns about global growth, but at the same time there is the possibility that OPEC will continue the production cuts that they have been under for some time during the December meeting. At this point, the market is very likely to go back and forth before running towards the $60 level in breaking back down. The risk to reward scenario certainly favors the downside given enough time, and therefore it’s likely that the upside could happen, but it’s very unlikely that the $60 level will get broken for any significant amount of time, and therefore it’s very likely that any rallies at this point will begin to cause issues.

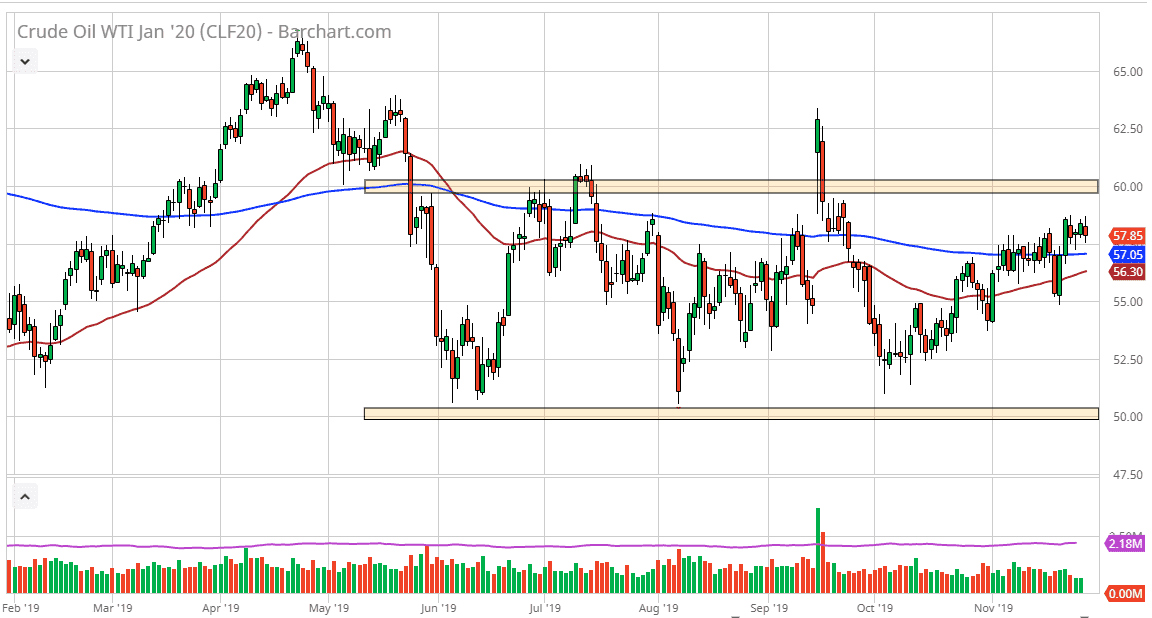

Looking at the chart, we have been dancing back and forth between the $50 level on the bottom and the $60 level in the top. Overall, this is a market that continues to see a lot of choppy and volatile trading, because we have the issue of both the global slowdown and the OPEC situation pushing back and forth. At this point, the market is likely to stay within the range that it’s in, and as we are at the top of it simply makes more interest in selling then buying on signs of exhaustion. That doesn’t mean that is going to be easy to break down, but there’s just more room for to run to the downside that it is likely to run to the up. With that, expect a lot of volatility and choppy behavior, but the pattern has been rather well defined for some time.