After the televised debate between the British prime minister, who leads the Conservatives, and the most prominent opposition parties in the general and early elections to be held in the country on Dec.12, Conservatives have come under fire amid fears that online deception of political parties is undermining democracy in the country as the British Conservative Party tried to deceive voters by changing its Twitter account to “factcheckUK” during an election television debate. This pushed the GBP/USD down during Wednesday's trading to the 1.2886 support after it was on the threshold of the 1.3000 psychological resistance amid Conservative’s progress in recent poll results.

Both Johnson and Corbyn are trying to overcome a great deal of mistrust as they try to influence the electorate exhausted by Brexit. British Prime Minister Boris Johnson has been sharply criticized for failing to deliver on his repeated pledge that Britain will leave the European Union on October 31, 2019.

After Tuesday's debate, a YouGov poll showed that there is an actual draw from 51% to 49% in favor of Johnson. Reviews show that Johnson was better in the first half and Corbyn was better in the second half of the debate. The debate is unlikely to be a measure of the outcome of next month's election. The issue that voters are watching for are whether or not Britain can leave the European Union on the new date of January 31, 2020.

On the US side, the minutes of the Federal Reserve's monetary policy meeting in late October were released, and gave no further clarity on future interest rate expectations. The strongest expectation for the markets is that interest rates will remain unchanged in the near future after the Fed statement and the testimony of Governor Jerome Powell before the Congress. Monetary policy officials considered that the decision to delete the phrase “act as appropriate” from the Bank's policy statement following the decision was considered consistent with the view that the current monetary policy stance is likely to remain appropriate as long as the economy performs in line with Fed expectations. The bank also stressed that policy was not on a predetermined path and could change if developments emerged that led to a material reassessment of the economic outlook.

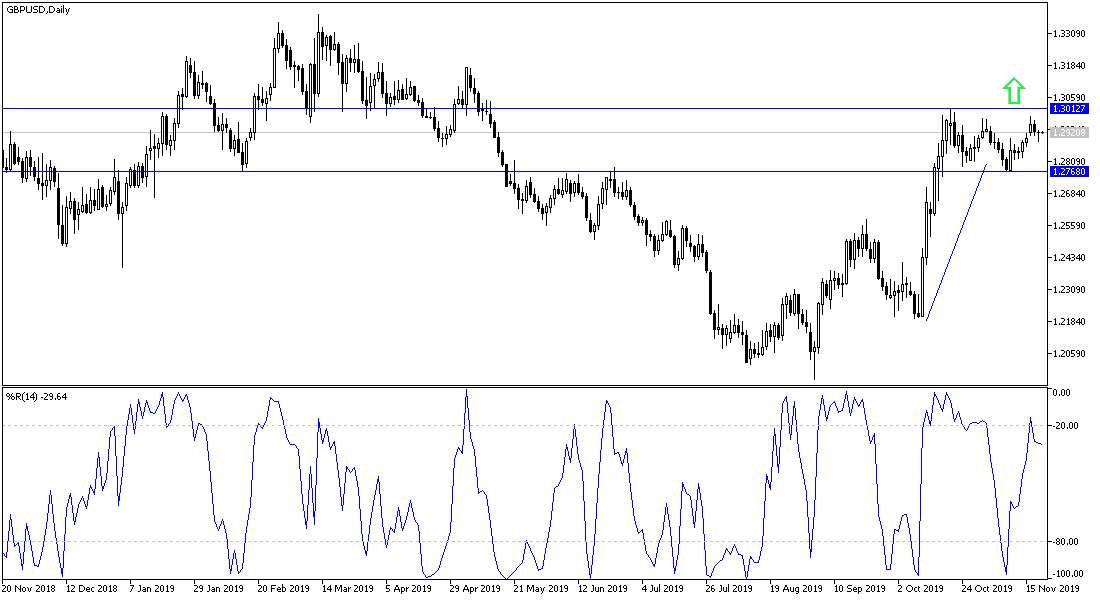

According to the technical analysis of the pair: On the GBP/USD daily chart, it is still maintaining its upward correction and the current stability is still supporting the trend towards the 1.3000 psychological resistance, which strengthens the trend and foreshadows a strong move towards higher resistance levels. Conversely, if the pair moves below the 1.2800 support, the current outlook will be negatively affected. I still prefer to buy the pair from every bearish level. Taking into account that the results of opinion polls until the completion of the elections will affect the direction of the Pound.

As for the economic calendar data: From Britain, net public sector borrowing will be announced. The US is to release the Philadelphia Industrial Index, jobless claims and existing home sales data.