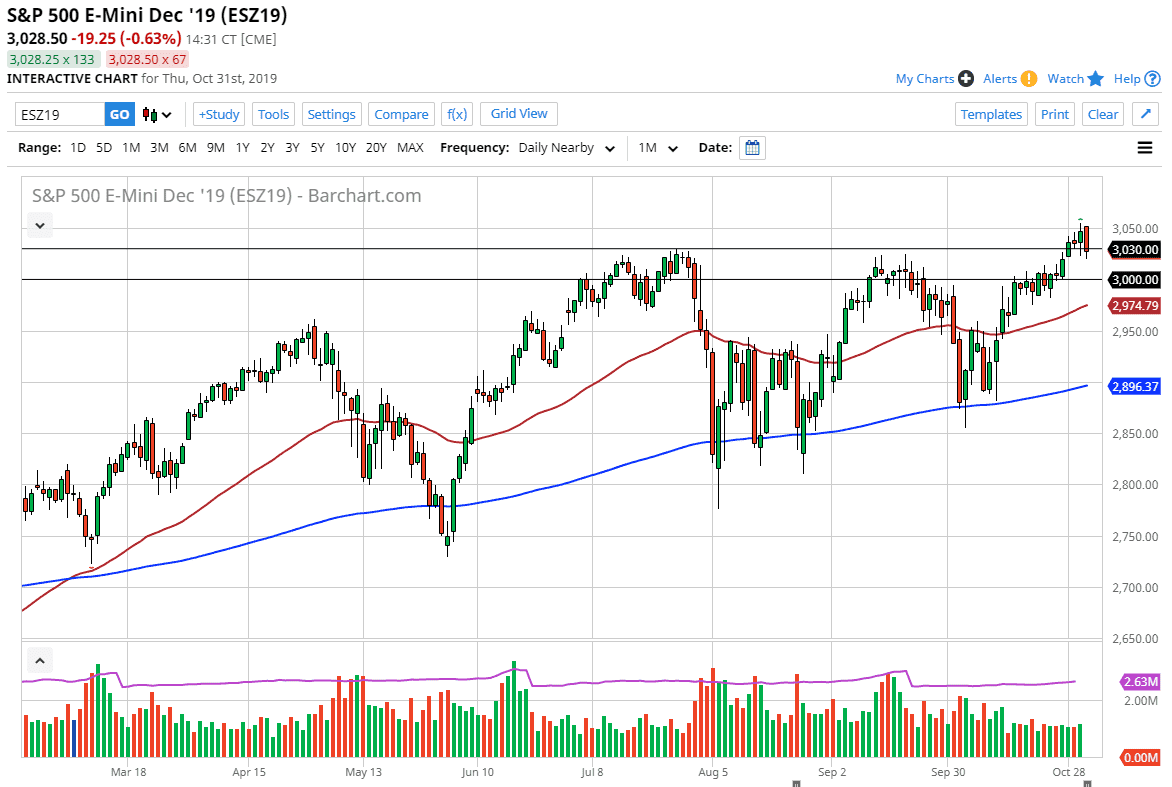

The S&P 500 fell during the trading session on Thursday, enveloping the previous candlestick on the daily chart. That tells you just how all over the place this market is. That being said, the market is sitting right on top of an entire range of support that extends from the 3000 level on the bottom to the 3030 level. At this point, there is plenty of reason to think that the buyers will return underneath, therefore I like the idea of picking up value as it occurs. With the jobs never coming out on Friday, it’s likely that we could get some type of volatility. That being said, looking at the longer-term chart makes more sense.

When you look at the longer-term chart, you can see that the market is at recent highs essentially, and that a pullback should continue to offer value. The area below that extends down to the 3000 level makes the most sense, as the 3000 level is a large, round, psychologically significant area and a level that has offered a lot of volume in the past. Beyond that, if you look at volume studies the “point of control” over the last 30 days is sitting just underneath the 3000 handle, meaning that there should be a lot of oil order flow waiting in that region.

Below there, the 50 day EMA should offer plenty of support as well, so I don’t have any interest in any short positions anytime soon. Quite frankly, I hope that the jobs number causes a knee-jerk reaction to the downside in this market, because I can pick up the value that will be offered. Some type of bounce would make a lot of sense, and very likely we would continue to go towards the highs again. The previous ascending triangle should continue to offer an attempt to go much higher. The market could move as high as 3200 based upon the measurement of this ascending triangle. Regardless of that, there’s no reason to think that the market is anywhere near breaking down, although I am the first to admit that the session is negative for Friday, the reality is that the longer term uptrend continues to be the main theme in this marketplace. The S&P 500 is being supported by the Federal Reserve who has cut interest rates three times in the last year, although they are essentially on pause at the moment.