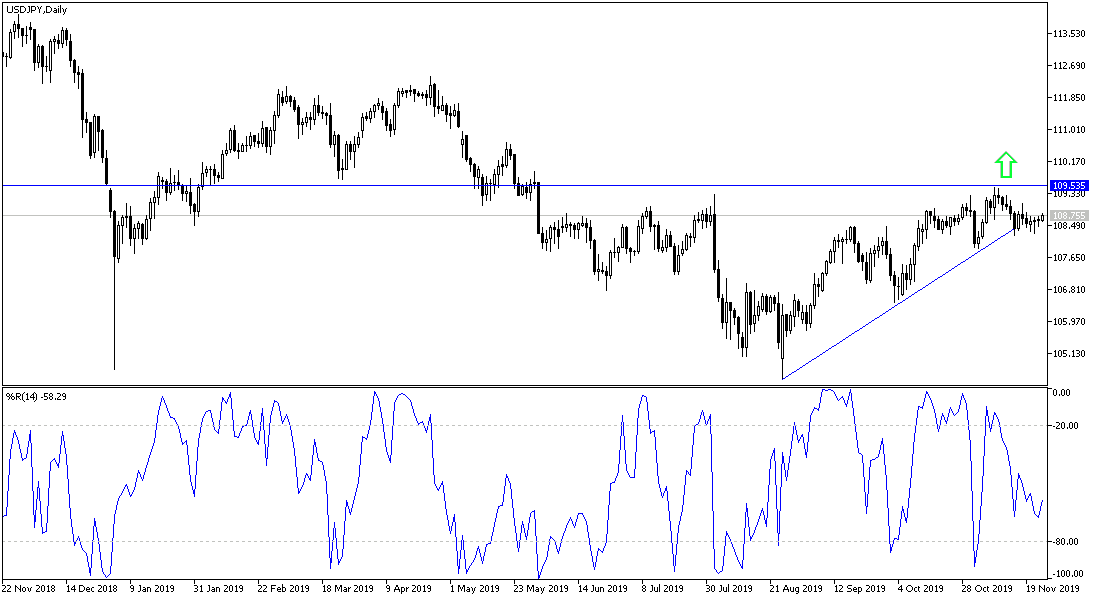

Throughout last week's trading, we have not seen strong USD/JPY moves, as the pair has tried to avoid breaking the uptrend by moving below the 108.00 support level. The pair lost support at 108.27 but at the same time it did not find enough support to hold onto the 109.00 resistance which motivates the bulls for more upside momentum. The pair’s volatility was in light of conflicting reports regarding the future of the Phase 1 trade agreement between the United States of America and China, with the deal remains elusive. Expectations continue to strongly indicate continued weakness in the pair's performance in the coming days.

The dollar-yen exchange rate has failed to maintain the break above its 200-day moving average, and since the first week of November, the pair has been in a bearish correction. US government bond yields could prove important in determining whether the USD/JPY is once again challenging its 200-day average or falling further. Revenues are important because Japan's double surplus, coupled with negative interest rates and weak economic growth for decades, has boosted the appetite of Japanese institutions and households to invest abroad. As is well known, Japan has savers with surpluses in both trade and current accounts, rather than deficits such as the US and UK, which is important for currency markets.

The pair will continue to watch carefully the developments of the world trade war, the future of Brexit and the future of global economic growth. It is the most prominent global trade and geopolitical concerns and with its activity increases investor appetite for safe havens, most importantly the Japanese yen.

According to the technical analysis of the pair: My technical outlook for the performance of the pair remains unchanged. A break below the 108.00 psychological support will strengthen the bears' position to move towards stronger support levels and may be closest to 107.65, 106.90 and 106.00 respectively. On the upside, the 110.00 psychological resistance remains the key to the long-term uptrend strength. Overall, the pair seems to lack direction despite recent developments in US-China trade talks. After President Trump threatened to impose tariffs on Chinese goods, he returned to hint that a trade deal with China could be made.

As for the economic calendar data: There are no significant economic data today from either Japan or the United States.