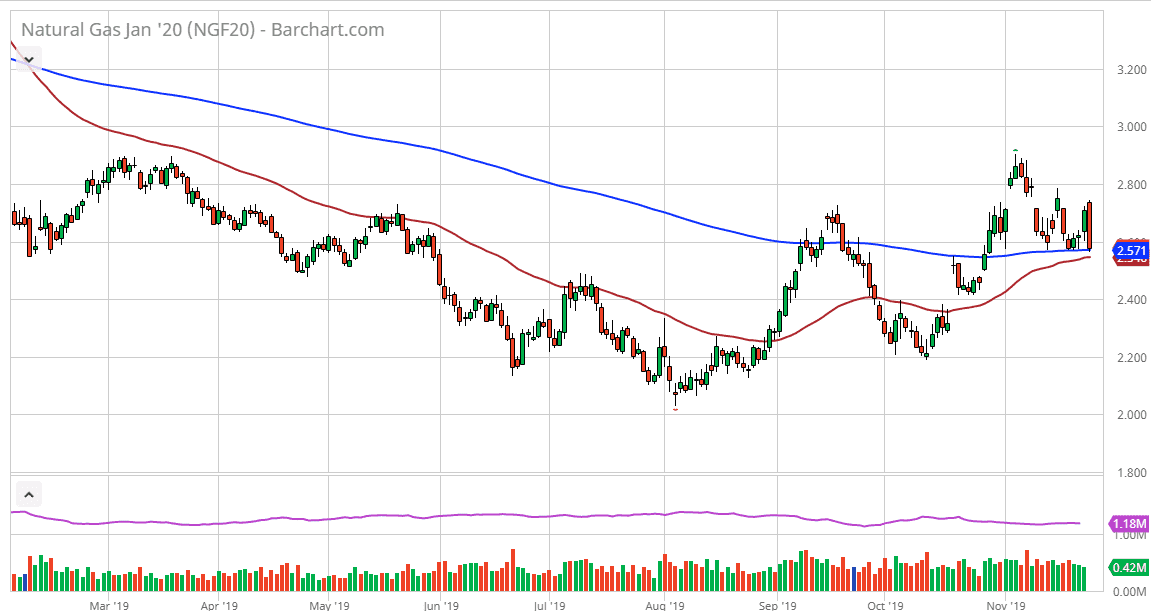

Natural gas markets got hammered during the trading session on Monday, reaching down towards the crucial 200 day EMA. More importantly, it is also the bottom of the last couple of weeks’ worth of trading, and at this point it’s worth paying attention to. That also is where the 50 day EMA is getting ready to start crossing above, which is known as a “golden cross.” This of course is a very bullish sign, and a longer-term “buy-and-hold” type of situation.

One thing that I would say is that the candlestick for the trading session for Monday suggests pretty negative, and therefore it is extraordinarily bearish. If we were to break down below the 50 day EMA, then the market could go down to the $2.40 level which is the scene of a major gap underneath, and therefore it would make a lot of sense to see the market target that level. That also should be an area that is a buying opportunity, and therefore I would be more interested in getting a bit more aggressive in that area. All things being equal though, this is the time a year where we see a lot of bullish pressure, due to the fact that there will be a lot more positive demand as colder temperatures in the United States will bring prices higher typically. This is a cyclical trade that I see every year, so it does make sense that we could see it pop off rather soon. Because of the cyclicality of this market, I have no interest in shorting right now, and I am simply looking for buying opportunities. A break above the $2.75 level could be a nice buying opportunity, just as the previous mentioned pullback towards the $2.40 level offers.

At this time of year, it’s likely that the market continues to see plenty of volatility, but the short covering rallies can be brutal. All it is going to take is one significant cold weather report, and this market will shoot straight up in the air. Once we break above the $2.75 level, it’s likely that we go to the $3.00 level, possibly even towards the $3.20 level. That being said, you are probably better off looking at short-term dips as buying opportunities, perhaps using them as opportunities to do short-term trades, but above the $2.75 level I think it becomes more of a “core position” until the middle of January.