While US equity markets are at all-time highs, the US Dollar is under selling pressure as forex traders react to the negative economic news at a time equity traders take it as a bullish sign. Adding to downside pressure is the US Fed which cut interest rates three times, but cautioned market participants that a pause may be warranted. Economic data out of the US suggests that the central bank may not be done with its monetary adjustment. The USD/CAD spiked into its short-term resistance zone on the back of comments from the Bank of Canada that an interest rate cut may be warranted, but price action started to reverse as bearish sentiment out of the US remains dominant; a breakdown in this currency pairs should be expected.

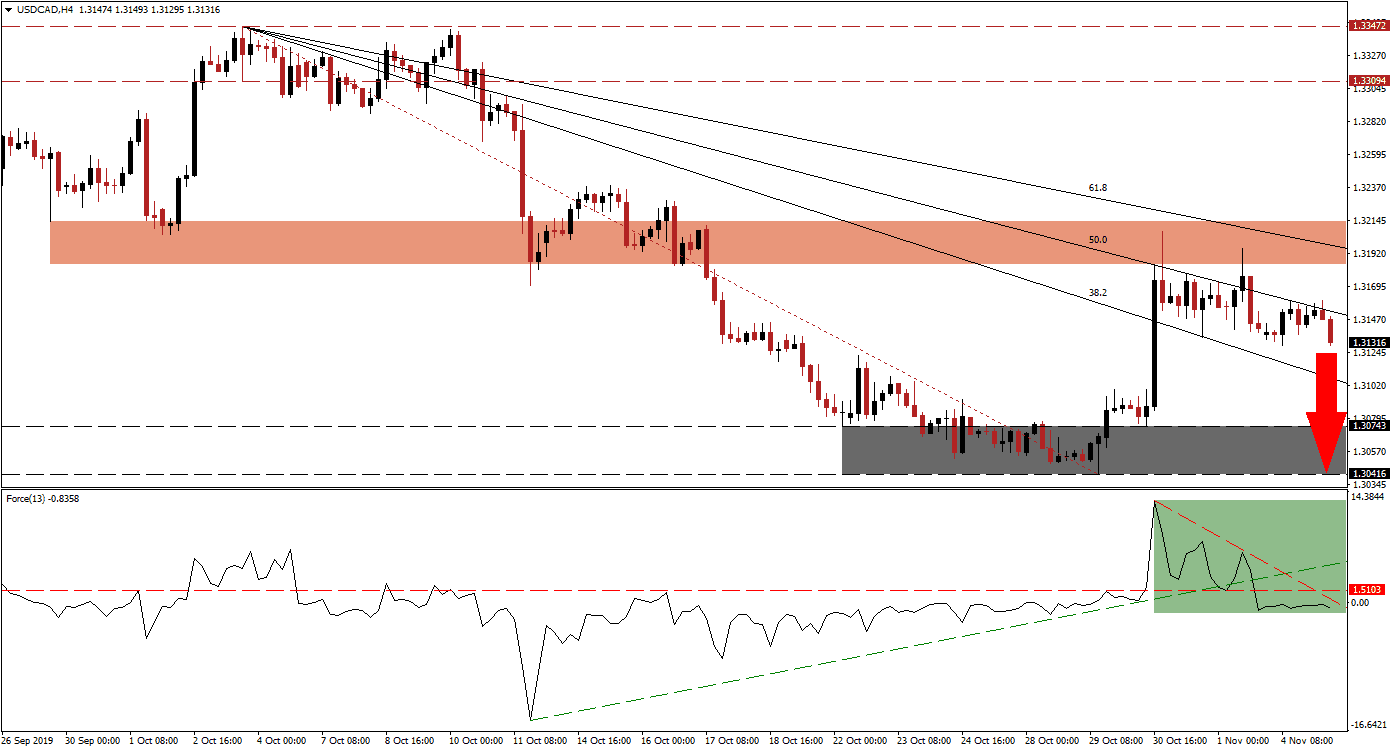

The Force Index, a next generation technical indicator, indicates that a bigger corrective phase may be on the horizon. As the USD/CAD accelerated to the upside, which was limited by its descending 61.8 Fibonacci Retracement Fan Resistance Level, the Force Index moved below its horizontal support level and turned it into resistance. Another bearish development occurred after this technical indicator completed a breakdown below its ascending support level which took the Force Index into negative conditions as marked by the green rectangle; its descending resistance level also exercises downside pressure and more downside is possible. You can learn more about the Force Index here.

With the bearish effects from the Bank of Canada commentary on the Canadian Dollar fading, bearish pressures on the USD/CAD are strengthening. The 61.8 Fibonacci Retracement Fan Resistance Level, currently passing through the short-term resistance zone located between 1.31850 and 1.32138 as marked by the red rectangle, prevented a short-term advance to turn into a bigger rally. Fundamental data out of the US has generally disappointed and a series of lower highs has further increased breakdown pressure on this currency pair. The Fibonacci Retracement Fan is expected to guide price action farther to the downside, unless a new fundamental catalyst emerges which will break bearish momentum.

Price action is currently trending lower between its 38.2 Fibonacci Retracement Fan Support Level and its 50.0 Fibonacci Retracement Fan Resistance Level. The entire Fibonacci Retracement Fan sequence is slowly approaching the top range of its next support zone which is located between 1.30416 and 1.30743 as marked by the grey rectangle. A breakdown below this zone is a likely scenario, especially if more economic data out of the US will disappoint; the technical picture also suggests that forex traders should account for an extension of the breakdown in this currency pair below its support zone. Adding downside pressure to the USD/CAD is the Chinese demand for the US to drop more tariffs in order to accomplish the phase one trade truce and US President Trump’s insistence to sign the deal in the US. The next support zone is located between 1.29122 and 1.28818; you can learn more about a support zone here.

USD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 1.31300

⦁ Take Profit @ 1.29150

⦁ Stop Loss @ 1.31950

⦁ Downside Potential: 215 pips

⦁ Upside Risk: 65 pips

⦁ Risk/Reward Ratio: 3.31

A triple breakout in the Force Index, above its descending and horizontal resistance levels as well as above its ascending support level, may ignite a short-covering rally in the USD/CAD. This will require a fundamental catalyst such as better-than-expected economic data out of the US. While the short-term resistance zone remains well enforced, if price action manages to push above it, this currency pair can extend an advance into its next long-term resistance zone located between 1.33094 and 1.33472; this would represent an excellent short-selling opportunity.

USD/CAD Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 1.32300

⦁ Take Profit @ 1.33100

⦁ Stop Loss @ 1.31900

⦁ Upside Potential: 80 pips

⦁ Downside Risk: 40 pips

⦁ Risk/Reward Ratio: 2.00