The West Texas Intermediate Crude Oil markets have pulled back a bit during the trading session on Monday to kick off the week in direct response to the US/China trade relations not necessarily been a strong as thought last week. After all, there were talks of the Americans cutting back on tariffs against the Chinese as part of “phase 1”, but at this point Donald Trump suggested that he wasn’t clear as to whether or not he was willing to cut back on tariffs. This has had people a bit concerned, as it could weigh upon the demand for energy. After all, if the US and China can’t come together with some type of terms, it will greatly influence the amount of transportation needed to move goods.

Beyond that, there are a lot of concerns out there about global growth, so that puts a certain amount of bearish pressure on this market. Adding further bearish pressure to the market over the weekend was that the Iranians suggest that they have found another oilfield that could bring as much as 55 billion barrels into the market over the next several years. That obviously will increase supply and an already oversupplied market.

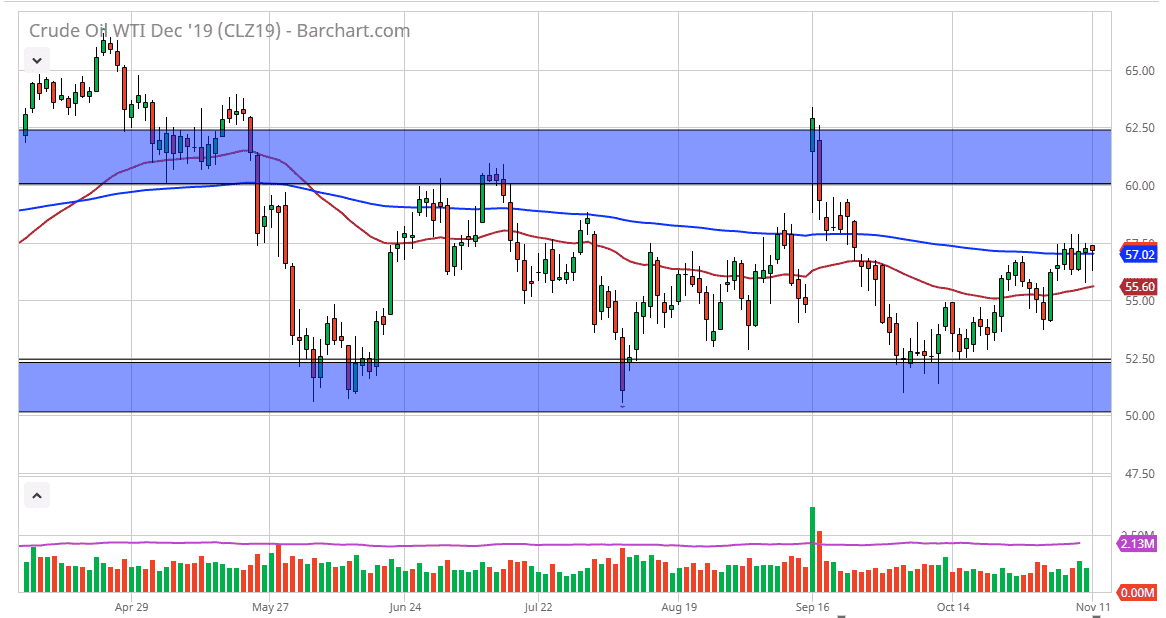

However, the market has been recently consolidating, between the $52.50 and $60 above. At this point, the market should continue to go back and forth and at this point the last couple of daily candles have ended up forming supportive hammer sitting right at the 200 day EMA so I suspect that what we are going to continue to see is that short-term pullbacks will be bought. At this point, market participants look to be short term bullish, but I suspect that we will struggle to break above the $60 level above that shows a significant amount of resistance at the $62.50 level. To the downside, the 50 day EMA is going to offer support as we have seen over the last couple of days, sitting at roughly $55.60 below. Below there, the $55 level will be very supportive as well. I anticipate that the next several sessions will continue to be very choppy, therefore it’s difficult to imagine that it’s going to be a very good trading environment for anything more than a bit of a scalp here and there in this overall range. It does of course look very much likely to favor the upside in that short-term environment.