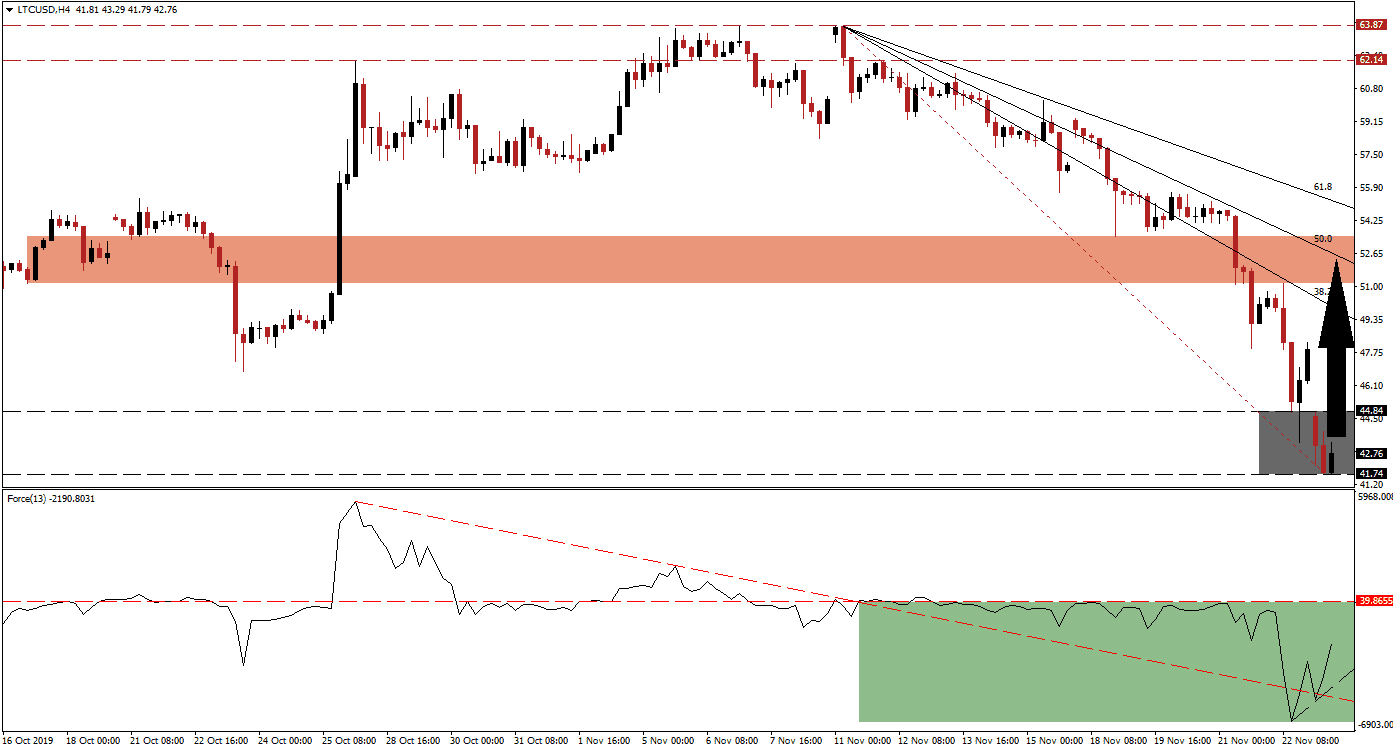

It appears the bearish momentum is on the rise with each leg lower and the timing of the current cryptocurrency mini-crash brings back memories of the Crypto Winter of 2018. Arguably, the situation is much different now and markets have matured. While Bitcoin is dragging most names down with it, the sell-off started to create excellent buying opportunities for long-term investors willing to brave the selling pressure. The LTC/USD has stabilized after plunging into a very strong support zone and bearish momentum is fading. This has increased the likelihood of a short-covering rally.

The Force Index, a next-generation technical indicator, shows the acceleration in bullish momentum after price action reached its support zone. After the Force Index moved above its descending resistance level, which currently acts as temporary support, the magnitude of the sell-off in the LTC/USD briefly pierced the descending resistance level to the downside. A quick reversal followed and as this technical indicator created a set of higher lows an ascending support level started to form as marked by the green rectangle. The Force Index is now expected to advance into positive condition, put bulls in charge of price action, and lead this cryptocurrency pair into a price action reversal. You can read more about the Force Index here.

Litecoin shares one critical similarity with Bitcoin as both deploy the proof-of-work (PoW) consensus algorithm, but this should not be considered a bond between LTC/USD and BTC/USD; both projects are on a different path as Bitcoin has transitioned to value storage while Litecoin continues to march down the remittance path. The increase in bullish pressures is expected to lead to a breakout in the LTC/USD above its support zone, located between 41.74 and 44.84 as marked by the grey rectangle. This is additionally expected to close the gap between price action and the descending 38.2 Fibonacci Retracement Fan Resistance Level.

A sustained breakout above its support zone and its 38.2 Fibonacci Retracement Fan Resistance Level will face the first major challenge at its next short-term resistance zone. This zone is located between 51.14 and 53.46 as marked by the red rectangle; the 50.0 Fibonacci Retracement Fan Resistance Level is nestled inside this zone. The LTC/USD remains fundamentally oversold and depending on the degree of bullish momentum that will accompany any breakout attempt, more upside in this cryptocurrency pair remains an option. The LTC/USD will be faced with its next long-term resistance zone between 62.14 and 63.87. You can learn more about a resistance zone here.

LTC/USD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 42.50

⦁ Take Profit @ 52.50

⦁ Stop Loss @ 40.25

⦁ Upside Potential: 1,000 pips

⦁ Downside Risk: 225 pips

⦁ Risk/Reward Ratio: 4.44

Should the Force Index reverse and complete a breakdown below its ascending support level, the LTC/USD may attempt a breakdown of its own. Downside potential remains limited and the next support zone awaits price action between 33.09 and 35.91 which would include the closure of a price gap to the upside. Any descend into this support zone represents an excellent long-term buying opportunity as long-term fundamentals favor a significant move to the upside.

LTC/USD Technical Trading Set-Up - Limited Breakdown Scenario

⦁ Short Entry @ 39.00

⦁ Take Profit @ 33.25

⦁ Stop Loss @ 41.50

⦁ Downside Potential: 575 pips

⦁ Upside Risk: 250 pips

⦁ Risk/Reward Ratio: 2.30