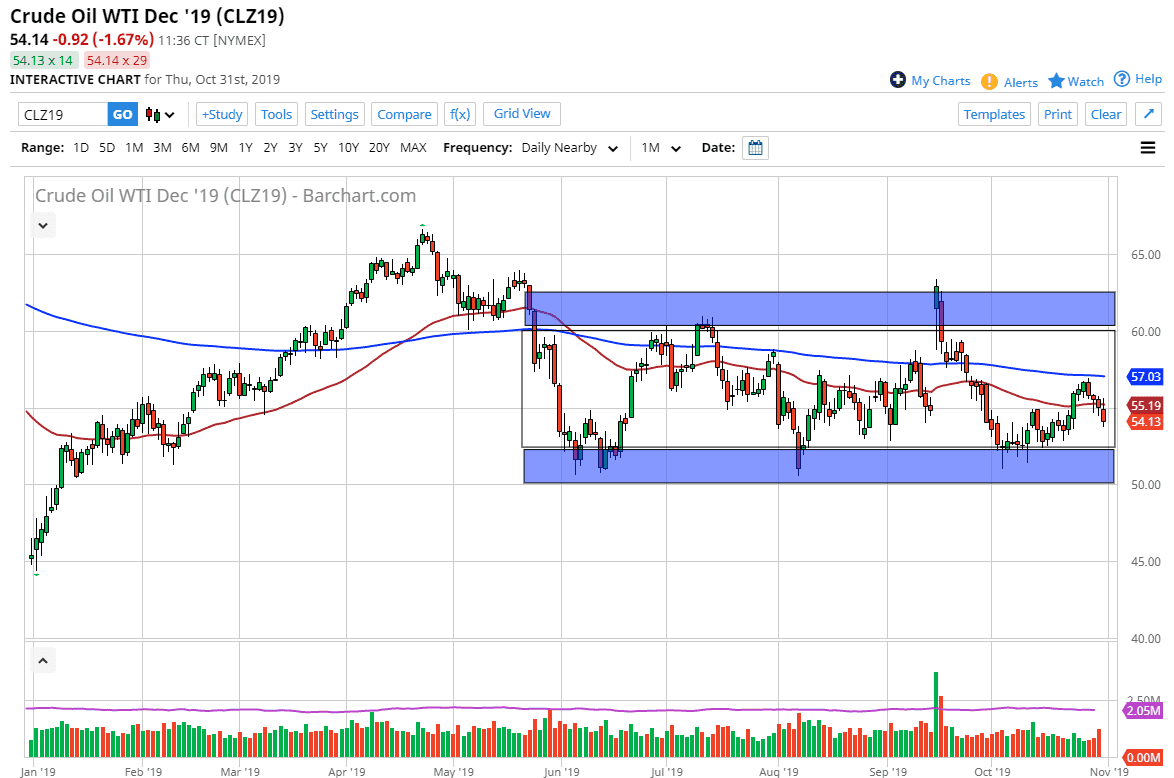

The West Texas Intermediate Crude Oil market pulled back a bit during the trading session on Thursday, as the market continues to undulate in general. We are in a larger consolidation area, that extends from the $50 level underneath to the $62.50 level on the top. That being said, there is a range of trading that I have been using lately, and it looks as if the buyer should come back into this market somewhere closer to the $52.50 level. With that, the market should find plenty of support underneath and it’s only a matter of time before the buyers return.

OPEC is likely to cut production in the month of December at the meeting, and it’s likely that should cause a bit of a supply/demand disruption. At this point, the market will probably find itself trading in this general vicinity, as the moving averages are flattening and of course the market suggests that we are probably going to stay range bound for the time being. As there are so many different concerns around the world right now as far as growth is concerned it makes sense that crude oil won’t necessarily take off to the moon, as demand will continue to be an issue. However, if OPEC starts to disrupt their part of the supply chain, that could add some bullishness to the market. That being said, keep in mind that the United States is the largest exporter of crude oil right now, and that means OPEC doesn’t have the effect that it used to.

Because of this, and the fact that the global growth concern is a major issue, it will keep this market going back and forth and it is going to be difficult to make a decision for longer-term trading. In the short term, it’s likely that we could continue to go back and forth between the two outer edges of the box. Now that we have the job numbers coming out during the day on Friday, it’s likely that we will continue to see a bit of volatility but of this market pulls back based upon the numbers, I will be waiting to buy at lower levels as it should offer a bit of value. Having said that, if we were to turn around a break above the 50 day EMA, it’s likely that the market will go looking towards the 200 day EMA.