The strength of the US dollar and risk appetite pushed the USD/JPY pair to the 109.47 resistance, its highest level in five months, and closed last week's trading around 109.22, near recent highs. The pair has continued its upward trend since the beginning of the month and it seems that this trend is likely to continue this week as well. The pair's gains were fueled by optimism from the declaration of the two sides of the World Trade War to the imminent agreement on the first phase of a comprehensive agreement to halt the pace of their tariff warfare that slowed global economic growth.

At the economic level. The US ISM Services PMI beat expectations at 53.5 with a 54.7 reading, factory orders exceeded expectations and initial jobless claims fell 211K versus 215K, but continuing claims missed expectations of 1.683 million to 1.689 million for the week ended November 1. The view that the US economy needs no further support from the Fed will be reinforced by this week's data, if released more strongly than expected. The Consumer Price Index for October will be released on Wednesday. In the past two months, the core CPI surprised to the upside and on Friday, October retail sales are scheduled to be announced. In the past two months, retail sales have become weaker, reflecting lower growth in consumption. Given the weakness in the manufacturing sector, we will monitor whether private consumption growth can keep pace with growth.

On the other hand, Japan's total household spending for September exceeded expectations by 7.8% with growth of 9.5% on an annualized basis, while monetary employment earnings outperformed consensus estimates by 0.4% with 0.8% reading. Initial forecasts and leading economic indicators in Japan surpassed expectations at 99.5 and 91.7 with 101 and 92.2.

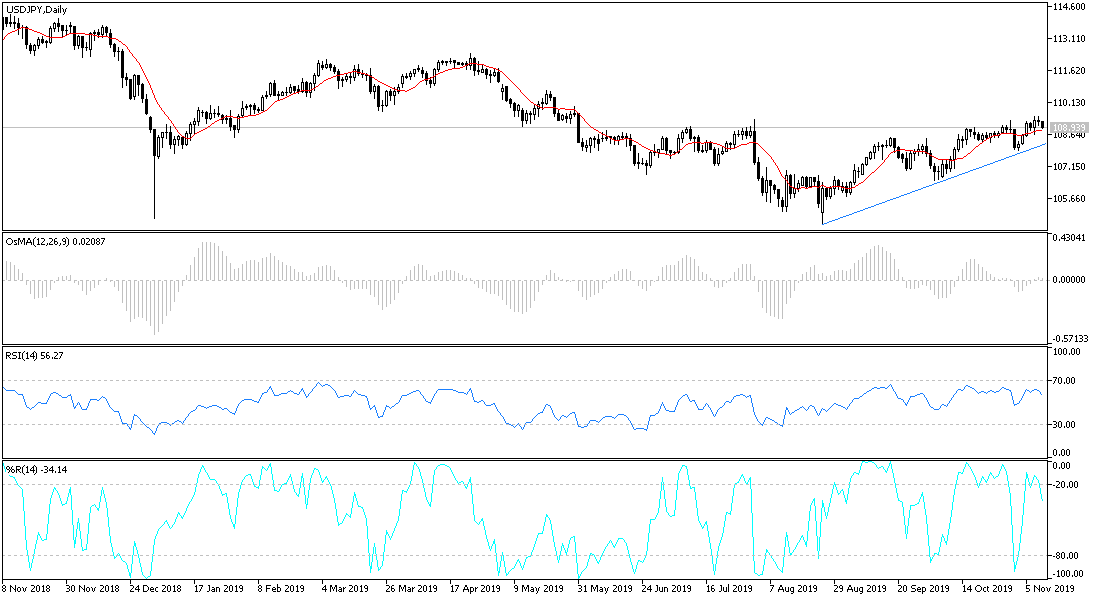

According to the technical analysis of the pair: On the daily chart, the USD/JPY appears to be trading within a sharp bullish channel, indicating a strong bullish bias in long-term trading. The pair has continued its upward trend since September when it reached the 104.446 support. As trading begins this week, bulls may target long-term profits around 109.981 or 110.537 or higher at 111.133. On the other hand, bears are aiming for the next support levels at 108.42, 107.89, 107.41 or below at 106.98.

As for the economic calendar data today: From Japan, the current account, the economic watchers' index and the bank loans will be announced. There will be a holiday in the US markets.