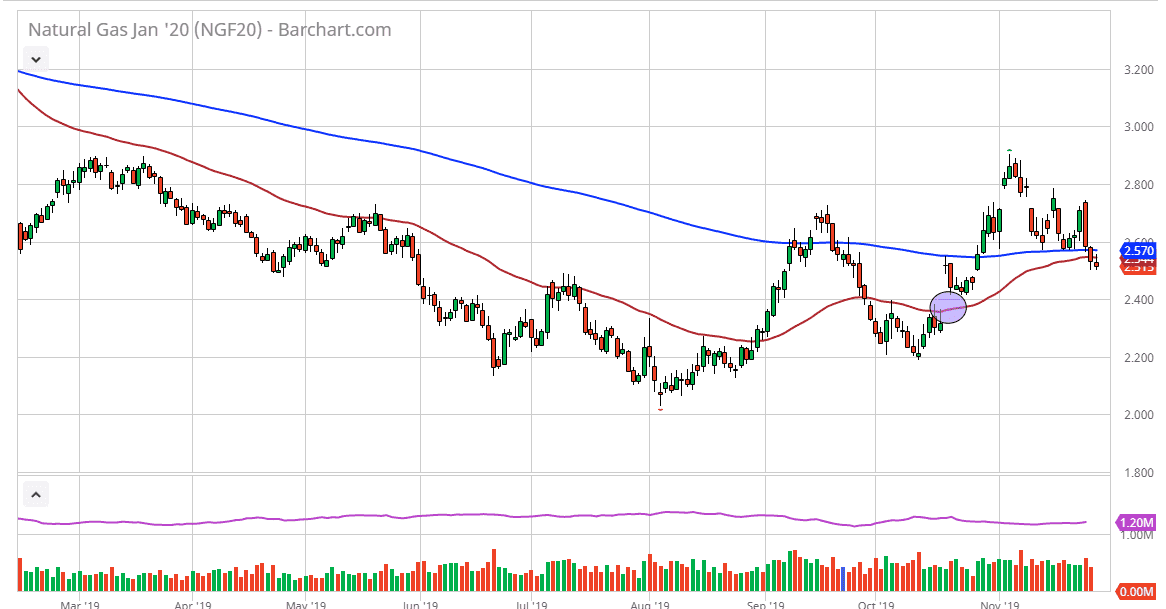

Natural gas markets initially tried to rally during the trading session on Wednesday, but then broke down as we got above the 50 day EMA. By doing so, the market ended up rolling over yet again and showing signs of exhaustion. At this point, the market is trying to break down below the bottom of the Tuesday session, which should send this market down towards the gap. The gap underneath that starts at the $2.40 level is rather crucial, and a huge sign of support a longer-term charts.

The natural gas markets are falling in the midst of a major winter storm in the United States, mainly because there are whether reports that perhaps December might be warmer than expected. That being said, it’s only a matter of time before it gets cold again, and we start to see the market go much higher. The gap underneath should continue to offer a lot of support, and I find it interesting that if you draw an uptrend line at the bottom of what could be an uptrend and channel, it should in the general sense show up at about the same price level. At this point, the market then could bounce based upon the fact that it is awfully cheap this time of year, simply because we had over drilled in the United States, offering a massive amount of bearish pressure. That being the case though, the oversupply is going to continue to be a scenario that will be worked through eventually.

I am bullish of natural gas, but I recognize it is very likely that we will have to reach down to find some value underneath. At this point, I don’t have any interest in shorting the natural gas markets, because quite frankly things can turn around almost immediately, shooting straight through the roof. That happens almost every winter, and the last thing you want to do is be on the wrong side of that trade. With this, I’m looking at the $2.40 level as a potential entry point. The alternate scenario of course is that we simply turn around a break above the breakdown candle at the $2.75 level, and then start aiming towards the $3.00 level after that. The over drilling of natural gas has dampened the winter rally so far, but it’s only a matter of time before we chew through supplies. That being said, keep in mind that it’s going to be very thin on Thursday, so it may take a couple of days to get down to where I want to start buying again.