Gold markets pulled back a bit during the trading session on Monday to kick off the week, as there were reports that the United States and China had a very “constructive phone call” over the weekend. However, the markets have turned around completely as conflicting reports out of the Chinese government have been released. Because of this, it’s very likely that we will continue to see the gold markets react directly to the trade war situation and now that we have a real lack of clarity, it makes sense that we would bounce just a bit.

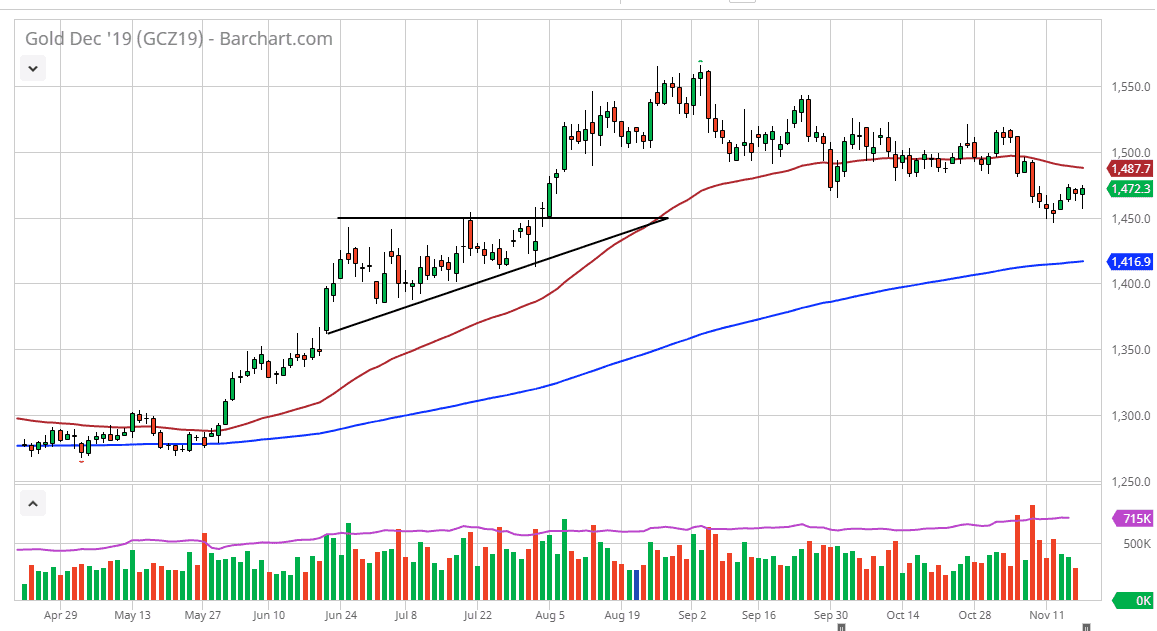

Looking at the daily candlestick it appears as if we are trying to for some type of hammer, and then hammer of course is a bullish sign. What’s even more important is that the hammer has been formed just above the crucial $1450 level, an area that was the top of an ascending triangle from previous trading. That’s a good sign, and it’s exactly where we needed to find buyers in order to continue the overall uptrend. Quite frankly, if it failed there I was going to become very concerned about the overall trend of gold. Even underneath there though we have the 200 day EMA, so it’s very unlikely that we would just simply meltdown.

Looking at the chart, you can see that intraday we reacted to the headlines very drastically, and therefore looks like gold will continue to move right along with it. The US/China trade situation continues to be spotty at best, and quite frankly I don’t think there is a real solution. Gold will continue to go higher given enough time, as there is no reason to think that suddenly the Chinese are going to change their behavior, nor are the Americans going to step away from the tariffs that they currently levy the on the Chinese.

The Chinese strategy seems to be one of waiting out the impeachment hearings and of course the election, to see whether or not they will be dealing with Donald Trump going forward. Because of this, I do believe that eventually we get some type of break in the market and gold will rally significantly. However, if the market were to break down below the 200 day EMA, then we could go much further to the downside. To the upside, I think it’s going to continue to be a “buy on the dips” type of scenario.